June 2018, Vol. 245, No. 6

Projects

Projects

Mountain Valley Pipeline Proposes North Carolina Expansion

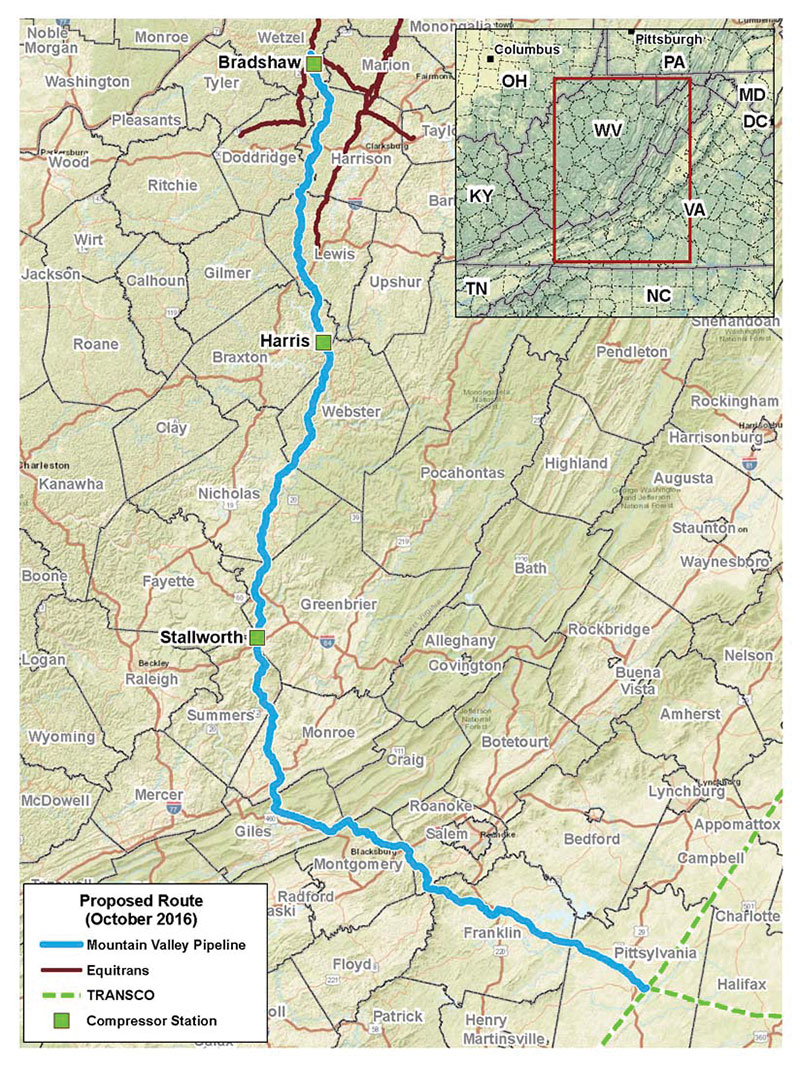

Developers of the Mountain Valley Pipeline plan to extend the project currently proposed to carry natural gas through West Virginia and Virginia into North Carolina.

The company laid out plans for an extension called MVP Southgate. The new segment would receive gas from the Mountain Valley Pipeline mainline in Pittsylvania County, Va., and extend 70 miles (113 km) south to new delivery points in Rockingham and Alamance counties in North Carolina.

PSNC Energy, a natural gas service company, has already signed up for capacity on the Southgate project, and additional customers will have the chance to subscribe, the company said.

PSNC President Rusty Harris, said the company’s customers benefit from the company having supply diversity.

“This project will help ensure low costs for customers and enhance service reliability,” he told the Associated Press.

The Mountain Valley Pipeline has secured the approval of the Federal Energy Regulatory Commission. The extension will also require approval from that body.

The extension’s targeted in-service date is the fourth quarter of 2020.

Judge Says Enbridge Line 3 Should Follow Existing Route

Minnesota regulators should approve Enbridge Energy’s proposal for replacing its aging Line 3 crude oil pipeline only if it follows the existing route rather than company’s preferred route, an administrative law judge said.

Enbridge’s preferred route would carry Canadian tar sands crude from Alberta across environmentally sensitive areas in the Mississippi River headwaters region where American Indians harvest wild rice and hold treaty rights.

Administrative Law Judge Ann O’Reilly’s recommendation the Public Utilities Commission sets up further disputes, however, because the existing line crosses two Ojibwe reservations where tribal governments have said they want the old line removed altogether.

O’Reilly wrote Enbridge had established the project is needed, but the negative consequences to Minnesota related to the company’s more southerly preferred route outweigh the benefits. The cost-benefit analysis shifts in favor of approving the project if Enbridge builds the pipeline in Line 3’s existing trench, the judge said.

Line 3 carries crude oil 1,097 miles (1,765 km) from Hardisty, Alberta, through North Dakota and Minnesota to Enbridge’s terminal in Superior, Wisc. Enbridge has already begun work in Canada and Wisconsin. The commission is expected to make its final decision in June.

Pipelines Completed for Vashishta, S1 Fields

McDermott International and Larsen & Toubro Limited subsidiary LTHE, completed an engineering, procurement, construction and installation (EPCI) contract for development of the Oil and Natural Gas Corporation (ONGC) Vashishta and S1 gas fields, located off the southeastern coast of India.

The companies were responsible for a series of pipeline-end terminations and inline tee structures, a pipeline-end manifold structure, rigid jumpers and about 30 miles (50 km) of umbilicals. The pipeline included 58 miles (93 km) of 14-inch dual rigid pipelines, extending from the shallow water shore line to a maximum water depth of 2,300 feet (700 meters).

To complete the installation, McDermott deployed three vessels, Derrick Barge 30, Lay Vessel North Ocean 105 and North Ocean 102, along a portable spool base at the LTHE base in Kattupalli, India, in order to fast track the production of pipeline stalk for loading onto the vessels.

The Vashishta field is projected to produce 9.56 Bcm of natural gas over a period of nine years, with the S1 field expected to deliver 6.22 Bcm over a period of eight years.

Duke Energy Moves Forward with Ohio Gas Pipeline Application

Duke Energy Ohio is moving forward with its application before the Ohio Power Siting Board (OPSB) to construct the proposed Central Corridor Pipeline, a 13-mile, 20-inch natural gas pipeline designed to delivery natural gas to southwest Ohio.

Once completed, the project will connect to an existing pipeline near the intersection of Butler, Warren, and Hamilton counties, and extend to an existing pipeline in either Norwood or Fairfax. In addition, two propane peaking stations will be decommissioned.

In August 2017, Duke Energy Ohio requested a delay in its application process for additional time to examine site-specific matters it became aware of through meetings with property owners and municipalities, concerning the proposed alternate, or western, route that runs primarily through Blue Ash, Evendale and Reading.

Since then, the company has been advancing the design and alignment of this route. This involved taking a more in-depth look at all properties where the pipeline would be located, including near the Pristine Inc. Superfund site in Reading. Duke Energy Ohio also conducted additional environmental testing, including soil borings along the route, reviewed records of existing environmental databases, and met with property owners and community leaders.

Uzbekistan to Join TAPI Gas Pipeline Project

Uzbekistan plans to join an $8 billion project to build a natural gas pipeline from Turkmenistan to India, according to Reuters, although it was unclear whether Tashkent might eventually ship gas through it.

Turkmenistan, which sits on the world’s fourth-biggest gas reserves and borders Afghanistan, started this year laying the Afghan section of the pipeline which will also cross Pakistan, seeing it as key to diversifying exports away from China.

Uzbekistan also exports gas, mainly to China and Russia, although its export volumes are much lower than the Turkmen ones due to higher domestic consumption.

Turkmenistan and Uzbekistan, both ex-Soviet Central Asian republics, each produce more than 60 Bcm of gas a year. China dominates Turkmen exports while Uzbek gas sales are split roughly equally between China and Russia.

Velocity Completes Crude Pipeline, Begins Another

Velocity Midstream Partners completed the construction of a 45-mile, 12-inch crude oil pipeline loop of its existing condensate pipeline through the fairway of the South Central Oklahoma Oil Province (SCOOP).

The crude oil loop project is supported by expanded commitments from Continental Resources, an Oklahoma City-based exploration and production company, and CVR Refining.

Velocity also started construction of a 22-mile, 12-inch crude oil pipeline extension linking the core of the merge play to its SCOOP pipeline assets. The merge pipeline will be placed into operation in April 2018.

Enterprise, Navigator Gas to Build Ethylene Export Terminal

Enterprise Products Partners and Navigator Holdings entered into a 50/50 joint venture to build a new ethylene export facility along the U.S. Gulf Coast that will have the capacity to export 1 mtpa of ethylene.

The project is supported by long-term contracts with anchor customers including U.S. ethylene producer Flint Hills Resources and a major Japanese trading company.

Refrigerated storage for 30,000 tons of ethylene will be constructed on-site and provide the capability to load ethylene at rates of 1,000 tons per hour. The facilities are expected to be in service by the first quarter of 2020.

Enterprise is also developing a high-capacity ethylene salt dome storage facility at its complex in Mont Belvieu, Texas, with a capacity of 600 million pounds and an injection/withdrawal rate of 420,000 pounds per hour. The storage facility is expected to begin service in the first quarter of 2019. P&GJ

Haynesville Global Access Open Season Underway

Tellurian subsidiary Haynesville Global Access Pipeline launched a non-binding open season to secure prospective shippers for the Haynesville Global Access Pipeline (HGAP).

The proposed 42-inch natural gas pipeline connecting the Haynesville and Bossier shale production region to southwest Louisiana will cost about $1.4 billion and will have the capacity to transport up to 2 Bcf/d. Construction is expected to begin in 2022, with an in-service date of mid-2023.

The pipeline will stretch 200 miles and interconnect with the Midcontinent Express and Gulf Crossing pipelines in Claiborne Parish and to other pipelines located near Gillis in Calcasieu Parish, LA. The system is expected to have multiple receipt and delivery locations, connecting industrial facilities and other third-party pipelines.

Pipeline from Iraq to Target Jordan Shortages

Jordan and Iraq agreed to a framework for building a 1,045-mile (1,680-km), twin oil and gas pipeline from Basra to Aqaba. When completed the project will move 1 MMbpd of oil and 258 MMcf/d of gas it destination.

The pipelines are of great significance to Jordan, which, because of terrorist activities at nearly all border crossing between the two countries, has been forced find more expensive sources of oil.

Jordan currently imports 98% of its needed energy, using about 134,000 bpd with most of that coming from Saudi Arabia.

Iron Horse System Underway in SCOOP/STACK Play

Cardinal Midstream III is developing the Iron Horse System, a new natural gas gathering and processing system designed to serve producers working in Oklahoma’s SCOOP/STACK merge play. Located in Oklahoma’s Anadarko Basin, the liquids-rich play targets multiple benches within the Woodford and Mississippian pay zones, with upside from additional horizons.

Construction of the gathering system is underway, and Cardinal expects to commission the system’s first natural gas processing plant in the third quarter of 2018. The Iron Horse System is anchored by a long-term acreage dedication from Travis Peak Resources.

Cardinal III is in discussions with other producers in the area to bring gas onto the Iron Horse System.

New DJ Basin Midstream System to Be Built

Outrigger Energy II began development of a tri-stream midstream system in Weld County, Colo. The system, which is anchored by long-term acreage dedications from Mallard Exploration, will include wellhead natural gas gathering, a 60-MMcf/d cryogenic processing plant, field compressor stations, crude oil gathering, and produced water gathering.

The processing plant will deliver residue gas to Cheyenne Plains Pipeline, a 36-inch line that offers abundant access to both the Cheyenne Hub and to Mid-Continent markets. NGLs will also be delivered to the Overland Pass Pipeline operated by the Williams Companies and co-owned by ONEOK. In addition, multiple outlet opportunities exist for crude oil delivery, including Tallgrass’ Pony Express Pipeline system and NGL Energy’s Grand Mesa Pipeline system.

The permitting process for the project is currently underway, and the system is expected to be in service by early 2019.

West Texas Crude Pipeline System to Be Built

Phillips 66 Partners received sufficient binding commitments on its initial open season to move forward with construction of the Gray Oak Pipeline system, which will be owned by Gray Oak Pipeline, a joint venture owned by Phillips 66 Partners (75%) and petroleum refinery and marketer Andeavor (25%).

Subject to the results of a second open season, the pipeline could transport up to 700,000 bpd of crude oil from the Permian Basin to downstream markets. If fully subscribed, the pipeline’s capacity could be expanded to approximately 1 MMbpd of long-haul takeaway. P&GJ

Comments