August 2011, Vol. 238 No. 8

Features

Pipeline & Gas Journals 2011 International And Offshore Report

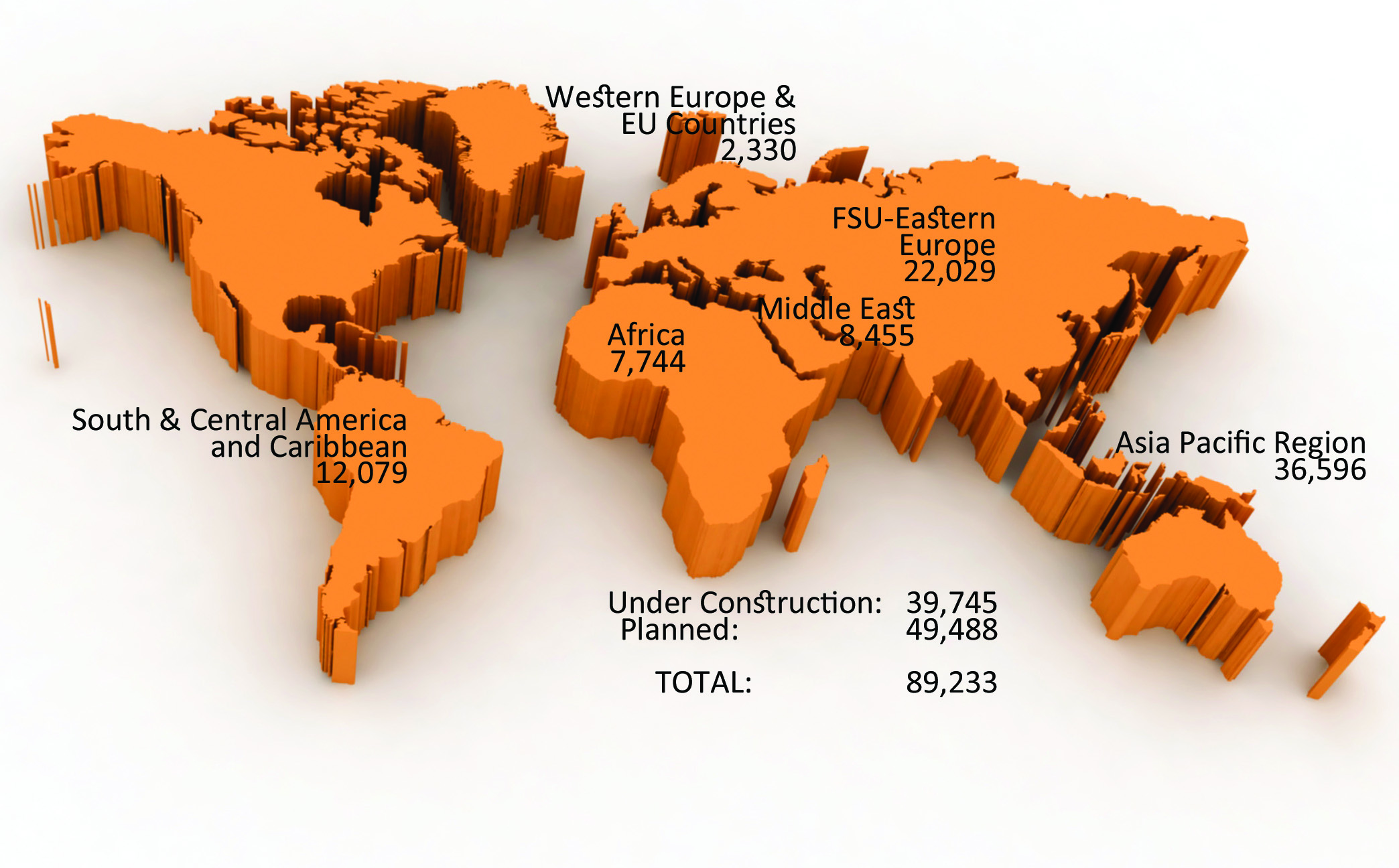

P&GJ’s latest international survey indicates 89,233 miles of new and planned pipelines are under construction and planned. Of these 49,488 miles account for projects in the planning and engineering phase and 39,745 miles are in various stages of construction.

Based on BP’s recently released Statistical Review of World Energy 2011, many more miles of new pipelines will be needed to meet global energy consumption demand which grew 5.6% last year, the highest increase since 1973. The report credits the increase to rebounding economies after the recession and strong growth among developing nations.

The report shows oil consumption grew 3.1% last year, the highest since 2004. It shows a strong rise in natural gas consumption which rose 7.4%, the largest gain by volume on record. Coal use rose by 5.2%, its highest single-year jump in 31 years. Chinese energy consumption grew by 11.2%, as China surpassed the U.S. as the world’s largest energy consumer for the first time in 2010.

Construction Overview

As several countries in the Asia Pacific region lead the way in the global economic recovery, it is not surprising this region accounts for the highest number of new and planned pipeline miles in the six basic country groupings (see accompanying map) used in this report. Here is a breakdown of the pipeline miles planned and under construction in each respective area: Asia Pacific Region – 36,596; South-Central America, Caribbean – 12,079; and Western Europe and European Union countries –2,330; Middle East – 8,455; former Soviet Union and Eastern European countries – 22,029; Africa – 7,744.

Asia Pacific Region

Fast-growing Asian economies are driving global energy demand growth and taking an increasingly larger share of oil and gas markets from developed economies.

China, India and Australia remain the most active in the region in terms of pipelines planned and under construction. Much of the activity in China is centered around China National Petroleum Corp. (CNPC), the country’s largest oil and gas producer and supplier, that remains focused on coordinating domestic and international resources and markets to safeguard China’s energy security.

CNPC plans to double the length of pipelines laid during its 12th Five Year plan – 2011-2015 – vs. the 2006-2011 Five Year plan when 167,775 miles of pipeline were constructed. This would indicate construction of some 335,550 miles, or 67,100 miles per year, by the end of 2015.

CNPC’s most significant construction project is the second West-to-East Gas Pipeline Project (WEPP), one of the largest infrastructure projects in China. The first part of the WEPP is a 2,485 miles long and capable of transporting 17 Bcm/a from Xinjiang to Shanghai.

Construction of the second part of the WEPP will have a total length of 5,656 miles and capacity of 30 Bcm/a of gas. The entire pipeline is scheduled to be completed by the end of 2012.

With its high economic growth rates and 15% of global population, analysts expect India’s oil and gas import demands to increase. Several import schemes, including LNG and pipeline projects, have been implemented or considered.

GAIL (India) Limited is constructing the870-mile Dabhol-Bangalore pipeline. Punj Lloyd is charged with laying seven of the 10 spreads totaling 510 miles. Two spreads were won by the KSS-KSSIIPL Consortium and the remaining spread by Advance Stimul Consortium.

In the Gulf of Thailand, Chevron plans to start up its $3.1 billion Platong Gas II natural gas project later this year. The development, located in shallow water 120 miles offshore, will add 420 MMcf/d of natural processing capacity.

Also in Thailand, Punj Lloyd is building a 185-mile, 42-inch pipeline for PTT LNG to transport gas from an LNG terminal being built near Rayong. The project requires 45 horizontal directionally drilled crossings and is set for completion by year-end 2013.

In Indonesia, front-end engineering and design work is under way on Chevron’s Gendalo-Gehem natural gas development in East Kalimantan. Located in the Makassar Strait in water depths of 6,000 feet, maximum daily production is expected to be 1.1 Bcf of natural gas and 31,000 bbls of condensate.

In Papua New Guinea, Esso Highlands is moving into a four-year construction phase of the $US15 billion PNG LNG project.

Australia

Australia was the world’s largest coal exporter and the fourth-largest exporter of LNG in 2009. Its prospects for expanding these exports are promising as Asian demand for coal and LNG is rising along with Australia’s proven natural gas reserves. Because the distances between Australia and its key natural gas export markets in Asia discourage pipeline trade, all exports are in the form of LNG.

Australian LNG exports have risen 48% over the past decade and are expected to continue to increase over the short to medium term. Japan is the main destination, but other customers include China, South Korea, India, and Taiwan.

For this reason, much of the activity in Australia is closely tied to numerous LNG terminals planned or under development. One is the Australia Pacific LNG (APLNG), a 50/50 joint venture between Origin Energy and ConocoPhillips to deliver coal seam gas to a plant in Gladstone. The APLNG project is designed to span from gas fields in the Surat and Bowen Basins in Queensland along a 280-mile pipeline to an LNG facility near Laird Point on Curtis Island off Gladstone.

Origin will be responsible for construction and operation of the gas fields and pipeline and ConocoPhillips will be responsible for construction and operation of the LNG facility. A McConnell Dowell and Consolidated Contractors JV is charged with constructing the pipeline while a Baulderstone and Bilfinger Berger Services joint venture was awarded the upstream facilities contract. Pipeline construction will start shortly with completion in two years.

[inline:FLNG_Front_Low_3K_LAvailableForPrint[1].jpg]

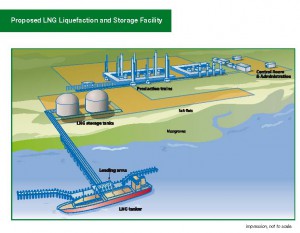

Shell is moving ahead with the world’s first Floating Liquefied Natural Gas Facility (FLNG) off Australia. Planned to be moored 125 miles from land in Shell’s Prelude gas field off the northwest coast, the facility will process gas offshore, does not require compression, a pipeline to shore, onshore construction or shipping channel dredging and jetty works. First production from the Prelude field is scheduled for 2016, which has an estimated operational life of 25 years.

Africa

While the potential energy resource base appears ample, there remain challenges and important considerations that may continue to deter oil and gas development, including but not limited to political, economic, operational, and geopolitical risks.

Despite these challenges, pipeline are being planned and constructed. One of the most ambitious is the Trans-Saharan Gas Pipeline (TSGP) planned by the Nigerian National Petroleum Company and Algeria’s Sonatrach. The 2,565-mile project will take gas from fields in the Niger Delta north through Nigeria to Algeria and then to the coast. It could be on line in 2015. Estimated cost is in the $10 billion range with $3 billion for upstream gas development. EU officials say the pipeline could supply 20 Bcm/y of gas to Europe by 2016.

In South Africa, construction is ahead of schedule on the 338-mile Durban-Gauteng multi-products pipeline for which Transnet received a license from the National Energy Regulator of South Africa to construct and operate, along with an associated 160-mile, 16-inch inland pipeline network. Transneft officials said the project would be completed by September.

In Nigeria, Saipem is carrying out a critical crude pipeline replacement project involving replacement of six 10–24-inch pipelines with a combined length of 53 miles that will connect six platforms in an offshore field. The work includes fabrication, transportation, installation and testing of new pipelines as well as a shore approach and bridges.

Western Europe, EU Countries

Western Europe and the EU countries hold promise for future activity with a decision by the European Commission to provide US$1.9 billion in grants to ensure that some 30 gas projects are not delayed. Those to receive grants include the 500-mile Interconnector Turkey-Greece-Italy (ITGI) project, 130-mile Poseidon Pipeline, 281-mile Skanled Pipeline, 2,050-mile Nabucco Pipeline, 235-mile Odessa-Brody project and the 130-mile Slovakia- Hungary Interconnector.

EU officials want a merger of two strategic pipeline projects – Nabucco and its smaller Italian rival ITGI – to secure gas supplies from Azerbaijan to Europe. Several options have been floated, including a two-phase construction sequence that would see gas transported to Greece and Italy in the first phase and creation of a spur from the main pipeline in the second phase that would follow Nabucco’s originally planned route to Austria.

Italy’s power and gas company, Edison SpA, took a major step to move the Southern Gas Corridor forward when Edison, Depa, the Greek Public Gas Corporation, IGI Poseidon S.A. (equally owned by Edison and Depa and responsible for construction of the offshore pipeline between Greece and Italy) and Bulgarian Energy Holding EAD, formed Natural Gas Interconnector Greece Bulgaria EAD (IGB EAD). This company is responsible for the new gas pipeline between Greece and Bulgaria (the IGB pipeline) which will be part of the ITGI project connecting Turkey, Greece and Italy. The 100-mile IGB will connect Komotini, Greece, to Stara Zagora, Bulgaria. The pipeline will have a transport capacity of 35 Bcm/a when it begins operations in 2013.

In Italy, Ghizzoni Spa is building an 83-mile gas pipeline from Massafra to Biccari for Snam Rete. Construction is scheduled for completion in May 2013.

In the Netherlands, Nacap is working on two projects that are part of the Nederlandse Gasunie’s north-to-south investment which will increase transport capacity from Groningen in the Netherlands to Belgium. The first contract is for a 16-mile, 48-inch gas pipeline in Groningen Province. The second is for the construction of 42 miles of 48-inch gas pipeline also in Groningen. Completion of both projects is planned by year-end 2013.

South America, Central America, Caribbean

Brazil, Venezuela, Colombia and Argentina have major pipeline projects under construction and planned.

A 530-mile ethanol pipeline is planned by Petrobras to link main ethanol-producing regions to consuming centers in Sao Paulo and Rio de Janeiro. The pipeline will have a transport capacity of 21 MMcm/a.

Saipem is carrying out several projects off the coast of Brazil for Petrobras. One involves a 33-mile pipeline to connect the Guara FPSO vessel to a subsea gathering manifold in the Lula field and a 93-mile rigid gas pipeline linking the Camarupim field gas pipeline to the Parque das Baleras completion.

Work is scheduled to start on the 2,575-mile Noreste Argentino Gas Pipeline (GNEA), to bring gas from Bolivia to Argentina. Argentina announced the first phase of construction will begin later this year to increase shipments of natural gas from Bolivia to 27.7 MMcf/d. The pipeline will cost an estimated $5 billion and will provide 3.4 million people in six provinces access to natural gas.

Construction companies listed to date are: Techint-Petersen, CPC Pamar, Lecsa-Vertua, Contreras Hnos-Isolux ing and BTU-Esuco-Victor Contreras.

Colombia has seen a dramatic increase in oil production in following a period of steady decline. Much of the increase is credited to regulatory reforms designed to make the sector more attractive to foreign investors. Colombia has implemented a partial privatization of state oil company Ecopetrol in an attempt to revive its upstream oil industry.

Expanded oil production will require further investment in transport infrastructure and refining capacity which China has expressed interest in financing.

Ecopetrol, one of the four principal petroleum companies in Latin America, is partnering with an international consortium to develop the Oleoducto Bicentenario pipeline. The $4.2 billion project will have a capacity of 450,000 bpd and is scheduled for completion late next year.

Sociedad Oleoducto Bicentenario de Colombia A.S. plans to build and operate a private-use oil pipeline between Casanare and Covenas that will be 596 miles long and have a final capacity of 450,000 bpd. The pipeline will be the largest of its kind in Colombia and developed in phases. The entire project is estimated to cost $US4.2 billion. Completion is scheduled in December 2012.

Venezuela remains a significant supplier of crude oil to the world market although no significant pipeline construction is reported. Still awaiting a construction is the $2.1 billion, 293-mile natural gas pipeline linking Venezuela’s Sucre and Anzoategui states and a second gas pipeline linking Venezuela to Argentina that will go through Brazil, Uruguay, Chile and Bolivia. On the oil side, construction is expected to start in 2012-13 on the pipeline planned by state-owned PdVSA and Russian oil transporter Transneft for development of the Orinoco oil belt.

FSU, Eastern European Countries

The slowest projected energy growth among non-OECD regions is for non-OECD Europe and Eurasia, which includes Russia and the other former Soviet republics. Growth in energy use for the region totals 17% from 2007-2035 as its population declines and substantial gains in energy efficiency are achieved by replacing inefficient Soviet-era capital equipment.

Nevertheless, Russia and nations in the FSU and Eastern Europe hold promise for future oil and gas activity and several are constructing and planning extensive pipeline networks to reach Europe and the Asia Pacific region.

Kazakhstan is expected to see increased oil and gas activity. Full development of major oilfields could make it one of the world’s top five oil producers within the next decade. With production of 1.54 MMbpd in 2009, Kazakhstan is expected to at least double its production by 2019. Steadily rising natural gas production is also transforming Kazakhstan from a net gas importer to a net exporter. Natural gas development has lagged behind oil due to the lack of pipeline infrastructure linking the western-producing region with the eastern industrial region as well as insufficiency in export pipelines. But the Kazakhstan-China gas pipeline will enable the transport of gas to Kazakhstan’s industrial region along with increased gas exports when it comes online in 2014.

While Kazakhstan is hampered by the lack of access to a seaport, which makes the country dependent mainly on pipelines to transport its hydrocarbons to world markets, it is also a transit state for pipeline exports from Turkmenistan and Uzbekistan. Neighbors China and Russia are key economic partners, providing sources of export demand and government project financing. For this reason, Kazakhstan could see considerable pipeline construction in coming years.

Kazakhstan accounts for several projects, including the $5.4 billion expansion of the Caspian Pipeline Consortium’s Caspian Pipeline. The capacity of the 932-mile pipeline, which carries crude from western Kazakhstan to a dedicated terminal in the Black Sea, will increase to 1.4 MMbpd from 730,000 bpd.

The project will be implemented in three phases with capacity increasing progressively from 2012 to 2015. Chevron, one of the largest Caspian Pipeline Consortium shareholders, is providing project management services to the project.

Also under way is Phase II of the 916-mile Kazakhstan-China gas pipeline being constructed by a joint venture made up of KazTransGas and CNPC Central Asia Gas Pipeline Company Ltd. It will connect to the Central Asia-China Gas Pipeline at Shymkent, Kazakhstan. The pipeline has a designed capacity of 10 Bcm and can be expanded to 15 Bcm. The first stage is planned to begin operations near year-end 2012.

Russia accounts for several ongoing projects. Construction began in April 2010 on Nord Stream AG’s Nord Stream, a natural gas pipeline through the Baltic Sea. In the last quarter of 2011, Line 1 of the twin 760-mile pipeline system will begin contributing to the energy security of the European Union (EU), helping it meet its greenhouse gas reduction goals. When fully operational in the last quarter of 2012, the two lines will supply 55 Bcm of Russian gas to the EU for at least 50 years.

Transneft is also building the Eastern Siberia-Pacific Ocean pipeline in two stages, with the first phase (1,491-mile, 600,000 bpd) completed in September 2010. This pipeline will provide Russia’s crude oil with easier access to Asia-Pacific markets. The 2,510-mile pipeline will be able to transport 1.6 MMbpd of crude.

In Turkmenistan, construction continues on the $2 billion East-West pipeline that will connect all major gas fields there to one network. Two state corporations – Turkmengaz and Turkmen Oil and Gas Construction – are developing the project. The 620-mile, 56-inch pipeline will have a capacity of 30 Bcm/a.

Awaiting a construction start is the US$21.5 billion South Stream pipeline which will transport up to 63 Bcm/a of gas to 10 consumer countries in the EU that is being developed by Italy’s Eni and Gazprom. French EdF and Germany’s Wintershall will also participate in the project. Russia now plans to launch the pipeline in 2015.

Middle East

Several major projects are slated in the Middle East where 3,201 miles of pipelines are in various stages of construction and 5,254 pipeline miles are in the planning and engineering phase.

The Iranian Gas Engineering and Development Company is planning to invest $US6 billion for 1,677 miles of high-pressure gas pipelines and 19 compression facilities in the next two years. Plans call for construction of the 335-mile Tran-Iranian gas pipeline from Iranshahr to Zahedan and another to the Pakistan border; a 373-mile pipeline from the Dehgolan region to Ahmaz; and a 56-mile line to Chabahar in the southeast.

The Iraqi electricity ministry signed a $365 million contract with an Iranian company nominated to build a gas pipeline to supply power plants with Iranian gas. The pipeline would transport 25 MMcf/d of Iranian gas, enough to generate some 2,500 MW of power.

The planned pipeline will pass through Iraq’s Mansouriyah gas field near the Iranian border in the Diyala province and will feed three power plants; one in Sadr City in northern Baghdad and the other two north and south of the capital.

Comments