July 2014, Vol. 241, No. 7

Features

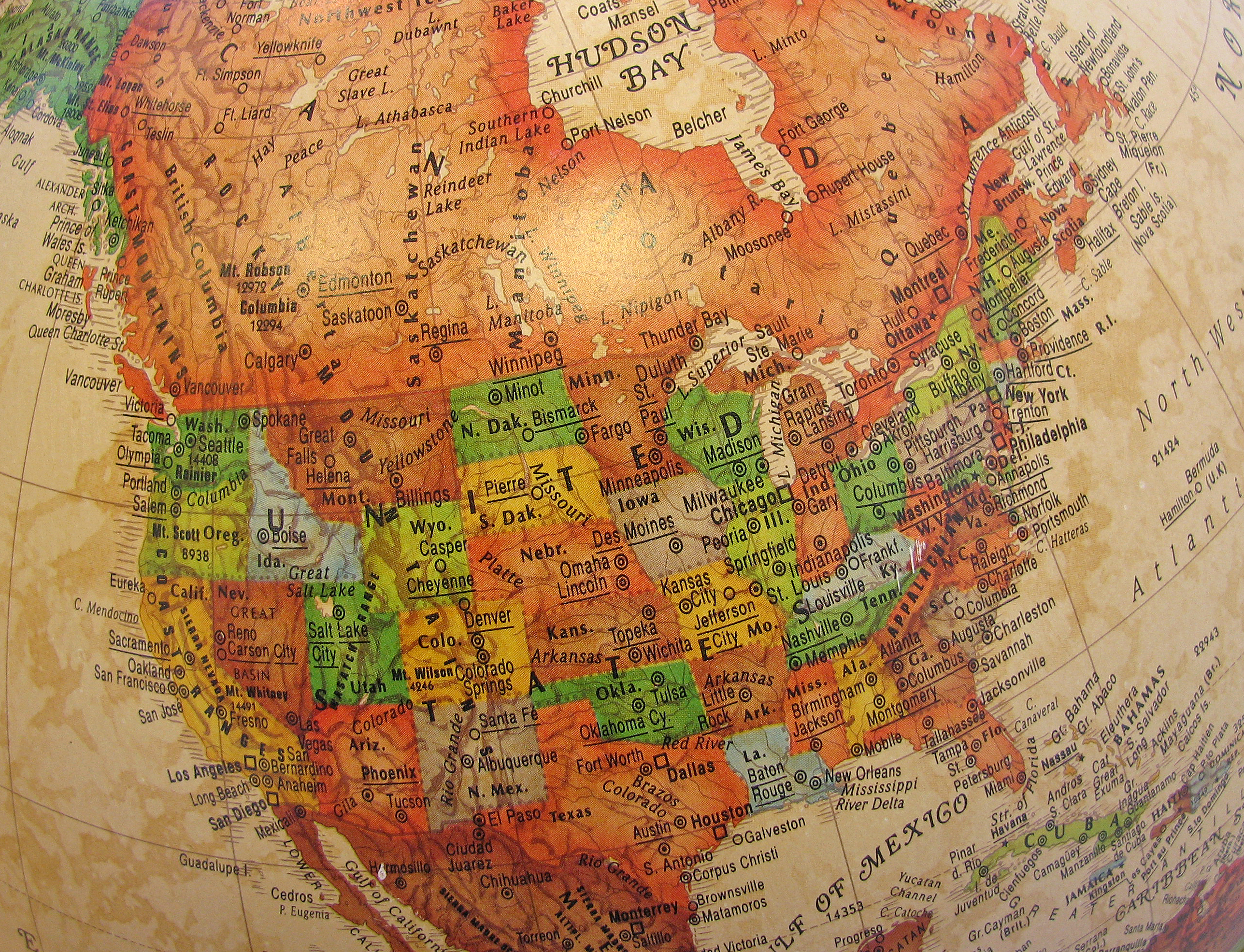

North American Production Still Accelerating, ICF Says

An ICF report determined shipping oil overseas would spur the U.S. economy, lowering gasoline prices in the process.

“Allowing crude exports would reduce refinery margins due to higher domestic crude costs and slightly lower U.S. and global petroleum product prices,” said the study, done on behalf of the American Petroleum Institute (API).

Overall, ICF analysts concluded exporting U.S. crude would save consumers $5.8 billion a year on petroleum products over the next 20 years.

In addition, the report offered the following findings:

• In the short run, reduced gas-directed drilling activity will continue to slow gas production growth from “dry” gas plays such as the Haynesville Shale, the Greater Green River Basin, the Barnett Shale and the Fayetteville Shale. However, these plays are likely to rebound as market growth firms up gas prices.

• Conversely, liquids-rich plays have fared much better in the relatively low gas price environment that persisted throughout much of 2013. Consequently, U.S. NGL production, which has increased by more than 600,000 bpd during the past five years, is expected to continue to grow and will likely double by 2035.

• With the relatively high oil price environment, output from the unconventional oil plays, such as the Bakken, the Cline, the Niobrara and the Eagle Ford, should continue to grow.

• While high oil prices could promote growth of bitumen production in Western Canada’s oil sands, continued delays in construction of new crude transport capability present risks.

Additionally, ICF’s report based on production numbers for the first quarter of the year showed U.S. and Canadian natural gas production growing by 1.8% per year, reaching the 121 Bcf/d mark (+40 Bcf/d: +36 Bcf/d in the U.S. and +4 Bcf/d in Canada) by 2035.

Meanwhile, unconventional gas (shale, tight, and coalbed methane) production will grow by 3.2% per year, reaching 101 Bcf/d (+50 Bcf/d: +40 Bcf/d in the U.S. and +10 Bcf/d in Canada) by 2035.

Shale gas production is expected to grow by 3.9% per year over the same period to reach 81 Bcf/d (+46 Bcf/d: +36 Bcf/d in the U.S. and +10 Bcf/d in Canada).

Not surprisingly, ICF reported the largest growth in natural gas production will come from the shale plays, which will account for more than 50% of all U.S. and Canada gas production by 2016 and about two-thirds of it by 2035. Utica Shale gas is expected to grow significantly from about 0.2 Bcf/d in 2013, reaching more than 1 Bcf/d by 2017 and 2.5 Bcf/d by 2035, ICF said.

Robust growth of crude oil and condensate production in the U.S. and Canada. Production grows to 18.2 MMbpd (+7.2 MMbpd) by 2035 with the largest growth coming from oil sands in Alberta.

Oil sands production is expected to grow by 4.9% a year, reaching 5.8 million bpd (+3.8 MMbpd) by 2035. Production from shale and tight oil plays will grow significantly, at 4% a year, reaching 6.3 MMbpd (+3.6 MMbpd) by 2035.

Comments