November 2015, Vol. 242, No. 11

Features

Natural Gas Market Dynamics in the Northeast

Natural gas markets have gone topsy-turvy. Until recently, prices around the country were generally pretty similar, with gas costing a bit more in the Northeast, far from where it was produced on the Gulf of Mexico coast. But that reality has changed dramatically in the last few years.

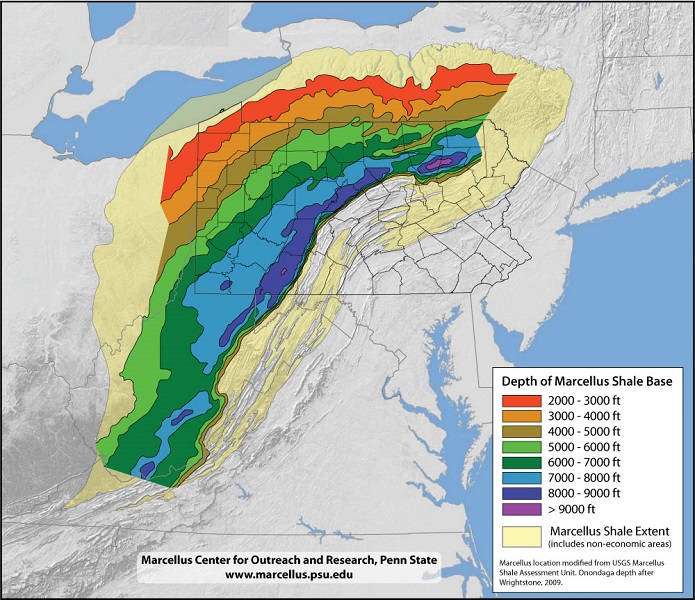

Flipping the historical dynamic, a deluge of gas produced in the Marcellus Shale region – responsible for over 20% of national production as of late spring, up from virtually zero in 2010 – has made gas prices in its backyard (western Pennsylvania and its environs) much cheaper than in some other parts of the country, such as the Midwest, Far West and Mid-Atlantic.

The other repercussion of exploding production in the Marcellus is price uncertainty. As shale gas production continues to expand, no one knows precisely how the tug-of-war between supply and demand will play out.

Will burgeoning supply keep gas cheap? U.S. shale gas production has risen from 33 to 42 Bcf/d in just 18 months and is now responsible for almost 60% of all U.S. natural gas production. Or will cheaper gas drive up local consumption in the Northeast and nearby Rust Belt, and tempt shippers with opportunities to pipe it away and profitably sell the gas outside the region, making prices rise?

With gas prices at rock-bottom in the Marcellus, there is evidence that shipment west (for example, through the Rockies Express pipeline east of Chicago) and south (through the Columbia TCO pipeline) to Henry Hub and the upper south, as well as underground storage, are on the rise as sellers seek more expensive markets outside the Northeast and wait for the coming winter.

Additionally, there has been a renaissance in the U.S. petrochemical sector, a source of new demand. Chemical manufacturers making plastics and fertilizer are guzzling large quantities of cheap gas – though no one knows quite how much – because some producers use their own gas onsite and report only what they ship out by pipeline.

This complex web of supply-and-demand factors means that no one knows for sure which way prices will turn. Layered on top of this is the ultimate uncertainty: weather. Always hard to predict, doubts remain whether cool temperatures – and consequent lower gas consumption needed to power air conditioning – will persist this summer, as the National Weather Service (NWS) has predicted.

A cool summer and mild winter are expected as the current El Nino picks up speed. But weather is fickle and unpredictable. While some weather and industry experts have been expecting otherwise, so far the NWS has been vindicated: the Fourth of July weekend was 9 degrees Fahrenheit cooler than average in New York and Boston, leading daily-market prices to tumble to less than one dollar per million Btu.

These spot prices hit record lows at the Algonquin Citygate location outside Boston and also in New York, roughly one-third of the going rate nationally and the monthly NYMEX levels. Consequently, recent natural gas prices in the Tri-State and New England area have, at a bit below $2.50/MMBtu, been 35-50% below last summer’s and roughly 15% below the national average.

But will the trend persist? Will the weather stay cool and will gas producers and shippers keep the spigots wide open in the Northeast? Time will tell. In the meantime, customers are enjoying their lower bills.

Scott LaShelle is co-manager of Freepoint Commodities’ East Gas business and the newest member of Great Eastern Energy’s executive board. He earned a bachelor’s degree in foreign service from Georgetown University.

Comments