December 2018, Vol. 245, No. 12

Global News

Global News

Natural Gas Utilities Testing Demand Response Programs

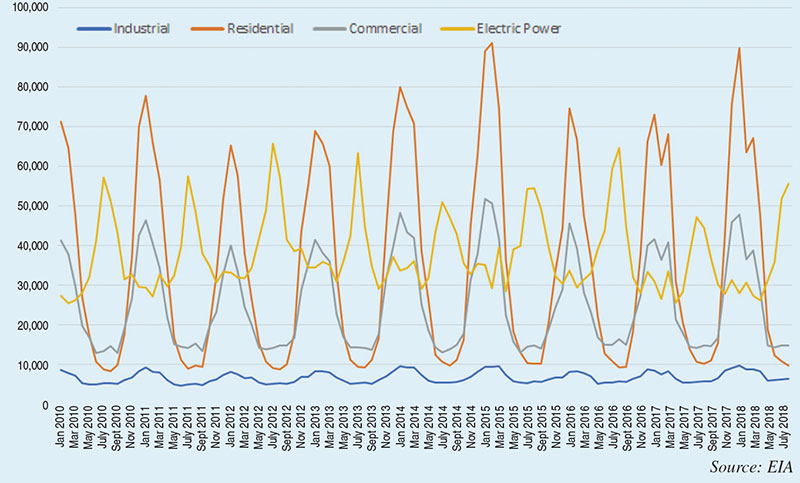

Demand Response (DR) programs have become a fairly common method of reducing electricity demand during summer peak periods, and now the approach is being tried by natural gas utilities – most recently due to concerns about limited pipeline capacity to meet peak winter demand in the U.S. Northeast.

The New York Public Service Commission has approved a petition by Consolidated Edison Company of New York for a $5 million, three-year natural gas demand response pilot program, one of the first demand response projects for natural gas. Nearly 60% of New York homes used natural gas as their primary heating fuel in 2017, based on data from the U.S. Census Bureau’s American Community Survey.

Con Edison has firm pipeline transport contracts to meet 83% of its peak-day demand in the winter of 2017-2018 but expects that to fall to only 78% by the 2023-2024 season absent any new pipeline capacity. However, no remaining firm pipeline capacity is currently available into New York City or Westchester County, and recent attempts to add pipeline capacity have stalled as a result of regulatory challenges. Con Edison is planning alternative measures, including DR, to reduce reliance on interruptible contracts and to help ensure all its customers are served on the coldest days of the year.

According to Con Edison, firm natural gas demand on its peak day increased by more than 30% between 2011 and 2017, and it expects the peak to grow by an additional 23% during the next 20 years. The increasing peak is driven by a preference for natural gas heat in new buildings and the switch from heating oil to natural gas in existing facilities.

In early 2017, Southern California Gas Company (SoCalGas) piloted the Seasonal Savings program, which used direct load control to adjust about 50,000 residential thermostats according to a household’s schedule and preferences to reduce short-term peak demand. In the winter of 2017–2018, 16 National Grid customers in New York City and Long Island participated in a DR program aimed at commercial and industrial customers, where large heaters or machinery running on natural gas were turned on and off to manage peak demand days.

Operators Profit from Permian Basin Bottlenecks

Some of the biggest pipeline operators in the United States have supercharged earnings this year by buying deeply discounted shale in West Texas oilfields and selling it at a premium at Gulf Coast ports.

These companies are taking advantage of extraordinary markdowns in West Texas where surging production and a lack of pipeline space sent the regional price for oil in late August $23 per barrel below the coastal price in Houston. Permian Basin oil production is projected to hit 3.55 MMbpd, up from 2.04 MMbpd two years ago, according to Reuters.

Occidental Petroleum’s marketing and logistics business earned $796 million in the third quarter of 2018, excluding asset sales, compared with $4 million in the same period last year.

Plains All American Pipeline got a boost by buying cheap at the wellhead and selling at Gulf Coast prices, earning $75 million in the quarter from a part of its business that lost $56 million in the third quarter of 2017.

Energy Transfer, operator of the Permian Express pipeline, credited “more favorable market price differentials between the West Texas and Gulf Coast markets” last quarter for lifting its profit by $108 million over a year earlier.

Magellan Midstream Partners also credited strong Permian volumes for its record crude oil earnings in the quarter. The Houston firm collected $4 per barrel on increased spot shipments, twice that of its contract volumes, spokesman Bruce Heine told Reuters.

The Midland-to-Houston crude differential narrowed as Plains began transporting additional crude from its newly expanded Sunrise pipeline from the Permian to Cushing, Oklahoma, but is expected to continue until additional capacity comes online.

China Passes Japan as Top Gas Importer

China’s natural gas imports grew by a third during the first 10 months of 2018 from the same period last year to more than 72 million tons, overtaking Japan as the world’s No. 1 importer of natural gas, according to Reuters calculations based on General Administration of Customs data.

Demand in China is increasing as the country enacts stricter environmental laws to combat air pollution, while the restart of nuclear reactors in Japan has reduced its demand for LNG imports 17% from the same 10-month period of 2017 to about 69.35 tons, according to ship-tracking data from Refinitiv Eikon, down 17% for the same 10 months of 2017. Japan imports all its gas as LNG.

China already ranks first in oil and coal imports, and it is the third-largest consumer of natural gas behind United States and Russia, but it produces only enough gas to meet about 60% of its total demand. While China still lags behind Japan on LNG imports, it surpassed South Korea as the world’s second-biggest importer last year and may exceed Japan within a few years, according to energy consultancy FGE.

Feds Open Criminal Probe into Natural Gas Explosions

NiSource, the parent company of Columbia Gas of Massachusetts, said it is cooperating with a federal criminal investigation into the natural gas explosions and fires that rocked three communities north of Boston in September.

The Indiana-based utility made the disclosure in its quarterly financial disclosure report to the U.S. Securities and Exchange Commission.

NiSource says it was served initial grand jury subpoenas on Sept. 24, shortly after the Sept. 13 incident that killed one person, injured 25 others and damaged or destroyed more than 130 structures across Lawrence, North Andover and Andover.

Argentina Restarts Natural Gas Exports to Chile

Argentina has begun exporting natural gas to Chile after a 12-year interlude, Chilean President Sebastian Pinera said, as the two South American neighbors seek to increasingly integrate their energy supply and electricity grids.

The unconventional gas is being piped from Argentina’s oil-and gas-rich Vaca Muerta shale field in the Neuquen Basin, then sent over the Andes mountain range to Chile’s southern province of Biobio, Reuters reported. The 20-inch, 585-mile (941-km) Atacama Pipeline travels from Argentina to the west coast of Chile also crosses a tropical rain forest and the driest desert in the world. It was completed in 1999.

“We are working enthusiastically with (Argentine) President Mauricio Macri to integrate our energy supply,” Pinera said in a speech, noting two countries have very different, but often complementary, energy needs and could either export or import fuel and electricity across their shared border.

The exports mark a turning point in energy trade in the region. Argentina, once a major supplier of natural gas to Chile triggered a diplomatic crisis in the mid-2000s by cutting off shipments when its own supplies ran low.

Italy Gives Green Light to Contested TAP Gas Pipeline

Prime Minister Giuseppe Conte gave Italy’s final approval to the Trans Adriatic Pipeline (TAP), a $5.13 billion project the European Union views as strategic to its goal of reduced dependency on Russian gas.

TAP, the last leg of the $40 billion Southern Gas Corridor that will bring Azeri gas to Italy, had been strongly contested by the 5-Star Movement, one of the two parties in the ruling coalition. It is due to start pumping gas in 2020, but local opposition to the project has raised concern that work at the Italian end may not be completed in time.

“It’s no longer possible to intervene in this project, which was planned by previous governments and carries contractual constraints,” Conte said in a statement, citing the “unsustainable costs” of Interrupting the process and noting that “the accords signed in the past take us down a path with no way out.”

Shortly before Conte announced the project’s approval, the environment ministry said it had investigated complaints brought by the local community and found no legal irregularities in the pipeline project. TAP shareholders are BP, Socar, Snam, Fluxys, Enagas and Axpo.

Colombian Pipeline Repeatedly Bombed

Three November attacks have raised the total number of bombings on Colombia’s 485-mile Cano Limon pipeline this year to 82, state-owned Ecopetrol said. Production from the Occidental Petroleum-operated Cano Limon field is being delivered through the Bicentenario pipeline and exports are reportedly unaffected.

The 210,000 bpd crude oil pipeline has been out of service during much of 2018 because of bombings and illegal taps and was not functioning during the latest attacks, but Ecopetrol said the bombings sent oil spilling into waterways, and it alerted nearby towns of potential contamination.

Ecopetrol did not specify who is responsible for the bombings, but military sources told Reuters that the attacked were staged by members of the National Liberation Army. The rebel group of about 1,500 combatants opposes multinational companies it accuses of seizing natural resources without benefiting Colombians.

Iraq Resumes Piping Oil to Kirkuk Oil after Yearlong Pause

Iraq has begun piping oil from its fields around the disputed city of Kirkuk, more than a year after exports were halted over troubles with the autonomous Kurdish administration north of the country.

The region will export between 50,000 bpd and 100,000 bpd through a pipeline to Turkey, said Oil Ministry spokesman Assem Jihad, after a deal was reached to break the deadlock between Baghdad and the Kurdish Regional Government (KRG) based in Irbil.

Iraq used to export 300,000 bpd from Kirkuk when the city was under Kurdish administration. The takeover was a blow to the region’s finances and led to cuts in public sector wages.

Federal forces seized Kirkuk and the surrounding oil fields in October 2017 after the KRG organized a symbolic but controversial referendum for Kurdish independence. Exports were terminated in the wake of the takeover, costing both sides billions of dollars in revenues as they haggled over revenues and pipeline fees.

The Turkey pipeline is the only one available to Kirkuk for exports. It runs through the Kurdish region. Revenues from the resumed sales will go to the federal government, said Jihad, told Reuters.

But the KRG has since made up for the lost revenues by boosting production from other fields, according to the Iraq Oil Report trade publication. Iraq exports close to 5 MMbpd, the vast majority through its southern Basra terminal. P&GJ

Comments