September 2018, Vol. 245, No. 9

Global News

Global News

Ichthys LNG Project Commences Production

Japan’s Inpex Corp. marked a key milestone in late July with the start of natural gas production from its giant Ichthys Field offshore northern Australia. Initial LNG cargo shipments from the $40 billion project are projected to start around late September, the company said, with condensate to be shipped first, followed by LNG and then LPG.

Development of the large-scale Ichthys project included construction of a 553-mile (890 km), 42-inch subsea gas export pipeline – the longest in the southern hemisphere and third-longest in the world. It may take 2-3 years to reach full annual production capacity of about 8.9 million tons of LNG, 1.7 million tons of LPG and 100,000 bpd of condensate.

Ichthys Field production will be separated within the Ichthys Explorer Central Processing Facility, with liquids piped to the nearby Ichthys Venturer FPSO, and gas transported via the export pipeline to an onshore gas liquefaction plant at Darwin in Australia’s Northern Territory.

Inpex, Japan’s largest exploration and production company, is operator and holds just over 62% of Ichthys LNG, with France’s Total holding 30%. The remainder is owned by Taiwan’s CPC Corp and Japanese utilities Tokyo Gas, Osaka Gas, Kansai Electric Power, JERA and Toho Gas.

U.S. Energy Leaders Lament Tariffs as Pipeline Costs Rise

U.S. President Trump’s proposal to double tariffs on steel and aluminum from Turkey could push up costs even further for domestic oil and gas pipeline projects, as energy executives said they were already struggling from earlier tariff rises.

There are more than a dozen U.S. energy pipelines on the drawing board, some of which are still seeking financing. The projects would pave the way for greater U.S. oil and gas exports and relieve a bottleneck in West Texas shale fields that is starting to pinch output in the region.

The trade actions “threaten important energy infrastructure projects,” said Catherine Landry, vice president at Interstate Natural Gas Association of America (INGAA). Companies were “being unfairly punished for participating in international trade,” she said.

Turkey delivers just 4% of steel mill imports, but doubling tariffs on a supplier could force buyers to turn to other steel makers and, in turn, lift prices.

The Trump administration’s original move in March to raise tariffs on most steel and aluminum imports already added $40 million to the cost of a Plains All American crude oil pipeline that will use steel supplied by a Greek company.

Kinder Morgan ordered nearly half of the specialized pipe needed for its Gulf Coast Express project from a Turkish steelmaker before the original tariff went into effect, Reuters reported.

Australia’s APA Backs $9.5 Billion Bid from Hong Kong’s CKI

The board of Australia’s APA Group has recommended shareholders vote for a $9.45 billion (A$12.98 billion) takeover offer from a consortium led by Hong Kong’s CK Infrastructure Holdings Ltd (CKI). The recommendation comes after CKI conducted nearly two months of due diligence without changing its offer made in June.

The deal would make CKI the biggest gas pipeline player on Australia’s east coast, giving it more pricing power in a market where gas prices are so high that the issue has become political.

Gas prices have soared since the opening of three liquefied natural gas export plants on the east coast, sucking gas out of the domestic market. A consequent rise in utility bills has become a sore point for voters, leaving the government trying to win approval for an energy policy aimed at bringing prices down.

Nord Stream Seeks Denmark Detour as Court Clears German Path

Germany’s top court rejected an environmental group’s bid to block construction of the Nord Stream 2 pipeline, but its Russia-led consortium has applied for a new route to avoid Danish territorial waters.

Denmark’s parliament is considering legislation allowing it to veto the pipeline going through Danish territorial waters on security grounds, but Gazprom has vowed to press ahead with the controversial project, which could double Russia’s subsea gas exports to Germany, bypassing traditional routes through Ukraine.

The United States opposes the project, while some eastern European countries fear it will make the European Union a hostage to Russian gas.

Nord Stream 2 construction has already been approved by Finland, Sweden, Russia and Germany, leaving Denmark as the sole holdout along its proposed 764-mile (1,230-km) path under the Baltic Sea.

The project faced a legal challenge in Germany from the Naturschutzbund Deutschland environmental group, which sought to overturn a lower court’s rejection of an injunction to block construction in German waters. But the Federal Constitutional Court threw out the complaint last month on grounds that the group failed to explain its case sufficiently.

China Interested in Joining TAPI Pipeline Project: Pakistan Official

China is considering construction of a TAPI pipeline spur to deliver natural gas natural gas from Pakistan, a Pakistan official said.

Mobin Saulat, CEO of Pakistan’s state-owned Inter State Gas Systems (ISGS), told Reuters that Chinese officials have shown growing interest in building a spur from Pakistan and the line could act as an alternative to Beijing’s plans to build a fourth China-to-Turkmenistan pipeline.

“With this channel, there is a possibility they don’t have to do another line, and they can off-take from this pipeline, which is passing through Pakistan,” Saulat said.

TAPI is to be built in two phases, with the pipeline constructed without compressors in the first phase, cutting gas volume but reducing project costs. Financing would be raised after the pipeline starts generating cash flow and fund installation of 11 compressors along the 1,127-mile (1,814-km) project.

Russia Loses Bulk of WTO Challenge to EU Gas Pipeline Rules

Russia largely failed in its bid to overturn the European Union’s gas market rules in a World Trade Organization (WTO) ruling.

The panel of three WTO adjudicators disagreed that the EU broke WTO rules by requiring the “unbundling” of gas transmission assets and production and supply assets, effectively blocking Gazprom from owning the pipelines that deliver its gas to Europe. It also rejected Russia’s claim that the EU unfairly discriminated in favor of LNG and upstream pipeline operators by exempting them from unbundling requirements.

However, it upheld Russia’s complaint about an unbundling exemption for Germany’s OPAL pipeline, granted on condition that Gazprom supplied no more than 50% of the gas in the pipeline. The panel also agreed that Croatia, Hungary and Lithuania had discriminated against Russia by requiring a security of energy supply assessment for foreign, but not domestic, pipeline operators.

China Issues Draft Rules to Open Access to Oil, Gas Infrastructure

China’s state planner issued new draft rules to give private companies access to the country’s oil and gas infrastructure, including crude oil pipelines, gas pipelines, liquefied natural gas terminals and underground gas storage.

The new rules followed requests from the country’s energy operators, especially in natural gas, for equal access to the nation’s natural gas pipeline network, the National Development and Reform Commission (NDRC) said.

The draft marks the first time the government has published a concrete plan to promote fair access to gas-related facilities, including LNG terminal and storage.

Gas Pipeline Issues Blamed for Malaysia’s Falling LNG Exports

Malaysian LNG exports fell to a four-year low in July as domestic gas pipeline issues plaguing the country since January took their toll, according to industry sources and Thomson Reuters data.

Natural gas supply from the Sabah Oil and Gas terminal to the Petronas LNG Complex in Bintulu was cut in January following a gas leak in the 310-mile (500-km) pipeline which transports gas from Kimanis in Sabah to Sarawak for processing. While the pipeline has been repaired, Petronas was still awaiting the approval to resume operations, a source told Reuters.

Malaysia’s LNG exports fell to about 1.5 million tons in July, the data showed, the lowest since July 2014 when it was about 1.43 million tons. The drop in export volumes came at a time when demand from Japan, the world’s biggest importer of LNG, has been robust amid sweltering heat.

Ohio Study: Low Natural Gas Prices Saved Consumers over $40 Billion

Thanks to improved production and new technologies, which have decreased the price of natural gas, Ohio energy consumers saved more than $40.2 billion between 2006 and 2016, according to a new report released today by Consumer Energy Alliance (CEA).

Residential users saved almost $15 billion, while commercial and industrial users saved upward of $25.3 billion, the report, titled “The Benefits of Ohio’s Natural Gas Production to Energy Consumers and Job Creators,” said.

Prior to the shale revolution, prices for natural gas in Ohio peaked at $10.66 and has steadily decreased to just under $4, CEA said.

More than 700 new businesses have been established statewide to support the shale industry, bringing in over $63.9 billion in new investments. In the last seven years, shale-related industry employment increased 7.8%, employing over 389,000 Ohioans.

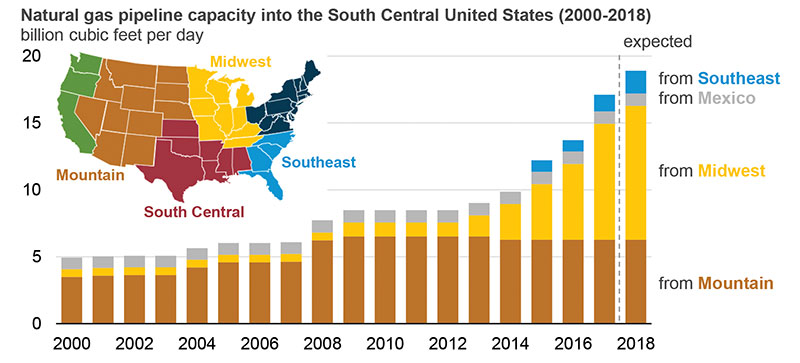

Gas Pipeline Capacity to South Central U.S. Projected to Reach 19 Bcf/d

Natural gas pipeline capacity into the South Central region of the United States will reach almost 19 Bcf/d as projects scheduled to come online by the end of 2018 bring additional supply to the Gulf Coast.

The South Central region has shifted from being a source of natural gas supply to a source of growing demand, the U.S. Energy Information Administration (EIA) said, reversing the historical flows of natural gas in the Lower 48 states.

Of the additional 6.4 Bcf/d of Northeast capacity planned to come online in 2018, more than 2.8 Bcf/d reaches the South Central region directly through three projects that transport natural gas through the Midwest and Southeast: Rayne Xpress, Gulf Xpress and Atlantic Sunrise.

Further west, Natural Gas Pipeline of America’s Gulf Coast Southbound Phase 1 is scheduled to enter service in October. This pipeline will transport up to 460 MMcf/d of natural gas from Illinois into south Texas and Louisiana, where it will supply the Corpus Christi LNG export facility and pipelines into Mexico.

The LNG export facilities scheduled to come online in 2018 and 2019 represent an additional 6.1 Bcf/d of LNG export capacity, requiring infrastructure to connect them to the interstate pipeline network and deliver large volumes of natural gas to the liquefaction terminals.

The United States has two operational LNG export facilities, which have a combined export capacity of 3.5 Bcf/d: Sabine Pass Trains 1-4 (2.8 Bcf/d) and Cove Point (800 MMcf/d). In addition to Train 5 at Sabine Pass, four new LNG export facilities are under construction, three of which are located in the South Central region and have associated pipelines scheduled for completion this year: Coastal Bend Header (1.5 Bcf/d), Cameron Access (800 MMcf/d) and Southwest Louisiana Supply (900 MMcf/d). P&GJ

Comments