August 2021, Vol. 248, No. 8

Features

Pipelines in Mexico: Opportunity for US Innovation, Exports and Patience

By Richard Nemec, Contributing Editor

Mexican scholar Adrian Duhalt has chased geography and economic development around the world, earning his doctorate at the University of Sussex in Brighten, England, in economic geography. More recently, Duhalt has directed his focus to his native Mexico.

His current preoccupation is the national government’s Program for the Development of the Isthmus of Tehuantepec (PDIT), the 77-mile (124-km) wide Interoceanic Corridor (IC) in the south end of the nation, which may end up narrowing the widening gap between Mexico’s relatively prosperous northern and central regions and its still-struggling southern states.

President Andres Manuel Lopez Obrador wants to stimulate industrial development with the expansion and modernization of road, railway, natural gas, telecommunications and electricity infrastructure, and Duhalt’s academic report in mid-June at Rice University’s Baker Institute for Public Policy stresses that gas supplies and infrastructure are a key element.

A postdoctoral fellow in Mexico energy studies in Houston and associate professor at the Universidad de las Americas Puebla in Mexico, Duhalt stresses in his report that a falloff in natural gas supplies in southeast Mexico and continuing infrastructure bottlenecks are long-standing barriers that need to be overcome.

Over the medium and long terms, the IC plans to call for the creation of 10 industrial parks in the Isthmus region, but Duhalt does not think they can be developed without resolving the gas barriers.

“The government acknowledges that there is a direct association between productivity and a state’s economic development (measured in gross domestic product per capita) and the consumption of natural gas,” Duhalt wrote.

“Before concluding his term, Lopez Obrador will seek to make as much progress as possible regarding the most important projects of his administration: the Interoceanic Corridor, the Dos Bocas Refinery in Tabasco and the Maya Train,” Duhalt told P&GJ. “And in doing so, the north-south development gap is likely to continue to be a key concern. But what remains to be seen is if these projects will successfully narrow such development imbalances.”

In 2021, there are very few new projects proposed in Mexico compared to what happened over the 2015–2020 period. New projects on the Mexican government’s radar are almost all related to connectivity with, and enhancing efficiency of, existing new pipelines. Much the existing pipeline capacity is underutilized. “The only new projects proposed in Mexico for the next five years are with the Mexican government,” said Connor McLean, an analyst specializing in Mexico for Colorado-based BTU Analytics Inc.

“Now the focus is on how the connectivity can be improved to better serve the demand. From a private sector perspective, the current national administration in Mexico is not exactly friendly,” McLean said. “So, we haven’t seen many private projects proposed lately.”

For most of the last decade Mexico represented a growth export market for the United States, coinciding with the U.S. shale revolution that saw the nation lead the world in oil and gas production. The previous Mexican national administrations encouraged more private investment in Mexico’s energy sector and billions of dollars flowed in. San Diego, Calif.-based Sempra Energy’s Mexican subsidiary, IEnova, had accumulated more than $10 billion in assets by the end of 2020, with 1,400 employees operating in 17 Mexican states.

IEnova, which now is 80% owned by Sempra, has a long list of projects south of the border, such as Rosarito Gas Pipeline, originally Gasoducto de Baja Norte, a 135-mile (217-km) pipeline across the top of Baja California connecting U.S. interstate pipelines in Arizona to the Mexican U.S. border city of Tijuana; Baja California Natural Gas Transporter, a 27-mile (43-km) line and 8,000 horsepower compressor station; and Aguaprieta Gas Pipeline, a 7-mile (11-km) line in Sonora from the U.S. border to a combined cycle gas-fired electric generation plant, Fuerze y Energia Nago-Nogales, southeast of Agua Prieta.

Justin Bird, Sempra’s executive vice president in charge of its infrastructure division that includes IEnova, spoke glowingly about Mexico prospects at the end of June at a virtual investor day hosted by the utility and infrastructure holding company. North America is Bird’s focus with a strong emphasis on Mexico, the Gulf Coast of the United States and Mexico, and markets in California and Texas, the nation’s two largest.

“We’re dedicated to investing in infrastructure to build the energy systems of the future,” Bird told an investment community audience. “Our mission is to deliver energy for change. Our infrastructure supports the integration of the U.S. and Mexican economies, with our gas network supporting more than 9.5 Bcf/d of capacity to Mexico.”

Sempra units operate 11 of 25 cross-border gas pipeline interconnections between the United States and Mexico, and they have 136,000 domestic gas customers south of the U.S. border. This year it also began commercial operations on a marine oil terminal and associated rail facilities at the port of Veracruz.

Giving Sempra and Bird much optimism are projections that North America will need in excess of $15 trillion to replace aging infrastructure over the next 20 years, along with another $2 trillion to reach net-zero carbon emissions by 2050. “We continue to find efficient ways to finance growth in our infrastructure,” Bird told the analysts.

In the liquefied natural gas (LNG) sector, IEnova’s $2.4 billion Energia Costa Azul (ECA) LNG export project is under construction, with a target for exporting U.S.-supplied gas by 2024. It is designed to competitively serve Asian customers from its West Coast position on the Pacific Ocean side of north Baja California. Bird and Sempra CEO Jeff Martin see the ECA LNG export facility as eventually a catalyst for expanding existing and building new pipeline capacity in north Baja California, further accelerating economic development along the border in northwest Mexico.

Acknowledging the ample excess pipeline capacity currently in Mexico, Bird said part of that can be used to create LNG exports, and “we’re looking at other opportunities there that we are frankly very excited about, and we’re looking for other opportunities to align our interest with Mexico’s.”

As private sector companies like Sempra move to develop closer ties with the Mexican government, crime and conspiracy reports circulate in the Mexican news media related to all levels of government, from Lopez Obrador’s administration down to state and local officials.

Under this layer of uncertainty and turmoil, there is an implication in the energy sector that Mexico may become even more dependent on U.S. gas exports. In addition, LNG terminals could turn Mexico into an export platform of U.S.-produced natural gas, so pipeline infrastructure can also contribute to develop other sources of demand domestically.

From its beginning, Lopez Obrador’s administration has inspired uncertainty in the energy private sector, with the primary concern focused on the fate of the many contracts and the worst-case scenario being that they would be rescinded. However, after the new administration’s review of the contracts amid questions about the legality of the government review, it was determined that the contract terms and conditions would remain the same as they had been approved originally.

In the spring, a seasoned Mexico energy stakeholder observed that Mexican national politics is at a legislative impasse between one side seeking the continuation of the current energy model adopted eight years ago and the Lopez Obrador reform initiatives, offering a different energy policy. For now, both are suspended.

With the contract review completed, energy conversation in Mexico centers on the recent elimination of the regulatory structures favoring the state oil company Pemex. There are concerns in the energy space about the conditions that Pemex will impose on the sales of hydrocarbons. The worry is that hydrocarbon sales will be restricted so much that any competition will be effectively nullified.

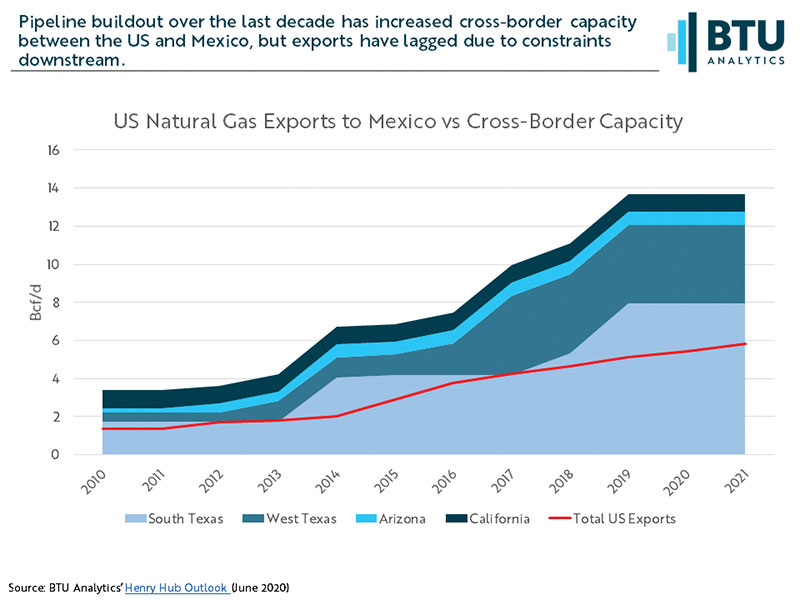

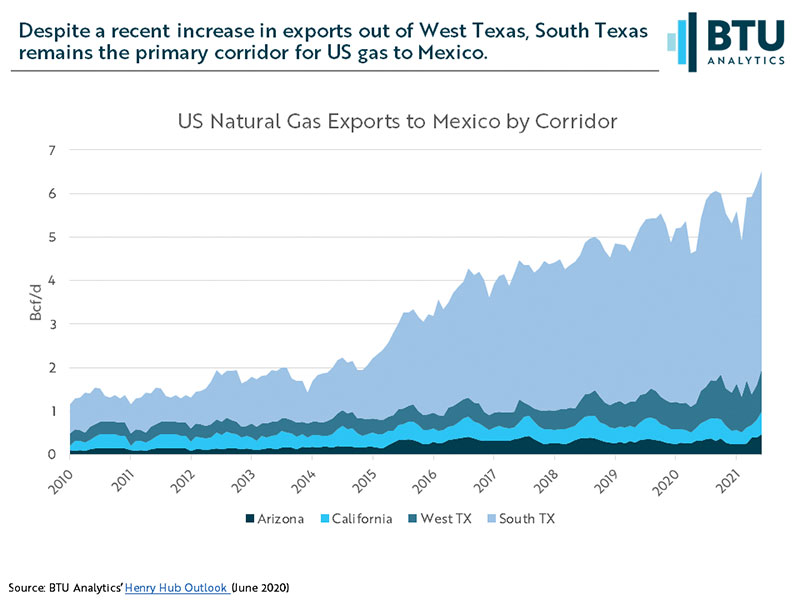

Following last winter’s Texas freeze, pipeline gas flowing to Mexico surged in April and May to record highs. Total pipeline exports to Mexico averaged over 6.1 Bcf/d (170 MMcm/d) in May with peak daily exports approaching 7 Bcf/d (198 MMcm/d).

The increase has been driven by an increase in exports out of West Texas on the recently completed Mexican company Fermaca’s Wahalajara pipeline system, according to BTU Analytics’ McLean. West Texas exports have averaged nearly 900 MMcf/d (25 MMcm/d) since October 2020 after averaging less than 700 MMcf/d (20 MMcm/d) in the prior six months.

“Despite the recent increase, constraints further downstream remain a barrier to full utilization of the nearly 4 Bcf/d of cross-border pipeline capacity,” McLean said. “The completion of the Samalayuca-Sasabe pipeline later this year should help alleviate some of the constraint by increasing westbound capacity out of the Permian. However, it is unlikely to significantly increase exports. While the pipelines in Northwest Mexico are mechanically complete, demand in the region has lagged available capacity, leaving much of the pipeline capacity perpetually underutilized.”

McLean also notes that exports out of South Texas have been strong as summer demand has emerged. Demand for South Texas exports has been driven in part by TC Energy’s Sur de Texas-Tuxpan pipeline, which has averaged more than 1.5 Bcf/d (42 MMcm/d) in both April and May after previously averaging 1.3 Bcf/d (37 MMcm/d) from January through March, he said.

“While LNG exports receive most of the attention in the U.S. gas demand market, pipeline exports to Mexico remain an important outlet for U.S. gas, especially in the Permian,” McLean wrote in a June BTU Analytics’ report. “With natural gas production set to grow in the coming years, continued growth in exports to Mexico will largely depend on the ability for Mexico to continue to build out natural gas generation facilities.”

On the U.S. side of the Mexican border, producers in four western oil/gas basins are salivating over the prospects of sales through the ECA terminal 80 miles south of the international border along the North Baja coast. They include the Green River in Wyoming, Piceance in Colorado, Uinta in Utah, and San Juan in parts of New Mexico and Colorado. Collectively, estimates indicate they could provide up to 11.5 Bcf/d (325 MMcm/d).

Pipeline capacity to supply a proposed second ECA LNG phase from the Rockies basins would still have to be built. Developers are already analyzing potential routes and permitting challenges. Alternatives include the existing Kinder Morgan El Paso interstate pipeline system as well as pipes out of Utah and the San Juan Basin.

Officials in four states also are looking at possible innovative steps, such as using state bonding authority to help ease the financing for new transmission pipelines and related infrastructure to get the gas into Mexico.

Further prospects for added U.S. supplies going to Mexico surfaced in June when Sempra Energy divulged it was looking to develop a second LNG project called Vista Pacifico at Topolobampo in Sinaloa State.

This project would target shale basins in the United States as the source of gas. Sempra holds permits from the U.S. Energy Department to export to nations with which the United States has free trade agreements (FTA) and expects to receive non-FTA approval in 2021. The company is convinced that this added LNG project would not require added pipeline capacity in either the United States or Mexico.

In late May, Federal Energy Regulatory Commission (FERC) staff issued notices on five pending gas certificate expansion projects that principally involve added compression. They range from a very modest 16.5-MMcf/d ([467-Mcm/d] a compressor upgrade, covered under blanket certificate authority) to a 495-MMcf/d (14-MMcm/d) expansion to increase service to the U.S.-Mexico border. Together, the projects represent just over $1 billion in infrastructure investment.

Economic development is also the focus of the Mexican government as Duhalt has documented in his latest report on the IC project, which includes the proposed 320-MMcf/d (9-MMcm/d) Jaltipan-Salina Cruz gas pipeline that would add gas supply to the Salina Cruz Refinery along the Pacific Coast of the isthmus.

As a result, the PDIT project includes the $435 million, 320-MMcf/d Jaltipán-Salina Cruz natural gas pipeline that would expand gas supply to the Salina Cruz refinery on the Pacific Coast and to petrochemical facilities and industrial consumers in the surrounding area.

There is also a proposed LNG export plant in Salina Cruz being pushed by Lopez Obrador’s administration. National energy ministry Sener indicates the pipeline will be completed next year, but industry sources are skeptical, noting that most projects have fallen behind because of the COVID-19 pandemic’s dampening of financial markets.

“PDIT appears to be a more comprehensive development strategy in the sense that it seeks to impact a much larger territory – 79 municipalities, 33 in the state of Veracruz and 46 in the state of Oaxaca – and, consequently, encompass a wider range of economic activities,” Duhalt wrote in his report.

Salina Cruz and other pipeline projects have been spurred by Comisión Federal de Electricidad (CFE), the national electricity company, and the anchor shipper for most of the nation’s new pipeline infrastructure. In the south, Lopez Obrador expects this energy infrastructure to drive industrial development in a region harboring some of Mexico’s largest poverty areas, including Veracruz and Oaxaca.

Further economic boosts are expected from two refineries (Salina Cruz and Minatitlan) and a series of petrochemical firms in various towns such as Coatzacoalcos.

Duhalt envisions various impacts if the government can eliminate critical energy infrastructure bottlenecks, building added pipeline infrastructure in new parts of Mexico.

“However, this government does not contemplate to build infrastructure in a significant manner,” he said.

In its 2020–2024 plan for the Expansion of the National Integrated Transportation and Storage System of Natural Gas, a handful of projects are contemplated, most of which are compression stations and interconnection upgrades. Only two pipelines are outlined.

“For Lopez Obrador, it seems that current infrastructure is enough to meet domestic needs. It is as if all that Mexico’s gas transport infrastructure needs are a tweak here and there,” Duhalt said.

But in the United States, there is growing recognition that an eventual contraction of the traditional fossil natural gas market is inevitable in the rush to decarbonize, electrify and whittle down climate changing greenhouse gas (GHG) emissions.

The Mexican populous has not adopted that mindset, but the nation is fertile ground for solar and wind developments, as Sempra Energy executives point out, and there is a growing Mexican Hydrogen Association that is betting Mexico can be a major future source of green hydrogen, drawing on renewable power sources.

The association is headed by a seasoned veteran of the energy industry, Isadore Hurtado, who worked at Pemex, CFE, Sener and the Comisión Reguladora de Energía (CRE), where he was a commissioner from 2006 to 2011.

Globally, gas is projected as a growing energy source in the midst of the climate change preoccupation in the West, according to the Energy Futures Initiative (EFI) in its report on “The Future of Natural Gas in a Deeply Decarbonized World.”

“In all global regions, natural gas may be seen as a ‘transition fuel’ for fuel switching away from more carbon-intensive fuels (especially away from coal and oil in power generation), as a feedstock for existing or burgeoning industrial sectors, as a fuel for end uses that require high-temperature heat and as a backup fuel in multiple end use sectors,” EFI’s report said.

It noted that in Europe, Northeast Asia, North America and other regions adopting or moving toward net-zero emissions targets, any continued natural gas use will require accompanying carbon capture or alternative emissions abatement technologies.

Meanwhile, the U.S. energy infrastructure advocacy group GAIN (Grow American Infrastructure Now), in a nationwide poll it sponsored in the spring, reported that nearly 90% of Americans believe the United States should reduce its reliance on foreign energy sources, and nearly three-quarters support oil and natural gas transport via pipeline.

GAIN officials indicated the opinion survey by pollster Ryan Munce, of co/Efficient, demonstrated that the American public “overwhelmingly” supports energy and infrastructure development.

U.S. energy executives with a thirst for building and operating more infrastructure south of the border better hope more Yankee enthusiasm can sweep into Mexico and change minds among some recalcitrant political leaders.

The future of private capital and innovation is far from certain.

Richard Nemec is a contributing editor to P&GJ based in Los Angeles. He can be reached at rnemec@ca.rr.com.

Comments