December 2021, Vol. 248, No. 12

Features

Looking Back at the Top 10 Midstream Stories of 2021

By Pipeline & Gas Journal Staff

In this year-ending issue of P&GJ, the staff has decided to take a look back at the long, frequently perplexing year that was 2021.

While not as volatile as the previous 12 months, the year certainly brought its share of anxiety as we in the energy industry – midstream in particular – worked to recover from the fallout caused by the COVID-19 virus, frequently not as quickly as we would have liked. That isn’t to say there were not victories along the way.

Our list of Top 10 stories was compiled from our website readership numbers throughout the year, along with staff suggestions. Like last year, the ramifications of COVID-19 are not listed among our top stories. Unfortunately, however, the pandemic still played a role in many of those listed.

- Colonial Pipeline Shuts Down after Cyberattack

(May) – Major pipeline operator Colonial Pipeline was forced to shut down its entire network to contain a cyberattack.

The system, which ships almost half of the U.S. East Coast’s fuel supply, remained off-line for several days and resulted in long lines at gas pumps in some southeastern states.

The Colonial transports 2.5 MMbpd of gasoline, diesel, jet fuel and other refined products through 5,500 miles (8,850 km) of pipelines, linking refiners on the Gulf Coast to the eastern and southern United States.

The company paid hackers $4.4 million in ransom as executives were unsure how badly its systems were breached, or how long it would take to restore the pipeline without cooperating.

“I know that’s a highly controversial decision,” Chief Executive Joseph Blount told the Wall Street Journal. “I didn’t make it lightly. I will admit that I wasn’t comfortable seeing money go out the door to people like this.” He added the move was “the right thing to do for the country.”

Blount later told a U.S. Senate committee that the attack occurred using a legacy virtual private network (VPN) system that could be accessed through a single password without a second step, such as a text message – a common security safeguard in more recent software.

- Nord Stream 2 Ready, Awaits Further Authorization

Stored pipes for the Nord Stream 2 gas pipeline, stacked up at the port in Sassnitz, Germany.

(November) – For the sheer amount of political intrigue generated, it would be difficult to surpass the ongoing controversies surrounding Russia’s Nord Stream 2 natural gas pipeline.

During the summer, Gazprom began filling the first of two pipelines that run along the bed of the Baltic Sea from Russia to Germany, bypassing Ukraine. The project has faced heavy criticism from the United States, which says it will increase European reliance on Russian gas.

The move, which brought the pipeline closer to operation, came as Europe faced dwindling natural gas reserves and mounting energy costs.

Earlier, Russian President Vladimir Putin announced the project was ready to start pumping gas to Germany, and the final stretch would be completed as the new U.S. administration seeks good relations with “key partners in Europe.”

The $11 billion project, designed to double the capacity of the existing Nord Stream pipeline to 3.88 Tcf (110 Bcm) per year, has been a focal point of tensions between Moscow and the United States throughout 2021.

Construction of the Nord Stream 2 has been shackled by sanctions introduced by the United States at the end of 2019, in an effort to boost U.S. LNG sales to Europe.

German authorities appear ready to certify the pipeline, which is completed, awaiting an operating license. But once the German authorization is given, probably no later than Jan. 8, 2022, a non-binding review by the European Commission (EC) will determine if the pipeline complies with European Union rules.

- TC Energy Terminates Keystone XL Pipeline Project

(June) – The writing may have already been on the wall, but word that TC Energy would no longer pursue development of its $9 billion Keystone XL oil pipeline sent reverberations throughout the industry.

The 1,200-mile (1,931-km) project, which was proposed in 2008 to bring oil from Canada’s Western tar sands to U.S. refiners, was halted after U.S. President Joe Biden revoked a key permit needed for a U.S. portion of the route.

Other North American oil pipelines, including Dakota Access and Enbridge Line 3, have faced steady opposition from environmental groups, which are concerned about spills and want to slow any expansion of oil production.

The Keystone XL had been expected to carry 830,000 bpd of Alberta oil sands crude to Nebraska, but the project has been in various stages of delay for the past 12 years due to opposition from some U.S. landowners, Native American tribes and environmentalists.

In Canada, the news was not taken well, with Alberta Premier Jason Kenney saying, “We remain disappointed and frustrated with the circumstances surrounding the Keystone XL project, including the cancellation of the presidential permit for the pipeline’s border crossing.”

The company took a first-quarter loss as a result, absorbing $1.81 billion (C$2.2 billion) in impairment charges related to the suspension of the Keystone XL project.

- Dakota Access Oil Pipeline Allowed to Remain Open

(June) – A U.S. federal court judge denied a request to shut the 570,000-bpd Dakota Access Pipeline (DAPL) after a key environmental permit was scrapped, ending what would have been seen as an unimaginable threat to in-service transportation routes only a few years ago.

Energy Transfer’s DAPL entered service in 2017 after months of protests from opponents who said it would threaten artifacts as well as Lake Oahe, a critical drinking supply, and the greater Missouri River.

Washington-based U.S. District Judge James Boasberg ruled the plaintiffs had failed to clear the “daunting hurdle” of proving that the pipeline’s continued operation would create irreparable injury.

The decision allowed the 570,000-bpd pipeline out of North Dakota’s Bakken Shale basin to continue operating at least until an environmental review of the line by U.S. Army Corps of Engineers is completed, in March 2022.

Energy Transfer had argued throughout the process that DAPL complied with all regulatory and safety requirements.

DAPL ships crude oil produced from the Bakken Shale region in North Dakota to refiners in the Midwest and to exporters in the U.S. Gulf.

- Iran Starts Pumping Oil into Goreh-Jask Pipeline

(July) – The National Iranian Oil Company (NIOC) begin transferring oil through the Goreh-Jask pipeline, which runs from the Goreh oil terminal in the Bushehr Province to the Jask oil terminal along the Gulf of Oman.

The 620-mile (1,000-km) project cost about $1.8 billion to build and can transfer 300,000 bpd. Iran has been planning since at least 2012 to set up the Jask terminal, just outside of the Strait of Hormuz.

While Iran is under U.S. sanctions that effectively bar it from selling oil, it has increased exports this year by often disguising the origin of the shipments, Bloomberg reported. Refiners in China are the main buyers, the report states.

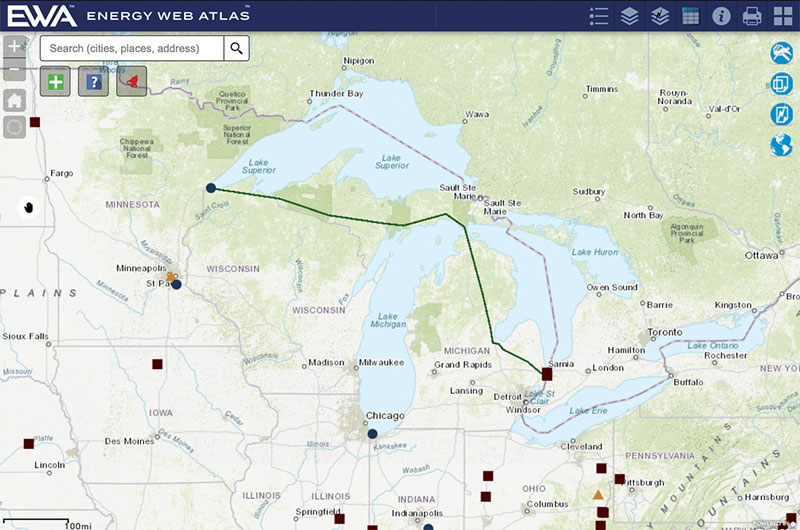

- Enbridge Seeks Michigan Court Ruling on Line 5 Pipeline Deal

(October) – Throughout the year, Enbridge’s Line 5 remained at the center of a long-running environmental dispute between the Calgary-based company and the U.S. State of Michigan, which has caused a rift between the Canadian and U.S. governments.

The pipeline, which ships 540,000 bpd of crude and refined products from Superior, Wisconsin, to Sarnia, Ontario, was ordered to shut down in May because of concerns over the development of a possible leak along a 4-mile (6-km) section running under the Straits of Mackinac in the Great Lakes.

Enbridge ignored the order, sparking a legal battle that ended up causing the governments of Canada and United States to intervene, with Canada invoking a 1977 treaty to request formal negotiations.

Earlier, Enbridge said it would go to court after failing to strike a deal with Michigan Gov. Gretchen Whitmer on building an oil pipeline tunnel beneath the channel that connects Lakes Huron and Michigan.

Whitmer indicated she might accept a tunnel, which Enbridge says it could finish by 2024, when it would decommission the existing pipes. But Whitmer is demanding a Line 5 shutdown within two years. Enbridge countered that the tunnel “cannot possibly be completed.”

Enbridge said it remains “fully committed” to building the tunnel.

- Double E Pipeline Construction on Track for Startup This Year

(October) – Summit Midstream’s Double E Pipeline achieved mechanical completion and appears on track to be commissioned by the end of the year, according to Summit Midstream Partners’ President and CEO Heath Deneke.

The 135-mile (217-km) Double E Pipeline appears on target to come in under budget, which is now expected to be approximately $400 million, down from a June 2019 estimate of $500 million.

The Double E system will provide firm natural gas transportation service from various receipt points in the Delaware Basin in the Permian Shale in New Mexico and Texas to various delivery points in and around the Waha Hub.

It will connect a growing associated natural gas supply basin to a liquid trading point, according to Global Energy Infrastructure’s project data. It should transport about 1.35 Bcf/d (38 MMcm/d) of gas.

The 43-inch pipeline received approvals for construction and implementation from the Federal Energy Regulatory Commission (FERC) in January.

The pipeline should be commissioned in the fourth quarter of 2021, Deneke said.

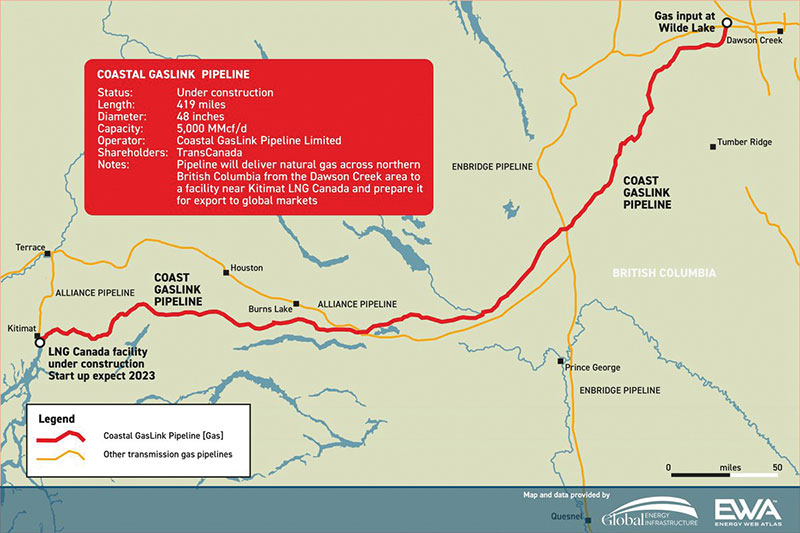

- ‘Critical’ Coastal GasLink Pipeline on Target for 2023

(May) – In a big dose of good news on the construction front, the Coastal GasLink pipeline, which will feed natural gas to one of the biggest LNG projects in Canada’s history, is halfway complete and on track to start up by 2023.

The project involves the construction and operation of a 48-inch, 416-mile (670-km) pipeline from northeastern British Columbia to the LNG Canada Export Terminal, currently under construction near Kitimat. LNG Canada’s joint venture participants include Shell, Kogas, Mitsubishi, PetroChina and Petronas.

“It tends to get lost in the shuffle, but it is a massive, massive development,” said Chris Bloomer, president and CEO of Canadian Energy Pipeline Association. “From an investment point of view, it’s huge. [LNG Canada] is the first LNG project off the west coast of Canada.”

Coastal GasLink will be the first large-scale transmission pipeline moving gas across the Rockies to the coast, Bloomer said, and it will tap into one of the largest natural gas reserves in the world.

TC Energy is building the pipeline, which will be capable of moving 2.1 Bcf/d (59 MMcm/d) of natural gas with the potential to deliver up to 5 Bcf/d (142 MMcm/d).

The Coastal GasLink project, including engineering, procurement and construction, was 43% complete as of Coastal GasLink’s April construction update. Construction was 26% complete.

- PennEast Ceased Development of Marcellus Pipeline

(September) – In an unpleasant turn of events, PennEast Pipeline stopped development of its proposed pipeline from Pennsylvania to New Jersey.

PennEast was cancelled, one of the last major projects in the works to move gas from the Marcellus/Utica formation, was canceled, the company said, because it had not yet received all of its required permits.

“The PennEast partners, following extensive evaluation and discussion, recently determined further development of the project no longer is supported,” PennEast said in an email.

PennEast decided to stop development even though the U.S. Supreme Court in June ruled in its favor in a lawsuit allowing the line to seize state-owned or controlled land in New Jersey.

In August, PennEast said it still hoped to finish the first phase of the $1.2 billion pipe in Pennsylvania in 2022. However, the company still lacks certain permits, including a water quality certification in New Jersey.

The 120-mile (193-km) pipe was designed to deliver 1.1 Bcf/d of gas from the Marcellus shale to customers in Pennsylvania and New Jersey.

PennEast had originally hoped to bring the pipeline online in 2019.

Other East Coast gas pipes held up by regulators and legal battles include Williams Cos’s Northeast Supply Enhancement from Pennsylvania to New Jersey and New York, and Dominion Energy’s Atlantic Coast from West Virginia to Virginia and North Carolina. The latter was cancelled in 2020.

- Enbridge’s Long-Delayed Line 3 Begins Operations

(September) – Enbridge’s Line 3 pipeline replacement project began operating on Oct. 1, the first successful major expansion of Canadian crude export capacity in six years, clearing hurdles that other projects were unable to overcome.

Its completion was welcomed by the Canadian energy sector after several proposed pipelines, including TC Energy’s Keystone XL, were scrapped due to environmental opposition and regulatory delays.

The $8.2 billion project allows Enbridge to double its capacity to 760,000 bpd on the 1,097-mile (1,765-km) pipeline.

Line 3, built in the 1960s, carries oil from Edmonton, Alberta, to refineries in the U.S. Midwest, but for years was transporting less than its capacity because of age and corrosion. The project was opposed by environmental and Native American groups, particularly in Minnesota, during the last stage of the expansion.

Construction in both the United States and Canada took more than seven years to finish, but the project succeeded where other projects have run aground, because it was replacing an old line, rather than starting one from scratch, Leo Golden, Enbridge’s vice president of Line 3 Project Execution, told Reuters in an interview.

The 337-mile (542-kim) Minnesota section of Line 3 is the last part of the pipeline to come in service, following already-completed segments in Canada, North Dakota and Wisconsin.

Comments