June 2021, Vol. 248, No. 6

Projects

Projects June 2021

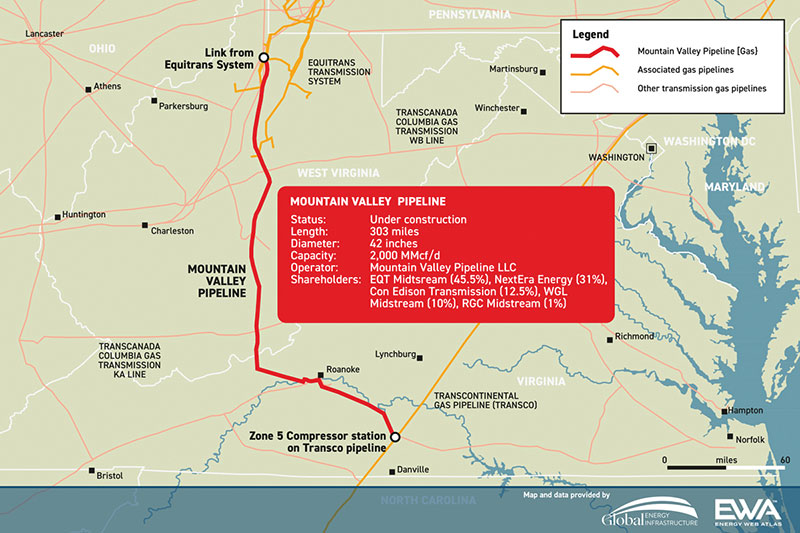

Equitrans: Quick Finish of MVP Best for Consumers, Environment

The joint venture behind Mountain Valley Pipeline (MVP) still targets an in-service date late this year and believes previous applications will contribute to an efficient permitting process, a spokeswoman said.

The natural gas pipeline will be 303 miles (488 km) long, and the project includes construction of pipeline and three compressor stations, according to project data from Global Energy Infrastructure. More than 264 miles of pipe has already constructed, a representative said.

The companies involved in the project decided in January to abandon plans to use a blanket permit from the U.S. Army Corps of Engineers, which would have allowed the project to cross all streams and wetlands along its route from West Virginia to Virginia.

Some analysts predict seeking individual permits will take long enough to push the pipeline’s in-service date into 2022.

“MVP continues to target a late 2021 in-service date and is following all procedures for the USACE’s Individual Permit process and related FERC amendment process, adhering to the requirements and decisions of each agency,” said Natalie Cox, a director of communications for Equitrans Midstream, in an emailed statement.

There are almost 500 streams and wetlands along the route, which will provide the only direct path for western Marcellus and Utica producers to supply customers, end users and consumers in the southeast with access to low-cost Marcellus gas.

Demand

MVP’s original in-service date was late 2018, and delays have been costly to both developers and consumers. The price of the project has increased from an estimated $3.5 billion.

Roanoke Natural Gas, an MVP end-user, issued a news release in February about a 68% increase in the price of gas due to the winter storm in Texas.

“This is a real-time, real-world example of the need for the (MVP) and the gas it will supply our customers and others throughout the United States,” Roanoke Gas President and CEO Paul Nester said. “If the MVP had been in service, we believe we would have saved our customers significant commodity gas costs by delivering gas from the prolific and affordable Appalachian Basin.”

The risk of this happening again remains until the region has additional gas supply from the MVP, Cox said. While existing pipelines have access to Northeast, Midwest and Gulf Coast markets, MVP will add the Southeast market, she said, adding the pipeline developers have consistently seen a growing need for the pipeline.

– Maddy McCarty, P&GJ Digital Editor

Enbridge to Keep Great Lakes Pipeline Running, Defy Order

Enbridge decided it will continue to operate its Line 5 even after an order from the U.S. state of Michigan to shut down the crude oil pipeline.

The Calgary, Canada-based company been involved in a lengthy dispute with the U.S. state of Michigan over the 540,000-bpd pipeline. The controversy involves a 4-mile (6.4-mile) section of underwater pipeline that is seen as a potential leak threat for the Great Lakes.

Michigan Gov. Gretchen Whitmer revoked the pipeline’s easement last year, along with permission to operate; the shutdown order went into effect May 12 and is currently being challenged by Enbridge in federal court.

“We intend to continue to operate the line and are certain we are in compliance with the easement and the law,” Enbridge CEO Al Monaco said during a recent earnings call.

Enbridge has proposed building an underwater tunnel to house the disputed section of pipeline and said the permitting process for that continues. However, the cost of the tunnel is likely to be more than the initial estimate of $500 million, the company said recently.

AquaDuctus Pipeline to Ship Green Hydrogen from North Sea

Gascade, Gasunie, RWE and Shell are moving forward with the AquaDuctus pipeline project, designed to transport green hydrogen from the North Sea directly to the continent.

The pipeline is part of the AquaVentus initiative, which looks to install 10 gigawatts of electrolysis capacity for green hydrogen production from offshore wind power between Heligoland and the Dogger sand bank.

In the dovetailed sub-projects, demand, generation and transport of hydrogen are to be synchronized to enable a swift market ramp-up. Once the construction of the generation plants is fully completed, AquaDuctus would transport up to 1 mtpa of green hydrogen from 2035 onward.

The pipeline will replace five high-voltage direct current transmission systems, which otherwise would have to be built. It is a cost-effective option for transporting large volumes of energy over distances of more than 249 miles (400 km), the companies said.

The first step in the AquaDuctus project is to carry out a detailed feasibility study. AquaDuctus also has participated in the Important Project of Common European Interest (IPCEI) process of the German Federal Ministry for Economic Affairs and Energy.

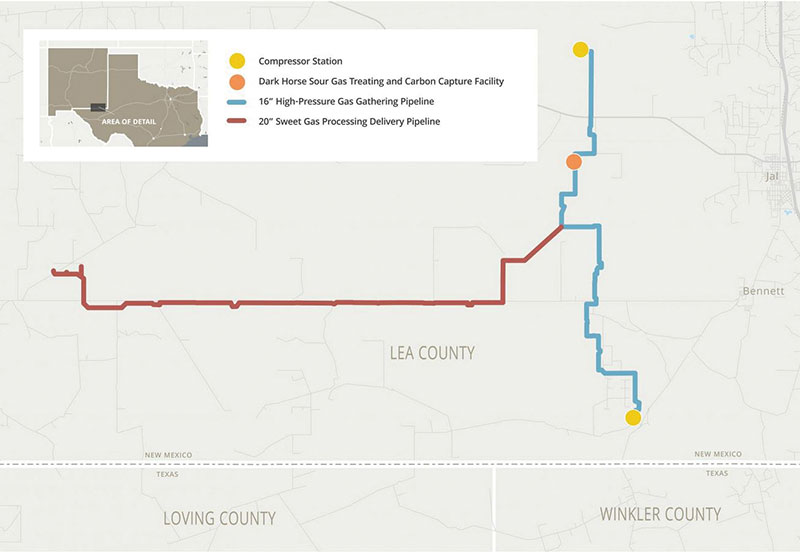

Piñon Starts Work on Sour Gas Treatment, Carbon Capture Facility

Piñon Midstream announced it has started construction on the Dark Horse Sour Gas Treating and Carbon Capture Facility and associated pipeline infrastructure in the Delaware Basin of New Mexico.

The greenfield project will provide a centralized amine treating facility, an 18,000-foot- (5.5-meter)-deep acid gas sequestration well and 30,000 horsepower of field compression, and it is expandable to treat up to 400 MMcf/d (11 MMcm/d) of sour gas.

The Piñon assets are designed to gather and treat natural gas containing any concentration of H2S and CO2 and deliver treated sweet gas to multiple third-party gas processing plants, the Houston-based start-up said.

The Dark Horse Facility and its associated pipelines are to be the first purpose-built, sour gas infrastructure solution of its kind in the Delaware Basin, the company said.

Piñon expects the Dark Horse Facility will begin operations in July 2021 at full capacity, treating 85 MMcf/d (2.4 MMcm/d) of sour gas.

The company said it also has purchased a second amine treating plant that is scheduled to be installed and operational in the fourth quarter of 2021, increasing Piñon’s total sour gas treating capacity to 170 MMcf/d (4.8 MMcm/d).

Hummingbird Nest Leads to Trans Mountain Suspension Order

The Canadian government ordered Trans Mountain to stop work on a section of its oil pipeline expansion project in Burnaby, British Columbia, for four months to protect hummingbird nests.

The $10.17 billion (C$12.6 billion) project will nearly triple capacity of the pipeline, running from Edmonton, Alberta, to the coast of British Columbia, to ship 890,000 bpd of crude and refined products by late 2022.

Trans Mountain told Reuters the order applies to a 0.62-mile (1-km) stretch along its pipeline right-of-way and work continues on all other areas of the 715-mile (1,150-km) route. There has been no change to the expected in-service date.

An Environment and Climate Change Canada (ECCC) enforcement officer visited the Burnaby site twice earlier this month after complaints about construction activity affecting nests, including those of a species known as Anna’s hummingbird, which are protected by Canadian law. The order lasts until Aug. 20 when the nesting season ends.

Brazil’s Petrobras Sells Stake in NTS Gas Pipeline Network

Brazil’s state-owned oil company Petroleo Brasileiro SA approved the sale of its remaining 10% stake in the NTS gas pipeline network for $337 million (1.8 billion reais) to Brookfield and Itausa SA, the company said.

In 2016, investors led by Canada’s Brookfield Asset Management and Brazil’s Itausa purchased 90% of the more than 1,240-mile (2,000-km) pipeline network from Petrobras for $5.2 billion.

Brookfield’s fund now will own 100% of Nova Transportadora do Sudeste SA, as NTS is formally known, according to Reuters. Petrobras, as the Rio de Janeiro-based firm is known, will receive $279.8 million (1.5 billion reais), the company said, after dividend payments and contract adjustments.

Project Canary to Measure Greenhouse Gases from Rio Grande LNG Facility

NextDecade and Project Canary formed a joint pilot project for monitoring, reporting, and independent third-party measurement and certification of the greenhouse gas (GHG) intensity of liquid natural gas (LNG) to be sold from NextDecade’s Rio Grande LNG export facility in the Port of Brownsville, Texas.

The partnership will enable the development of a responsibly sourced natural gas supply chain from leading producers in the Permian Basin and Eagle Ford Shale and independent, third-party certification of the GHG intensity of LNG.

NextDecade recently said its wholly owned subsidiary, NEXT Carbon Solutions, is developing a carbon capture and storage (CCS) project at Rio Grande LNG, which is expected to enable the capture and permanent geologic storage of more than 5 mtpa of carbon dioxide (CO2).

Feasibility for Gazprom’s Soyuz Vostok Pipeline Project Approved

The feasibility analysis concerning the construction project for the Soyuz Vostok gas trunkline has been approved, a Gazprom spokesman said. The pipeline will become an extension of Russia’s Power of Siberia 2 gas pipeline in Mongolian territory.

During Gazprom’s feasibility analysis, the basic parameters of the project were established, including the optimal route for the gas pipeline in Mongolian territory, length and pipe diameter of the project, operating pressure and the number of compressor stations that will be needed.

The preliminary indicators reflect the cost-effectiveness that needs to be achieved during the implementation of the project.

The feasibility study on Soyuz Vostok gas trunkline, including a detailed breakdown of investment and operating costs, will be developed before the end of this year, the company said.

Comments