October 2021, Vol. 248, No. 10

Projects

Projects October 2021

Enbridge’s Long-Delayed Line 3 Oil Pipeline Nears Startup

Enbridge’s Line 3 replacement project is expected to go online Oct. 1 after successfully staving off another legal challenge.

The completion comes as welcome news for the Canadian energy sector after several proposed pipelines, including TC Energy’s Keystone XL, were abandoned in the wake of court oppositions and regulatory delays.

The $8.2 billion project allows Enbridge to roughly double its capacity on the 1,097-mile (1,765-km) pipeline. The completion represents the only successful large-scale expansion of Canadian crude export capacity in six years.

The project replaces pipe, which initially went into service in the 1960s, from Alberta to Superior, Wisconsin. The project will increase the line’s capacity to 760,000 bpd from about 390,000 bpd.

Calgary-based Enbridge initially filed its Line 3 project application with the National Energy Board (now known as the Canada Energy Regulator) in 2014. The project got a green light from Prime Minister Justin Trudeau in November 2016, when it was expected to be completed by 2019.

The Canadian segment of the project was finished nearly two years ago. But its U.S. segment has faced stronger opposition, primarily in Minnesota, from environmental groups and some Indigenous communities.

Company Bolsters GOM Capacity with Purchase of Moda Midstream

Enbridge is also buying logistics company Moda Midstream Operating for $3 billion in cash, gaining access to an export terminal in Texas that loaded more than a quarter of all U.S. Gulf Coast crude exports last year.

The terminal, Moda Ingleside Energy Center, connects the prolific Permian and Eagle Ford Shale oil basins to international markets and has an export capacity of 1.5 MMbpd with storage of 15.6 million barrels.

“Over the last several years we’ve been building a strong position in the U.S. Gulf Coast through both natural gas and crude infrastructure,” Enbridge President and CEO Al Monaco said.

Private equity firm EnCap Flatrock Midstream owns Moda, which purchased the Ingleside export facility from Occidental Petroleum Corp. in August 2018.

The terminal can partially load very large crude carriers (VLCCs), tankers that can carry as much as 2 million barrels of oil.

Other assets in the transaction include Moda’s Viola pipeline, Taft Termina and Cactus II Pipeline.

Ukraine Says Russian Gas Transit to Europe Decreasing

The transit of Russian gas through the Ukrainian gas transit system to Europe will fall to 3.08 MMcf/d (87.2 Mcm/d) in September, from an average 3.51 MMcf/d (99.4 Mcm/d) in April to August, Ukrainian state-run gas transit operator said.

The operator said in a statement that the transit levels in September are the minimum amount provided by the existing transit agreement signed by Ukraine and Russia in 2019.

The company said a record rise in gas prices at European gas hubs was the result of a decrease in transit.

“Ukraine constantly offers transit capacities to supply additional volumes of gas to the EU. However, (Russian) Gazprom, unfortunately, constantly refuses them,” the company’s head Sergiy Makogon told Reuters.

Makogon said such a policy not only stimulates further growth in European gas prices, but it also sends “extremely transparent” signals to Europe that additional gas volumes could be supplied only through the new Nord Stream 2 pipeline.

Gazprom said last month that low gas volumes in European storage are set to support Gazprom’s exports in the second half of 2021 and in 2022.

Lebanon to Get Egyptian Gas via Pipeline in Plan to Ease Crisis

Egyptian natural gas travels by pipeline to Lebanon via Jordan and Syria to boost its electricity output under a plan agreed to by the four governments to ease a crippling power crisis.

The plan is part of a U.S.-backed effort to address Lebanon’s power shortages using Egyptian gas to be supplied via an Arab pipeline established 20 years ago.

Life in Lebanon has been paralyzed by the crisis that has deepened as supplies of imported fuel have dried up. It is part of a wider financial crisis that has sunk the Lebanese currency by 90% since 2019.

The plan is complicated by U.S. sanctions on the Syrian government of President Bashar al-Assad. Lebanese officials have called on Washington to grant an exemption.

The plan was approved by ministers from Lebanon, Jordan, Syria and Egypt at a meeting in Amman.

“We have put a roadmap with the ministers so that within the coming few weeks we can ensure that everything is ready so that we can after this review begin pumping gas at the earliest opportunity,” Egypt’s Petroleum Minister Tarek El Molla said.

Brazil’s Logum Makes Initial Ethanol Export to US via Pipeline

Brazilian transportation company, Logum Logistica, said it carried out its first ethanol export deal to California using pipelines to move the biofuel from the producing region to the port.

Logum said it moved 40 million liters (10 million gallons) of ethanol from a terminal in Ribeirao Preto, in the main sugar and ethanol belt, to the Ilha D’Agua port in Rio de Janeiro using a combination of short truck trips and its pipeline system for a total route of 745 km (463 miles).

The firm said the transport of the ethanol by pipelines, beyond the smaller cost and economies of scale, prevented the use of more than 700 trucks, estimating the operation avoided 2,000 tons of carbon emissions.

Logum said the deal was possible because the California government gives a price premium to cane-based ethanol as well as for biofuel that is transported through lower-emissions infrastructure.

“The California program foresees a premium of up to $8 per 1,000 liters of ethanol,” it said in a note.

Brazil and the United States are the two largest producers and consumers of ethanol. They trade between each other, with U.S. ethanol-makers usually exporting to Brazil’s Northeast region, while Brazilian mills ship the fuel to California using the environmental premiums.

Algeria Hints at Ending Contract for Gas Pipeline Crossing Morocco

Algeria may end gas supplies to Morocco, the country hinted two days after severing diplomatic ties with the Kingdom.

Morocco receives natural gas supplies through the Maghreb-Europe pipeline, linking Algeria to Spain and running across the Kingdom. The contract for the pipeline expires in October.

Algeria has a second pipeline, Medgaz, that does not cross Morocco, and Energy Minister Mohamed Arkab said it would supply all of Spain’s gas supplies.

“The minister affirmed Algeria’s total commitment to cover all Spain’s natural gas supplies through Medgaz,” the energy ministry said in a statement after a meeting between Arkab and the Spanish ambassador.

Medgaz directly links its facilities in the western town of Beni Saf to Almeria, in southeastern Spain.

Russia Waits for Germany’s Nod to Start Gas Sales via Nord Stream 2

Commercial natural gas flowing from the Nord Stream 2 gas pipeline will not start until a German regulator gives the green light, Russia’s Foreign Ministry said recently, according to Russian news agency TASS.

Certification is expected to take up to four months but will only start once all paperwork is complete, which entails checks by the German economics ministry and Russian gas giant Gazprom.

Foreign Ministry spokesperson Maria Zakharova said Russia hoped for a prompt decision from the German side.

“The timings for the commercial supplies depend on the position of Germany’s regulator,” she said, according to Reuters. “We hope that millions of European consumers will be able to receive the Russian gas in the nearest future via the shortest, the most economical and ecological route.”

The $11 billion pipeline has drawn opposition from the United States, Ukraine and others averse to Europe increasing its reliance on Russian energy imports.

China Approves $149 Million Coalbed Methane Pipeline Project

China’s state planner approved a $149 million (960 million yuan) coalbed methane pipeline project linking the northern provinces of Shanxi and Shaanxi, the National Development and Reform Commission said.

The 46-mile (74-km) pipeline is designed to transmit 70.6 Bcf/d (2 Bcm/d) of gas each year and will be managed by China United Coalbed Methane Corp., a subsidiary of China’s CNOOC.

The cross-region pipeline aims to help boost the development of coalbed methane, a form of natural gas extracted from coal beds.

Spire Gets More Time to Operate STL NG Pipeline

U.S. natural gas company Spire received the go-ahead from federal regulators to keep operating its STL natural gas pipeline in Missouri for another 90 days while regulators consider the next steps for the pipe.

The U.S. Federal Energy Regulatory Commission’s temporary order came after the U.S. Court of Appeal for the District of Columbia Circuit vacated in June the certificate FERC issued for the roughly $285 million pipe in 2018.

Spire has warned that the shutdown of the 65-mile (105-km) pipeline could cause gas outages for as many as 400,000 in St. Louis this winter.

“When we filed for a temporary certificate ... the goal was to address an emergency situation in the St. Louis region while allowing FERC more time to review the full certificate on remand. The order is a good first step in doing that,” Spire spokesperson Jason Merrill told Reuters.

But Merrill said Spire will keep working with all parties, including FERC, because “This authorization does not get us through what can be some of winter’s coldest months.”

FERC Commissioner James Danly dissented on the order for several procedural reasons and also noted that the temporary certificate will end Dec. 12, “not even halfway through the winter season.”

WhiteWater Acquires Sendero’s Gateway Pipeline in Delaware Basin

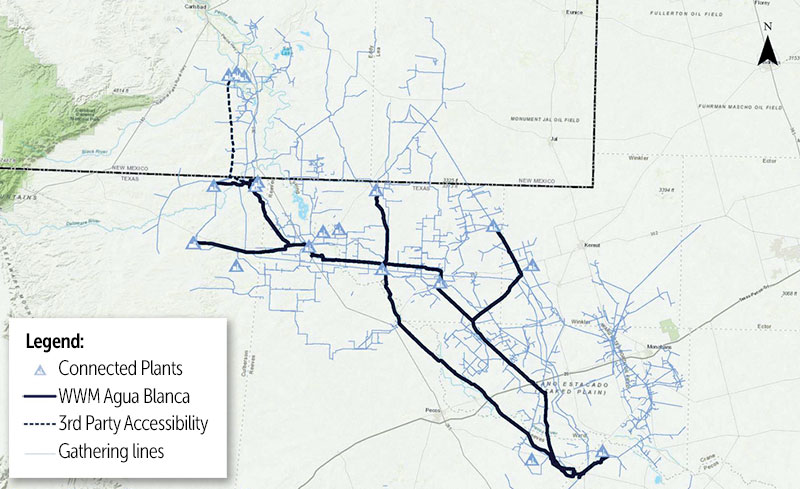

WhiteWater bought the Sendero’s 24-inch Gateway Pipeline, connecting to the company’s Agua Blanca natural gas pipeline system.

The Gateway Pipeline extends 24 miles (39 km) north from Reeves County, Texas, into the Carlsbad, New Mexico, area and has been in service since late 2020.

The Delaware Basin intrastate natural gas pipeline services portions of Culberson, Loving, Pecos, Reeves, Ward and Winkler Counties in Texas. The system consists of about 200 miles (322 km) of large-diameter pipelines and has a capacity of 3 Bcf/d (85 MMcm/d).

Agua Blanca is a joint venture with WhiteWater and MPLX.

Comments