August 2022, Vol. 249, No. 8

Features

Midyear International Update: Midstream Steps Up as Europe Pivots from Russian Energy

By Jeff Awalt, Executive Editor

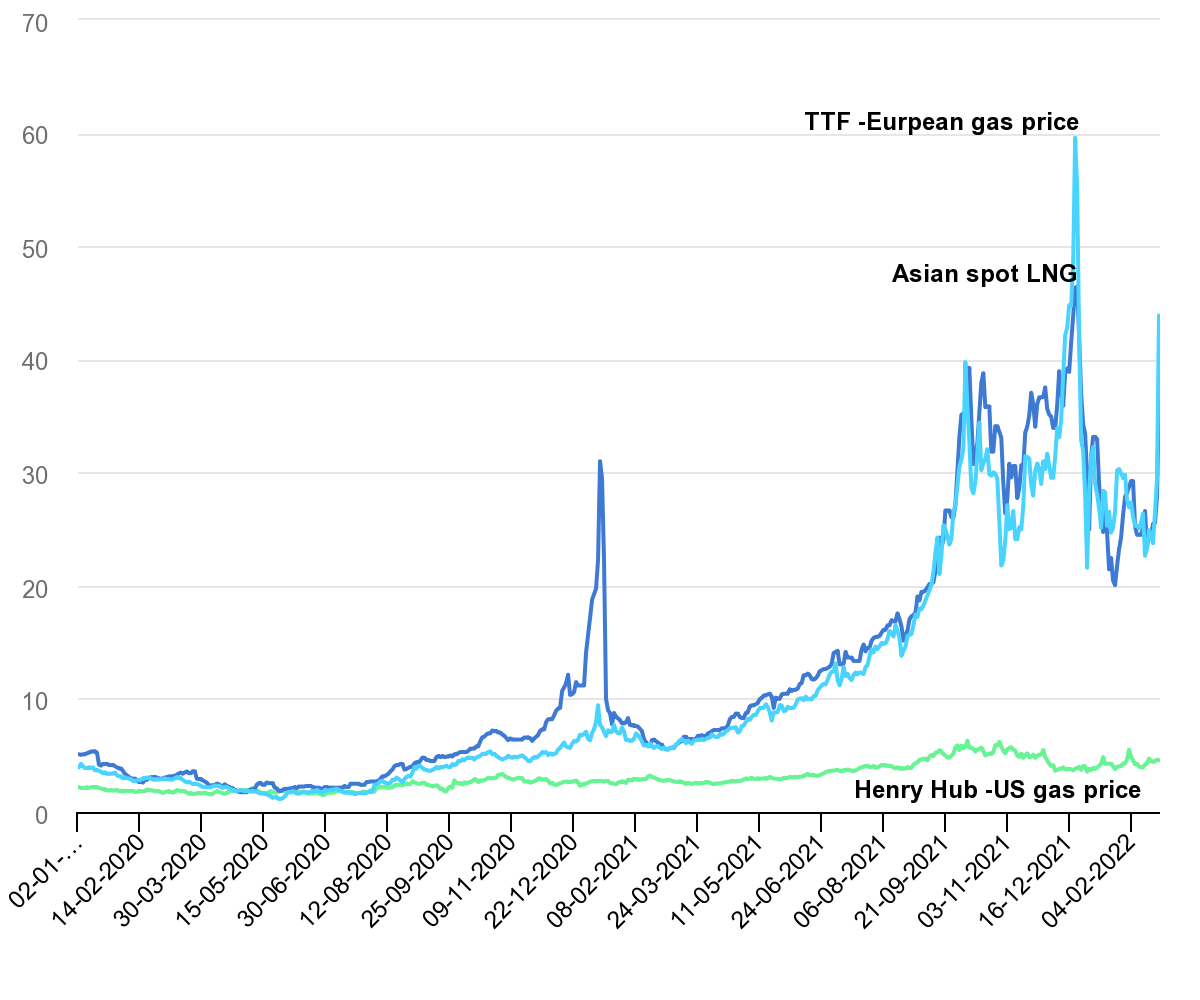

(P&GJ) — Six months into Russia’s war on Ukraine, a global oil and gas supply squeeze has been further tightened by sanctions on the world’s largest energy exporter, sending power and fuel prices soaring.

A weakening economic outlook has done little to alleviate a global energy crisis driven by a shortage of supply and a post-pandemic demand rebound.

Low inventories, cautious capital spending by Western energy companies, and limited spare capacity among OPEC+ producers has deepened the impact of oil supply constraints via sanctions on Russia.

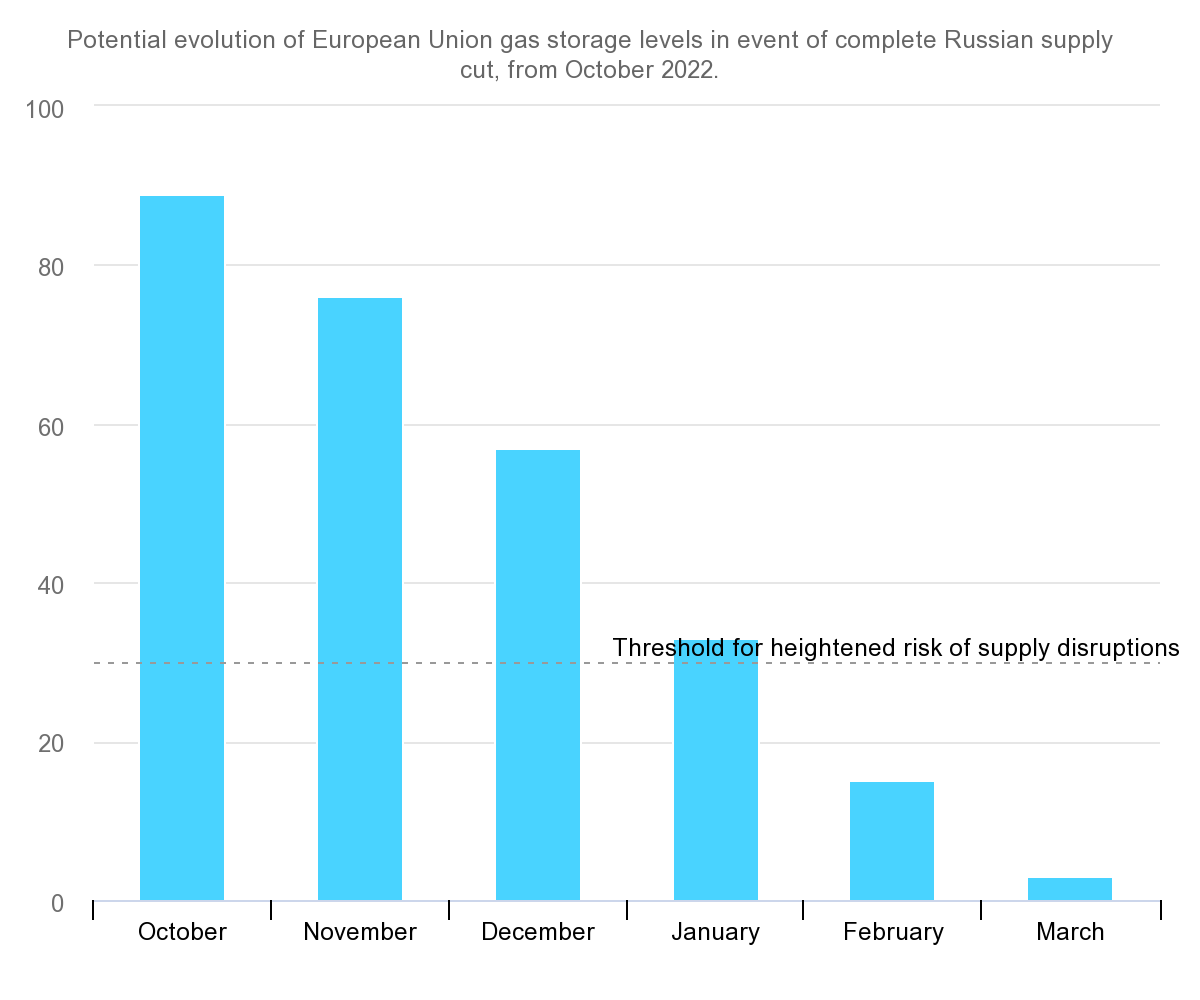

Europe, which relied on Russia for 45% of its natural gas supply in 2021, was on the verge of power rationing in July as European leaders accused Russia of drawing out maintenance and reducing natural gas deliveries via the Nord Stream 1 pipeline as retaliation for sanctions, with a goal of preventing critical storage builds ahead of peak winter demand.

“The world has never witnessed such a major energy crisis in terms of its depth and complexity,” said International Energy Agency Executive Director Faith Birol, describing Europe’s situation at the epicenter of the market turmoil as especially perilous. “I’m particularly concerned about the months ahead.”

Since the Ukraine invasion, Western Europe’s intensive focus on the climate-driven energy transition has been eclipsed by the more urgent pursuit of energy security. The pace at which the continent can replace Russian oil and gas with more reliable supplies will be largely determined by its ability to develop midstream infrastructure to deliver it.

Similar challenges face other regions of the world for both natural gas and oil, exacerbated by the failure of Middle East producers to boost output much beyond current levels, as U.S. President Joe Biden was reminded during an apparently unsuccessful effort to coax more oil out of Saudi Arabia during a summer visit to the kingdom.

He would have had much better luck looking for spare capacity at home, as North America appears to be the only region positioned for a meaningful increase in oil and gas production and exports. But it will take time and significant infrastructure investment to achieve them.

North America

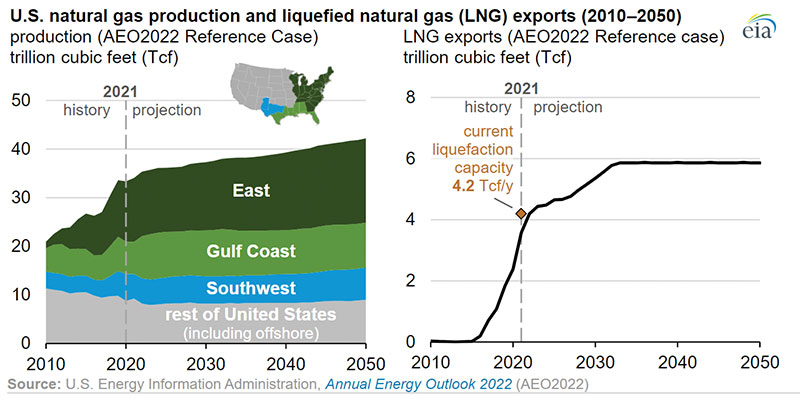

U.S. LNG has been a critical source of Europe’s supply and is projected to meet more of the EU's natural gas demand in the future. Export capacity is currently maxed out, but more natural gas pipeline and LNG export capacity is being added through numerous projects to help meet growing international demand.

Prior to the February invasion of Ukraine, Refinitiv data showed natural gas supplies to U.S. LNG export plants had reached a record 13.3 Bcf/d. Venture Global, which started producing LNG at its Calcasieu Pass LNG plant in Louisiana in January, loaded LNG on its first commissioning vessel in February. Around the same time, Cheniere reported that the six liquefaction trains at its Sabine Pass plant were already operating near full capacity after their startup in November.

New Fortress Energy in March filed for federal approval of a new LNG export project in federal waters off the Louisiana coast, which would be able to export about 2.8 million tonnes per annum (mpta) of LNG, or almost 400,000 Mcf/d of gas, using its “Fast LNG” technology.

Also in March, Cheniere announced that it contracted with Bechtel Energy for development of its 1.49 mtpa Corpus Christi Stage III Project, while Tellurian Inc. said it will begin construction of Phase 1 of its Driftwood LNG terminal, an export facility near Lake Charles, Louisiana. Phase 1 of the 27.6 mtpa Driftwood project would include two LNG plants with an export capacity of up to 11 mpta.

Meanwhile, export capacity was temporarily reduced starting in early June, when a fire at Freeport LNG halted exports, and the plant is not expected to resume full plant operations until late 2022, reducing U.S. supplies by an estimated 4 mt for the year.

When demand for natural gas grew in pre-pandemic years, the Appalachian Basin offered virtually an on-demand tap for incremental production increases, with growth rates of roughly 3-4 Bcf/d per year. Not anymore. There’s still plenty of gas in the ground, but Appalachia’s prolific Marcellus Shale is located across state lines from Gulf Coast export facilities and permitting issues have effectively bottlenecked the region.

That leaves two major basins to meet most of the surging demand – the hot-spot Haynesville Basin of Northeast Texas and Louisiana and the Permian Basin of West Texas and New Mexico.

Both the Haynesville and Permian have the ability to deliver natural gas to LNG facilities on the U.S. Gulf Coast via intrastate pipelines, potentially streamlining permitting and construction. As a predominantly dry gas basin, activity in the Haynesville shale has historically been limited by low natural gas prices, but its fortunes have reversed with higher prices and ever-increasing demand forecasts tied to nearby LNG plants.

Haynesville natural gas production grew to a record-high 12.5 Bcf/d in November of 2021 and has been averaging about 12 Bcf/d since, accounting for about 13% of all U.S. dry gas production, according to the U.S. Energy Information Administration (EIA).

That growth was made possible by expanding pipeline takeaway capacity, including Midcoast Energy’s CJ Express pipeline, which entered service in April 2021, and Enterprise Products Partners’ Gillis Lateral pipeline. The related expansion of Enterprise’s Acadian Haynesville Extension also entered service in December 2021.

Those three projects added 1.3 Bcf/d of takeaway capacity from the Haynesville area, raising its total estimated takeaway capacity to 15.9 Bcf/d, according to PointLogic. That figure suggests excess takeaway capacity out of the Haynesville is at or below 900,000 Mcf/d, or about 7% of total capacity.

In response, Energy Transfer started construction of the 1.65 Bcf/d Gulf Run pipeline to move gas from the Louisiana Haynesville to the Gulf Coast. That project, which Energy Transfer gained via its acquisition of Enable Midstream in December 2021, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant now under construction in Texas by QatarEnergy (70%) and Exxon Mobil (30%).

Energy Transfer has said it expects to complete Gulf Run by the end of 2022, and Co-CEO Marshall McCrea told analysts earlier this year that the Dallas-based company was making progress toward potential FID for its own LNG export project at Lake Charles, Louisiana.

As pipeline operators look toward intrastate pipelines as the fastest path to expansion, two distinct corridors are developing for egress from the Haynesville, with pipelines from the Louisiana side aimed at LNG facilities on the Louisiana coast and proposed projects from the Texas Haynesville targeting Texas LNG exports, along with increasing Permian volumes.

Williams announced in late June that it has reached a final investment decision (FID) to build its proposed Louisiana Energy Gateway (LEG) project to gather natural gas produced in the Haynesville. The project is set to move 1.8 Bcf/d of gas to several Gulf Coast markets, including its Transco gas pipe from Texas to the U.S. Northeast, industrial consumers and LNG export plants.

Williams said LEG, which is expected to enter service in late 2024, will enable it to pursue additional market access projects, including development of carbon capture and storage infrastructure.

Kinder Morgan has said it also is evaluating a project to link the Texas Haynesville with LNG export points on the Texas side of the border.

Additional North American LNG export capacity will be added with the expected 2023 startup of the $17 billion LNG Canada Export Terminal, which is currently under construction in Kitimat, British Columbia. It will have a production capacity of 14 mtpa from the first two trains, with the potential to expand to four trains.

LNG Canada, which will supply Asian markets, will get its natural gas supply via the 48-inch (1,219-mm), 416-mile (670-km) Coastal Gaslink natural gas pipeline now under construction by TC Energy. It will be the first major transmission pipeline to move natural gas across the Canadian Rockies to the British Columbia coast. The pipeline was approaching 65% completion, as its June project update.

Canada is also looking at LNG export expansion on its east coast to expand capacity to Europe, but Environment Minister Steven Guilbeault said in late June that existing natural gas infrastructure would only be able to supply one of two proposed options: an LNG facility in New Brunswick by Spain’s Repsol or in Nova Scotia by Pieridae Energy.

Guilbeault, who said the idea of constructing new gas pipelines to supply east coast export facilities is not “very realistic,” told Reuters that Repsol is “probably the fasted project that could be deployed, because it requires minimal permitting” with a pipeline already in place.

In Mexico, New Fortress agreed with Comisión Federal de Electricidad (CFE) in July to increase its supply of natural gas to multiple CFE power generation facilities in Baja California Sur and the development of a new LNG hub off the Gulf of Mexico coast at Altamira, Tamaulipas, with multiple FLNG units of 1.4 MTPA each. CFE will supply natural gas via existing pipelines to two FLNG units.

Western Europe/EU

Some European leaders have been warning for years of an overdependence on Russian natural gas, with some of the strongest voices coming from the eastern Baltics, where Poland, Lithuania, Latvia and Estonia, along with Finland, have been developing infrastructure. Bulgaria, Greece and Lithuania have also long been active in development of alternate routes.

Efforts to develop alternative sources of supply accelerated after Russia’s invasion and annexation of the Crimean Peninsula from Ukraine in 2014, and as of May 2022, 11 EU member states had become LNG importing countries with total regasification capacity of 160 Bcm/a and storage capacity of 7.65 million of m3 LNG.

Since Russia’s invasion of Ukraine, more than 20 LNG import projects have been announced or accelerated. With a potential capacity of more than 120 Bcm/a, the projects could allow Europe to replace nearly 80% of total 2021 Russian gas imports. While those will take time to develop, along with increased supplies, early efforts by countries such as Poland and Bulgaria have proven critical.

Efforts toward greater supply diversity by Poland and Bulgaria were motivated, in part, because their contracts with Russia’s Gazprom were set to expire in late 2022, and they did not intend to renew them. Their preparations proved to be prescient, as Russia cut off natural gas exports to both countries on April 27 over their refusal to pay in rubles – a demand that was widely viewed as both retaliation for sanctions and a scheme by Russia to prop up its unstable currency.

Before the cutoff, Wood MacKenzie analyst Alireza Nahvi told P&GJ, Gazprom’s 2.9 Bcm/a contract accounted for about 90% of Bulgaria’s roughly 3.2 Bcm/a domestic demand, while Poland had imported an average 12.2 Bcm/a over the previous five years.

“Poland has been preparing for this day for years, building LNG import capacity, expanding upstream portfolio in gas projects in Norway, securing gas and LNG contracts and improving interconnection infrastructure,” Nahvi said. “Bulgaria has also been involved in diversification projects, not only for the country itself, but also for the region.”

Those efforts have included Gas Interconnection Bulgaria-Serbia (IBS) pipeline, a 93-mile (150-km) project to provide Serbia with Azeri gas and make the pathway for other countries to receive gas from Azerbaijan.

The May 2022 completion of the 315-mile (508-km) Gas Interconnection Poland–Lithuania (GIPL) pipeline marked a major step for the region. The capacity to transport gas from Lithuania to Poland is expected to reach a level of 1.9 billion cubic meters per annum (Bcm/a) by October, and gas transportation capacity from Poland to Lithuania will be 2 Bcm/a.

Amber Grid Corp. is operator of the 27.5-inch, high-pressure pipeline, which runs from the Rembelszczyzna Gas Compressor Station in Warsaw to the Jauniunai Gas Compressor Station near Vilnius in Lithuania.

“In the context of today’s geopolitical tensions, the integration of the Baltic and Finnish markets into the common European gas market is a guarantee of energy security and independence for the entire region,” Lithuanian Energy Minister Dainius Kreivys said.

With the completion of GIPL, Lithuania, together with the other two Baltic states, and Finland will be integrated into the European Union (EU) gas transmission system. The interconnections are significant considering the Balticonnector gas pipeline between Estonia and Finland, which was officially launched in 2019, and the Baltic Pipe project now under construction.

Also aimed at diversifying Europe’s natural gas sources, Polish and Danish gas grid operators Gaz-System and Energinet are nearing completion of the Baltic Pipe, a 528-mile (850-km) bidirectional project that gives Denmark, Poland and Sweden direct access to Norway’s North Sea gas and moves Poland closer to its goal of becoming eastern Europe’s gas hub.

With expected completion in October, the project will deliver up to 353 Bcf (10 Bcm) per year at a projected cost of $1.88 billion. Poland and Denmark are financing construction, along with a $243 million contribution from the European Commission. The project includes a North Sea offshore pipeline that connects the Norwegian gas system with the Danish gas transmission system, an expansion of the existing Danish transmission system from east to west and the construction of a compressor station in the eastern part of Zealand. From there, a pipeline across the Baltic Sea will connect Denmark and to an expanded Polish transmission system.

Further south, Greece and Bulgaria have agreed to build a new LNG facility off the northern Greek port of Alexandroupolis to help create another new gas route for Europe. The new FSRU will be anchored about 11 miles (18 km) off Alexandroupolis port and carry gas ashore via a 28-km long pipeline. The new terminal will be able to regasify 5.5 Bcm of LNG annually and store 153,500 cubic meters. It is expected to start operations at the end of 2023.

To date, Greece has one LNG terminal off Athens. With the new Alexandroupolis terminal and other projects in the pipeline, it could triple its regasification capacity by the end of 2023, Mitsotakis said. The Alexandroupolis terminal will be built by Gastrade, owned by Greece's Copelouzos family, at an expected cost of $378 million (360 million euros).

In addition, Greece and Egypt have expanded their cooperation on LNG supply and are evaluating potential construction of a subsea gas pipeline between the two countries, the Greek energy ministry said. The two sides signed an MOU in Cairo as a step toward specific agreements between Greek and Egyptian companies in late 2021.

Greece, which mainly imports gas from Algeria, Azerbaijan, Russia and Turkey, has been looking to diversify its resources and become an energy hub in southeastern Europe. Greece and Bulgaria last year sought to reduce their reliance on Russian gas with an agreement that will allow Bulgaria to participate in a planned LNG terminal in northeastern Greece.

That project, which has strong support from the United States, is aimed at boosting energy diversification in southeastern Europe, a region largely reliant on Russian natural gas. Under the agreement, Bulgaria’s state-controlled Bulgartransgaz will acquire a 20% stake in the Greek company, Gastrade, that is developing the LNG terminal outside the Greek city of Alexandroupolis.

Greece has also joined Cyprus, Israel and Greece with plans for the Eastern Mediterranean Deepwater Pipeline (EastMed), which would supply east Mediterranean gas to Europe as the continent seeks to diversify its supplies. Prospects for the EastMed appeared to have dimmed over the past couple of years, but Europe’s de-Russification of energy has brightened its outlook.

In June, the independent assurance and risk management provider DNV issued confirmation of the feasibility statement for the 1,243-mile (2,000-km) onshore and offshore EastMed. The current design for the EastMed project envisions an 870-mile (1,400-km) offshore and 372-mile (600-km) onshore pipeline, with an initial capacity of about 10 Bcm/a, reaching a maximum water depth of about 3,000 meters.

It would connect offshore gas reserves from the Levantine Basin to Greece via Cyprus, and further to southeastern European countries in conjunction with the 12 Bcm/a Interconnector Greece-Italy Poseidon and 3 Bcm/a Interconnector Greece-Bulgaria (IGB) pipelines.

“The EastMed Pipeline, together with Poseidon Pipeline, is the most mature project in the Mediterranean area, being now in the final engineering phase, and will reach the start of the commercial operation in 2027,” Fabrizio Mattana, CEO of IGI Poseidon, said. “It will directly connect Europe to the natural gas fields in the Eastern Mediterranean basin, also creating opportunities for access to new hydrogen production sites in that area. The project will provide Europe with a new route of gas supply, complementary to LNG, enhancing the energy security and diversification of sources.”

Among LNG-related expansions underway in Europe, Germany’s economy ministry announced in July that a private consortium plans to build a floating LNG terminal in Lubmin, about 155 miles (250 km) north of Berlin, by the end of this year. The privately funded project is in addition to the four terminals already planned by the government.

Also in July, a government spokesperson said Portugal’s Sines port is ready to start onward shipment of LNG from larger vessels transferred to smaller vessels for delivery to other European states. A feasibility study concluded that “with the existing infrastructure and simultaneous operations, Sines could transfer to central and northern Europe up to 10 billion cubic meters of LNG annually” within six to 12 months, the spokesperson said. That amount – roughly double Portugal’s own natural gas consumption – could increase in the longer term, if required, he added.

Asia-Pacific

Economic activity in China – Asia’s largest energy consumer – has remained cooler in recent months, recording a 4% year-over-year decline in natural gas demand during March-May due to lockdowns and higher prices. But China’s natural gas demand has typically tracked GDP growth and based on updated Morgan Stanley projections of higher second-half growth, Asia Pacific Utilities analyst Simon Lee has forecast 7% gas demand growth for the whole country this year as the economy is projected to improve in the second half.

China’s returning growth in natural gas demand, including LNG imports, will further squeeze already-tight global markets as it continues to tap Russian supplies via an expanding natural gas pipeline network anchored by the Power of Siberia pipeline, completed in 2019, and the planned Power of Siberia 2.

Earlier this year, Russia agreed to a 30-year contract to supply gas to China via Power of Siberia 2, a new 1,615-mile (2600-km) pipeline originating in the Bovanenkovo and Kharasavey gas fields in Yamal, strengthening an energy alliance with Beijing amid Moscow's strained ties with the West. The Power of Siberia 2 is expected to transport up to 50 Bcm/a through Mongolia. Construction is scheduled to begin in 2024, with targeted operations beginning in 2030.

In July, China’s Yantai Port Group started pumping oil into a newly expanded pipeline that connects the port of Yantai to a group of independent refineries in the country’s refining hub of Shandong, according to a state media report. The 230-mile (370-km_ pipeline has a capacity of 400,000 bpd and is funded by Yanbtai Port

Group, a unit of provincial government-backed Shandong Port Group. The new line, which links Yantai with the city of Weifang, adds to an existing, parallel 404-mile (650-km) that connects Yantai with Zibo, bringing total transport capacity to 800,000 bpd. About 10 independent refineries are linked to the two pipelines, according to Shandong-based commodities consultancy JLC.

In South Asia, India has continued efforts to modernize and expand its natural gas pipeline network, with government projections now calling for natural gas to increase to 15% of the country’s energy mix by 2025 from 6% last year. A total of $15.8 billion in new natural gas infrastructure investment is expected to be made over the next 10 years.

India already has some 3,100 miles (5,000 km) of pipeline in the works, including the 1,713-mile (2,757-km) Kandla Gorakhpur project, which is expected to transport 6 Bcm/a of natural gas from Kandla port in Gujarat to the states of Uttar Pradesh and Madhya Pradesh. It is projected to begin operations in 2024.

Also in the region, Bangladesh’s government has announced funding for a $453 million natural gas project that includes the addition of seven wellhead compressors in the Titas Gas Field and construction of a 112-mile (181-km), 36-inch natural gas transmission pipeline between Chittagong and Bakhrabad. The pipeline project expands the capacity of an existing 24-inch transmission line and completes a full looping of an existing pipeline.

In Australia, Nacap announced in June that it has kicked off construction of the 360-mile (580-km) DN300 Northern Goldfield Interconnect (NGI) pipeline on behalf of APA Group. The NGI project involves the construction of a new buried pipeline from Ambania to the existing Goldfields Gas Pipeline.

The project will initially include compression at the inlet with associated aboveground facilities located along the route. NGI will supply natural gas for the mining industry and potential other industrial applications in the Goldfields region and beyond, Nacap said.

Africa

African nations have continued their pursuit of an ambitious array of oil export pipelines and largely domestic natural gas pipelines for electricity generation, LNG production and other uses, but some of those projects have faced greater funding challenges over the past two years as Chinese lending has softened and environmental pressures on institutional sources continue to mount.

Nigerian National Petroleum Corporation (NNPC) and the Office National Des Hydrocarbures et Des Mines of Morocco announced that they, are progressing with the plans for their mega-project Nigeria-Morocco Gas Pipeline (NMGP), an onshore and offshore gas pipeline that would transport Nigerian gas across 16 countries along Africa’s Atlantic coast to North Africa and on to Spain for the European market. The Pipeline would also provide gas transportation to and from other countries along the route.

ILF Consulting Engineers (ILF) and its joint venture partner DORIS Engineering said they have been commissioned to carry out project management consultancy services for the FEED Phase II.

If completed, the more than 3,700-mile (6000-km) natural gas pipeline would be the longest offshore pipeline in the world, according to its developers. It has a planned diameter of 48 inches offshore and 56 inches onshore, with a planned throughput of 30 Bcm/a.

Also in Nigeria, a spokesperson for state oil company NNPC said negotiations were ongoing with the Chinese lenders to cover $1.8 billion in project costs so it can continue construction of the 614-km (384-mile) Ajaokuta-Kaduna-Kano (AKK) pipeline.

Nigeria broke ground on the AKK pipeline in June 2020 to help generate 3.6 gigawatts of electric power and support gas-based industries along its route. The project was to be funded under a debt-equity financing model, backed by sovereign guarantee and repaid through the pipeline transmission tariff.

NNPC awarded engineering and construction work along three sections of the pipeline to Oando, OilServe, China First Highway Engineering Company, Brentex Petroleum Services and China Petroleum Pipeline Bureau.

Chinese lenders had originally been lined up to fund the bulk of the estimated $2.5 billion to $2.8 billion cost of the project, which is central to President Muhammadu Buhari’s plan to develop gas resources and boost development in northern Nigeria.

Zimbabwe has signed a $1.3 billion joint venture agreement with British-based Coven Energy to develop a fuel pipeline from the Mozambican port city of Beira to the capital city Harare, the minister of information said. The pipeline would complement an existing one that also links the two cities and make landlocked Zimbabwe a fuel hub for the southern Africa region. Construction is scheduled for completion in 2025. Coven Energy will form a 50-50 joint venture company with state-owned National Oil and Infrastructure Company, a government spokesperson said.

Zimbabwe has suffered perennial fuel shortages in the past, although supplies are said to have improved over the past year after the government allowed companies to sell the commodity in U.S. dollars.

Middle East

QatarEnergy signed a deal with Exxon Mobil in June for the Gulf state's North Field East expansion, the world's largest LNG project, following agreements with TotalEnergies, Eni and ConocoPhillips. Qatar is partnering with international companies in the first and largest phase of the nearly $30 billion expansion. The companies will form a joint venture and Exxon will hold a 25% stake in that, QatarEnergy CEO Saad al-Kaabi said.

Oil majors have been bidding for four trains - or liquefaction and purification facilities - that comprise the North Field East project. In all, the North Field Expansion plan includes six LNG trains that will ramp up Qatar's liquefaction capacity from 77 MTPA to 126 MTPA by 2027.

Earlier this year, the Iraqi cabinet approved the framework agreement for the long-studied Basra-Aqaba Oil Pipeline, roughly three months after talks between Iraq and Jordan were reported by Iraq’s oil ministry to have reached an “advanced stage.”

The latest step nudges along a project the two countries agreed to back in 2012. Last year, the ministry noted that the cost should be brought under $9 billion for the project to go ahead.

The pipeline would carry crude oil to the Jordan Petroleum Refinery Company’s plant in Zarqa to meet Jordan’s needs and to the Aqaba Port for export purposes. The first phase of the project would be constructed in Iraq across a 435-mile (700-km) stretch between Rumaila and Haditha.

South America

Pipeline construction activity in the South and Central Americas region has been expanding gradually in recent years as energy trade has grown between some nations and governments have acted to encourage investment around major production areas, such as Argentina’s Vaca Muerta shale play – home to the world’s second-largest shale gas reserves and fourth largest shale oil reserves.

In mid-June, Argentine state company Energia Argentina completed a critical step toward completion of the 350-mile (563-km) Presidente Nestor Kirchner Gas Pipeline (GPNK) from the Vaca Muerta when it signed a contract pipeline producer Tenaris.

The contract consists of the purchase of 582 km (362 miles) of 36-inch diameter pipelines and 74 km (46 miles) of 30-inch pipelines to be used between Tratayén, in Neuquén, and Saliquelló, in the province of Buenos Aires, as well as in several other complementary projects

GPNK, which is already under construction, will boost natural gas volumes from the Vaca Muerta by 25%. The first stage of construction will take 18 months and require a public investment of more than $1.5 billion, the energy ministry said.

Vaca Muerta is the world's fourth largest unconventional oil reserve and second largest gas reserve.

Brazil is also negotiating with Argentina on the construction of a billion-dollar pipeline from the Vaca Muerta. Argentina is proposing an 888-mile (1,430-km) pipeline running from the shale gas reserves in the Neuquen province to the border with Brazil at Uruguaiana and 373 miles (600 km) from there to the city of Porto Alegre, connecting to Southern Brazil’s gas distribution network. Project costs have been estimated at $3.7 billion for Argentina and another $1.2 billion for the Brazilian section.

Guyana’s natural resources minister, Vickram Bharrat, told Reuters in May that the country has entered discussions with Exxon Mobil to build a 120-mile (190-km) natural gas offshore pipeline. Bharrat said Exxon is likely to participate in construction of the project, which would bring ashore associated gas from Exxon's oil production in the Stabroek block.

Guyana is trying to build infrastructure, including a gas-fueled power plant, to develop its economy after Exxon discovered one of the world's largest oil reserves offshore the tiny country. The proposed pipeline would have 120 miles of pipeline offshore and another 10 to 15 miles onshore, said Bharrat, who added that studies are still in the early stages and a budget has not been set.

Guyana’s electricity is currently expensive and unreliable because it is mostly generated by burning imported fuel oil and distributed through an aging transmission system.

Comments