February 2022, Vol. 249, No. 2

Projects

Projects February 2022

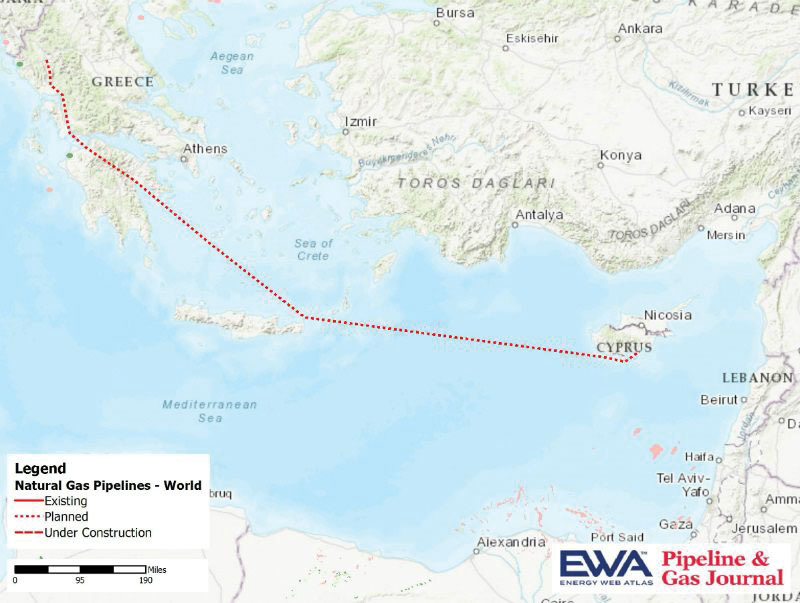

US Voices Misgivings on EastMed Gas Pipeline, Greek Officials Say

The United States has expressed misgivings on a subsea pipeline designed to supply Europe with natural gas from the eastern Mediterranean, Greek government sources said.

Washington let its concerns be known recently in a note sent to Greece, another source told Reuters.

Competing claims over gas reserves in the eastern Mediterranean are a point of tension between Turkey and ethnically split Cyprus. Turkey opposes the pipeline project.

Greece, Cyprus and Israel have approved an agreement for the EastMed pipeline, which has been in planning for several years. The countries sought to reach a final investment decision this year.

Reports of the United States having reservations over the pipeline were published in Greek media.

Advanced as an alternative to help ease Europe’s dependence on Russian gas, the 1,180-mile (1,900-km) project is expected to carry, initially, 10 Bcm/year (353 Bcf/year) to Europe.

Enterprise Completes Expansion of Acadian Natural Gas Pipeline

Enterprise Products Partners announced that it recently started commercial service on its new Gillis Lateral pipeline and the associated expansion of its existing Acadian Haynesville Extension system to serve the growing liquefied natural gas (LNG) market on the Gulf Coast.

The 80-mile (129-km) Gillis Lateral originates near Alexandria, Louisiana, on Enterprise’s Acadian Haynesville Extension system and extends to third-party pipeline interconnects near Gillis, Louisiana, including multiple pipelines serving LNG export facilities. The recently completed Gillis Lateral pipeline has the capability to transport approximately 1 Bcf/d (28 MMcm/d) of natural gas.

“By leveraging the flexibility of our Acadian system, Enterprise is providing natural gas producers in the growing Haynesville shale, one of the most lucrative natural gas plays in the U.S., with access to the higher valued global LNG market,” said Natalie Gaydon, senior vice president, Natural Gas Assets for Enterprise’s general partner.

The Gillis Lateral is fully subscribed with long-term, firm commitments from shippers, Gaydon said.

To accommodate the additional volumes, Enterprise increased capacity on its Acadian Haynesville Extension pipeline from 1.8 to 2.1 Bcf/d (51 to 59 MMcm/d) by increasing horsepower at its Mansfield compressor station in DeSoto Parish.

The Legacy Acadian and Haynesville Extension pipelines are part of the Acadian Gas Pipeline system, comprising approximately 1,300 miles (2,092 km) of natural gas pipelines and leased underground storage.

It links natural gas supplies in Louisiana and offshore Gulf of Mexico to distribution companies, electric utility plants and industrial customers located primarily in the Baton Rouge–New Orleans–Mississippi River corridor area.

Enterprise’s 378-mile (608-km) Haynesville Gathering System has a capacity of approximately 1.3 Bcf/d (37 MMcm/d) and can treat up to 810 MMcf/d (23 MMcm/d) of natural gas.

Norway’s Oil and Gas Output Expected to Rise 9% by 2024

Norway anticipates its petroleum output to jump more than 9% by 2024, due to an increase in investment spurred in part by tax incentives, new data from the Norwegian Petroleum Directorate (NPD) showed.

The nation, which is Western Europe’s largest oil and gas producer, expects oil companies to submit “dozens” of new investment plans this year, up from eight in 2021, according to Reuters.

Petroleum output is expected to rise to 4.33 MMboe in 2024, a rise of 9.1% from the preliminary 2021 reading of 3.97 million barrels, NPD forecasts showed.

Norway accounts for about 2% of crude oil and 3% of natural gas output globally. It is also Europe’s second largest pipeline gas supplier after Russia, accounting for up to a quarter of the European Union’s demand.

A surge in global gas prices has pushed Norway’s petroleum income to record levels in recent months, and the country continues to drill for new reserves.

NPD said expected investment in the sector would “contribute to continued high and profitable production toward 2030, at which point the current plans show that production will decline,” according to Reuters.

“The extent and speed of this decline will depend, among other things, on how much additional oil and gas the companies will discover in the years to come,” the government added.

Environmental groups have protested the plans, arguing that Norway should end exploration and set a date for when oil and gas output should stop altogether.

A broad majority in parliament has rejected such proposals however, arguing that the cash flow from oil and gas is essential and that it can help fund a transition to greener energy.

Illinois Court Vacates Approval of DAPL Capacity Expansion

An Illinois appellate court vacated approval to allow the expansion of the Dakota Access oil pipeline capacity up to 1.1 MMbpd.

The decision, rendered by the Illinois Commerce Commission (ICC), involved consideration of the public need for the proposed improvement, which the court said the commission erroneously interpreted to mean the world and not the United States.

Additionally, the court found that the commission abused its discretion when it offered evidence that the pipeline operator, Sunoco, had been fined for safety and environmental violations was irrelevant.

Pipeline owners Energy Transfer and Dakota Access LLC had petitioned the commission for permission to add more pumping stations to Illinois pipeline.

The Dakota Access Pipeline (DAPL) can transport about 570,000 bpd of crude oil from North Dakota to the Midwest, although the company said in August it had completed a capacity expansion to 750,000 bpd.

Last year, the pipeline prevailed in a legal challenge by Standing Rock Sioux and other complaints to shut the pipeline.

The court decision allowed the pipeline to continue operating at least until a federal environmental review is completed, a process that is expected to take until March 2022.

Uniper CEO Calls Nord Stream 2 Go-Ahead in Mid-2022

The Nord Stream 2 pipeline could get approved in the middle of the year, the CEO of one of the project’s financial backers told a newspaper.

The pipeline, led by Russia’s Gazprom, has been completed since September and is waiting for final certification by the German network agency, which has said that no decision would be taken in the first half of 2022.

This has burdened diplomatic relations that are already strained by the risk of open conflict between Russia and Ukraine, fueling speculation the pipeline could be used to exert political pressure on Moscow.

“I don’t see any political interference. The network agency is reviewing as planned. It could happen in mid-2022. Nord Stream 2 is important,” Klaus-Dieter Maubach, CEO of Uniper, told Germany’s Rheinische Post.

Uniper is among five European energy firms. The others being Wintershall Dea, Shell, OMV and Engie, which have paid half of the $11 billion Nord Stream 2 has cost.

White House Offers $1 Billion Loan Guarantee for Hydrogen Project

The Biden administration said it has offered Monolith Nebraska a conditional loan guaranteed up to $1.04 billion for a project to make clean hydrogen, in its first use of an office that has tens of billions of dollars in financing.

The financing from the Department of Energy’s Loan Programs Office (LPO) aims to help Monolith expand its Olive Creek plant to convert natural gas into hydrogen for making products like fertilizer.

The plant will also make carbon black, a product used in making tires and other rubber products. The project intends to slash carbon emissions by cutting the use of fuel oil to make those products, the department said.

The LPO has more than $40 billion in financing for innovative energy projects that can help tackle climate change. Congress authorized LPO in 2005 amid concerns about domestic energy supplies.

“Advanced, clean production technology like Monolith’s are the types of impactful projects that support not just sustainability, but economic growth and clean energy jobs,” said U.S. Energy Secretary Jennifer Granholm.

The department estimated the loan guarantee, which requires several steps before becoming final, would create about 1,000 construction jobs and 75 permanent positions.

Under the reins of Director Jigar Shah, the LPO has now attracted more than 66 loan and loan guarantee applications, valued at more than $53 billion in clean energy and advanced vehicle technology projects, the LPO said.

The infrastructure law recently signed by President Joe Biden expanded LPO’s loan authority and broadened its pool of eligible borrowers.

Aramco Pipelines Investors Miss Funding Goal with Bond Sale

A group of institutional investors that last year took a stake in Saudi Aramco’s oil pipelines network sold $2.5 billion in dual-tranche amortizing bonds, significantly below the amount sought, a bank document showed, according to Reuter.

Final spreads were unchanged from initial guidance, with the deal drawing about $5 billion in orders, according to documents that also showed investors looking to raise $3.5-4.4 billion.

Global debt markets have been rattled by the U.S. Federal Reserve’s indications of a faster run of interest rate hikes and stimulus withdrawal, with the resulting rise in borrowing costs leaving investors more reluctant to lend to companies until the picture is clearer.

The tranches are expected to have a weighted average life of 10.2 to 10.7 years and between 231/2 and 24 years, respectively.

In June, a consortium led by U.S.-based EIG Global Energy Partners bought 49% of the Aramco Oil Pipelines Company from Saudi Aramco, which retains a 51% stake. As part of the deal, Aramco agreed a 25-year lease and leaseback arrangement with the pipelines group.

US Court Vacates Federal Permit for Mountain Valley Pipeline

After a series of setbacks, the U.S. Court of Appeals dealt yet another blow to the embattled Mountain Valley Pipeline (MVP), invalidating its federal permits.

The court’s decision came within days of the Virginia State Water Control Board’s approval of a necessary stream-crossing permit, according to the Roanoke Times (Va.).

The board had voted 3-2, with two members absent, to issue a Virginia Water Protection Permit to MVP. MVP said in March it hoped to achieve startup in 2022.

According to Reuters, an email from Equitrans Midstream read, “We are thoroughly reviewing the Court’s decision regarding (Mountain Valley’s) crossing permit for the Jefferson National Forest and will be expeditiously evaluating the project’s next steps and timing considerations.”

Earlier in the year, the Federal Energy Regulatory Commission (FERC) voted to uphold a decision to allow partial resumption of construction near the Jefferson National Forest in Appalachia, staving off efforts to overturn a December ruling.

The Mountain Valley line, a $6 billion project that stretches from West Virginia to Virginia, is one of a series of energy infrastructure projects that have been delayed by legal opposition and regulatory problems.

Comments