March 2022, Vol. 249, No. 3

Features

South Africa’s Tribunal Approves Pipeline Company Acquisition

By Shem Oirere, Contributing Editor

The South Africa Competition Tribunal has approved without conditions the large merger of South Africa African Gas Development Company SOC O Ltd. (iGas), Companhia Mocambicana de Gasoduto S.A. (CMG) and Republic of Mozambique Pipeline Investments Company (Pty) Ltd. (ROMPCO).

“The Tribunal has unconditionally approved the large merger, wherein South African Gas Development Company SOC Ltd. and Companhia Moçambicana de Gasoduto S.A. intend to increase their existing shareholding in Republic of Mozambique Pipeline Investments Company (Pty) Ltd. (ROMPCO) by each acquiring additional issued share capital of ROMPCO from Sasol South Africa Limited (Sasol SA),” the Tribunal said in a written statement December 2021.

Previously, iGas and CMC, two of the existing shareholders in ROMPCO had exercised their preemptive right to acquire 30% of Sasol South Africa’s (SSA’s) equity in ROMPCO.

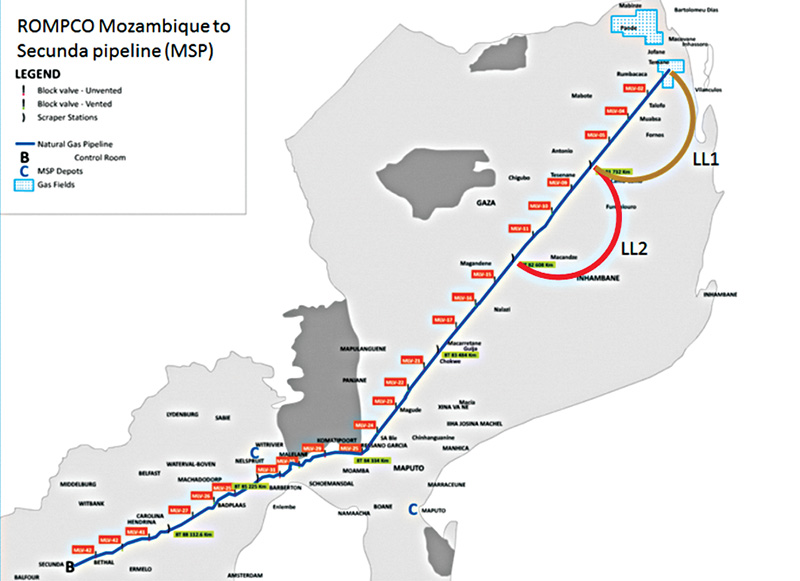

The ROMPCO pipeline conveys up to 1.4 Bcf (40 MMcm) of natural gas to South Africa. Sasol uses 1 Bcf (28 MMcm) of the total natural gas transported in the pipeline to power its operations, such as the Secunda Synfuels plant in Secunda, which produces close to 1.8 MMcf (50 Mcm) methane-rich gas annually.

Before the approval of the merger, iGas and CMG owned a 25% stake apiece in the 537-mile (865-km) ROMPCO pipeline, with Sasol owning 50%. But with the regulatory approval of the new share purchase agreement, iGas and CMG will increase their shareholding to a majority of 40% apiece, with Sasol maintaining a 20% minority stake.

Sasol, which through its affiliate of Sasol Gas, supplies up to 90% of South Africa’s existing natural gas demand, told shareholders in May 2021 the company “will retain a 20% shareholding in ROMPCO and will continue to operate and maintain the pipeline in terms of the commercial agreement between Sasol South Africa and ROMPCO.”

Both iGas and CMG will pay an initial amount of $268 million (ZAR4,145 billion) and a deferred payment of up to $65 million (ZAR1 billion), payable if certain agreed upon milestones are achieved by June 30, 2024, according to a previous brief by Sasol Group that operates onshore gas fields in Pande and Temane in Mozambique.

It is not yet confirmed how much the South Africa Government is contributing toward the acquisition of the additional stake, but Mineral Resources and Energy Minister Gwede Mantashe told the country’s Parliament the price payable was “market-related.”

“It was market-related based on the offers of the private sector. We had to match those offers to be able to exercise our preemptive rights,” said Mantashe. The Standard Bank had previously been approved as lender for the purchase of the additional stake in the pipeline company.

Both iGas and CMG indicate the acquisition of additional stake in ROMPCO is to be fully funded from past and future dividends generated by the pipeline company itself, which connects the onshore gas fields in Mozambique that is sold under long-term contracts to power Sasol operations and other external customers.

“We believe that the successful partners will add significant value to this important regional energy asset,” Sasol said in a previous statement.

iGas is wholly owned by South Africa State agency Central Energy Fund Group (CEF), a diversified energy company reporting to the Department of Mineral Resources and Energy.

“Having both governments as majority shareholders of the cross-border pipeline is strategic, since the pipeline is the single source of gas to the South African market, and gas is the immediate alternative supplier of cleaner energy,” ENH Chairperson and CEO Estevão Pale said.

CEF Group CEO Ishmael Poolo said the transaction would strengthen iGas’ mandate for the development of gas and gas infrastructure in Southern Africa and would lay a “solid foundation to address the challenges that lie ahead in the security of South Africa’s energy future.”

Sasol is not only divesting from the ROMPCO pipeline, which at the moment allows for third-party access along its transmission route, but also from Mozambique’s Central Térmica de Ressano Garcia S.A., a gas-to-power plant located in the Ressano Garcia area.

Sasol says it has already entered into a sale securities purchase agreement for the divestment of our full shareholding in CTRG, “subject to a number of conditions precedent.”

For South Africa, which sources up to 2.6% of its total energy mix from natural gas, the acquisition of an additional stake in ROMPCO pipeline is a major boost to the country’s Gas Master Plan that the Ministry of Mineral Resources and Energy says will, when fully implemented, “ultimately serve as a policy guide and roadmap for making strategic, political and institutional decisions when investing, planning and coordinating in the (gas) sector.”

Currently, Sasol Gas, ROMPCO and Transnet SOC Ltd., a rail, port and pipeline company, are the only transmission companies functioning within the midstream gas business in South Africa, including operating gas pipeline infrastructure.

iGas’ increase of its stake to 40% in ROMPCO pipeline could prove strategic in the future especially if South Africa succeeds in fully implementing the country’s Gas Master Plan that includes exporting processed natural gas to other Southern African countries and global markets using the ports of Mozambique.

With a majority stake in the ROMPCO pipeline, South Africa could open up the infrastructure to additional third-party users, including the private sector with interest in the Mozambican natural gas segment, at a fee. An estimated 130 to 180 Tcf (3.7 to 5.1 Tcm) of natural gas has been discovered in Mozambique’s Rovuma basin.

Meanwhile, South Africa’s oil and gas pipeline market has the potential to grow in the medium to long term should the country build on the recent hydrocarbon discoveries by international exploration companies.

In the fourth quarter of 2020, French oil major, Total, announced discovery of significant gas condensate resources on the Luiperd prospect, located on Block 11B/12B in the Outeniqua Basin, 108 miles (175 km) off the southern coast of South Africa.

“This discovery follows the adjacent play opening Brulpadda discovery in 2019, which proved a significant new petroleum province in the region,” Total said in in October 2020.

It is estimated that South Africa has 9 billion barrels of oil and 11 billion barrels of oil equivalent of gas, with the government planning to achieve at least 30 exploration wells in the long term under the government initiative Operation Phakisa Offshore Oil and Gas Lab.

According to the Strategic Environmental Assessment (SEA) for the development of a gas pipeline network for South Africa, gas transmission players in the country, including Sasol Gas, Transnet and ROMPCO, are in the process of identifying “routing corridors and management measures for the construction of the Phased Gas Pipeline Network infrastructure.” Identification of the routes, SEA said, would “allow the Cabinet to approve the energy zones and corridors as well as the management and planning interventions for inclusion in the relevant legal environmental and legal framework and local government planning tools including Municipal Spatial Development Frameworks.”

Comments