November 2022, Vol. 249, No. 11

Features

East African Pipeline Company’s Hits and Misses on Inline Inspection

By Shem Oirere, P&GJ Africa Correspondent

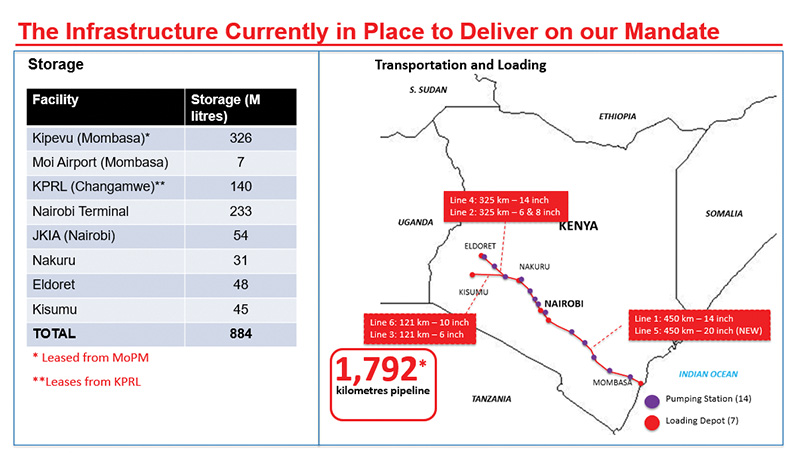

(P&GJ) — East Africa’s leading oil pipeline operator, Kenya Pipeline Company (KPC), has seen its inline inspection (ILI) program – for its portions of its 1,113-mile (1,792-km) product pipeline – swamped in legal hurdles in the last three years. Since 2020, only one of the three tenders were floated, proceeding to contract award. Kenya’s Public Procurement Regulatory Authority (PPRA), which oversees public procurement in East Africa, has annulled two of KPC’s tendering processes within three years for infringement of public procurement regulations.

At least two bidders in two separate tenders have succeeded in persuading PPRA, through its Public Procurement Regulatory Board (PPRB), to not terminate one of KPC’s tendering process. KPC readmitted another bidder that had been locked out at the preliminary evaluation phase.

In the first quarter of 2022, PPRB directed KPC to re-commence and complete a tender process for the ILI of the 1994-built, 202-mile (325-km), 8-inch and 6-inch Nairobi-Eldoret (Line 2) and 76-mile (122-km), 6-inch Sinendet-Kisumu (Line 3) multiproduct pipeline. PPRB allows all bidders whose bids had successfully gone through the technical evaluation stage to proceed with the remaining tendering phases.

These two pipeline sections run parallel to the 2011-commissioned, 202-mile, 14-inch Nairobi-Eldoret line and the 2016-commissioned 75-mile (121-km), 10-inch line from Sinendet to Kisumu.

PPRB withdrew a decision to terminate the tendering process for the project, whose value had not been disclosed after one of the nine bidders, Kenyan-based Sintmond Group Ltd., appealed KPC’s decision to abruptly cancel the procurement proceedings.

KPC says the two 1994-commissioned pipelines were last internally inspected in 2012 and require re-inspection using high-resolution magnetic flux leakage-axial (MFL) inspection.

However, before the planned inspection, KPC said, “the pipelines will be subjected to aggressive cleaning to ensure that dirt in the pipeline does not affect the data from the pipeline inspection report.”

Line 2 has two sections: the 8-inch pipeline portion between PS21 and PS22, 43 miles (70 km), and the 8-inch pipeline between PS22 and PS24, approximately 68 miles (110 km).

Section three of the inspection work involves the 8-inch pipeline between PS24 and PS26A, approximately 28 miles (45 km). Section four is the 6-inch pipeline section connecting PS26A to PS27, approximately 59 miles (95 kms).

As for Line 3, the 6-inch pipeline stretches between PS26 and PS28, approximately 76 miles (122 km), which has been categorized as Section 5. KPC says there are pig launchers at PS21, PS22, PS24, PS26 and PS26A and pig receivers at PS22, PS24, PS26A, PS27 and PS28.

“The successful tenderer must determine the suitability of these existing launchers and receivers in relation to their tools’ sizes and performance specifications,” KPC said in an earlier tender document.

Sintmond Group had been ranked as the best option by KPC’s tender evaluation committee, qualifying to proceed to the financial evaluation phase that precedes a contract award.

KPC’s supply chain general manager concurred with the tender evaluation committee recommendation and advised Sintmond Group’s tender to proceed to financial opening.

In a twist of events, KPC’s management disrupted the financial opening process by directing that all the tenders be reevaluated.

Three bidders, including the Sintmond Group, were allowed to proceed to the technical reevaluation phase.

During the technical re-evaluation phase, two bidders were disqualified for being unresponsive, leaving Sintmond Group as the sole responsive bidder that qualified for the next phase of financial evaluation.

However, KPC, yet again, abruptly announced the termination of the tendering process, claiming the maximum 30 days required by Kenya’s procurement law for evaluating public tenders had lapsed before tendering for the ILI project was concluded.

A letter to all bidders from the KPC managing director said the ILI tender process had been terminated “due to operation law.”

Sintmond Group approached PPRB to challenge the termination, arguing the decision was “illegal because only 14 days out of the 30 days for evaluation had been utilized.”

Sintmond Group said KPC failed to give explanation on the particular law it was required to comply with while carrying out the tendering process for the ILI of the product pipeline.

PPRB said KPC did not clarify “when the evaluation of the technical tenders commenced yet the tender documents and the Act that governs public procurement “do not guide on when evaluation of tenders would commence for purposes of computing the 30 days of tender evaluation.”

The KPC’s Board decided not to approve the opening of Sintmond Group’s financial tender for financial evaluation and instead directed it for a reevaluation of technical tenders without giving any reasons in writing, contrary to the requirements of procurement regulations.

PPRB found the KPC tender evaluation committee’s decision “quite odd” as it sought the company’s head of procurement’s approval to open the financial tender submission by Sintmond Group to conduct financial evaluation.

The Board said terminating the ILI tendering process in February violated the law and termed the decision “null and void.”

Consequently, the decision of KPC to terminate tendering of the ILI services for the Nairobi-Eldoret and Sinendet-Kisumu portions of the product pipeline was set aside.

PPRB further directed KPC to open and evaluate Sintmond Group’s financial tender. The Board also annulled the re-advertisement of the tender by KPC and directed the pipeline company to cancel and set aside the re-advertisement

Although KPC is yet to confirm when it will comply with the PPRB directive, the Board ordered the procurement proceedings of the Line 2 and Line 3 product pipeline “proceed to its logical conclusion including making of award to the successful bidder within 14 days from the date of this decision (March 18) taking into consideration the Board’s findings.”

Previously, Sintmond Group, under a subcontract agreement with NDT Global FZE, a business unit of Canada-based Previan Technologies Inc., was among the bidders for a similar tender involving Line 5. Sintmond Group’s bid was unresponsive.

KPC awarded the tender for the ILI and material grade determination for Line 5 in June 2020 to T.D. Williamson (UK) Ltd. in joint venture (JV) with Miranda East Africa Ltd.

Unfortunately, PPRB canceled the contract award. The contractor was the lowest evaluated bidder at $3,369,500 (KS406,530,175).

Himilo Construction and Supply Ltd. in JV with Lin Scan Advanced Pipelines & Tanks Services, one of the participating bidders, triggered the cancellation with an appeal.

The company had accused KPC of disqualifying its bid unfairly and, after subsequent arguments, PPRB allowed the appeal and directed the pipeline company to re-admit the bidder at the preliminary evaluation phase before conducting a re-evaluation. KPC is yet to give an update when the re-evaluation will be carried out and the tendering process completed before a winning bidder is picked.

KPC’s only successful tendering process, according to PPRB, was that of ILI services for Line 4 and Line 6 multiproduct pipelines. The contract, valued at $1,524,656 (KES183,949,746) was awarded to Himilo Construction & Supply Ltd and Lin Scan Advanced Pipeline and Tanks Services in April 2021 and is set for completion in September.

However, both Himilo Construction & Supply Limited and Lin Scan Advanced Pipeline and Tanks Services could not confirm the status of the contract, and the contract does not appear on their respective websites

In what emerged as a trend within the pipeline company’s operations, Auditor-General Nancy Gathungu previously audited KPC’s financial statements. Gathungu identified at least 16 KPC projects with an accumulated cost of $15,465,687 (KES1,865,935,136), an equivalent of 69% of the sample audited, that were behind their respective execution schedules. Three of them, with an accumulated cost of $1,009,000 (KES121,735,850), had stalled after their contracts either expired or were terminated by KPC.

“Delays in project completion deny taxpayers expected services and could result in increased project cost overruns and wastage of public resources,” Gathungu warned in her Sept. 29, 2020, summary of the audit report.

The annulment’s effect on the two key ILI tenders since 2020 is yet to be determined, but it most likely could be captured by the Auditor-General in the next audit, probably by end of year.

Comments