Explainer: Oil Storage Situation in Canada, US After Keystone Spill

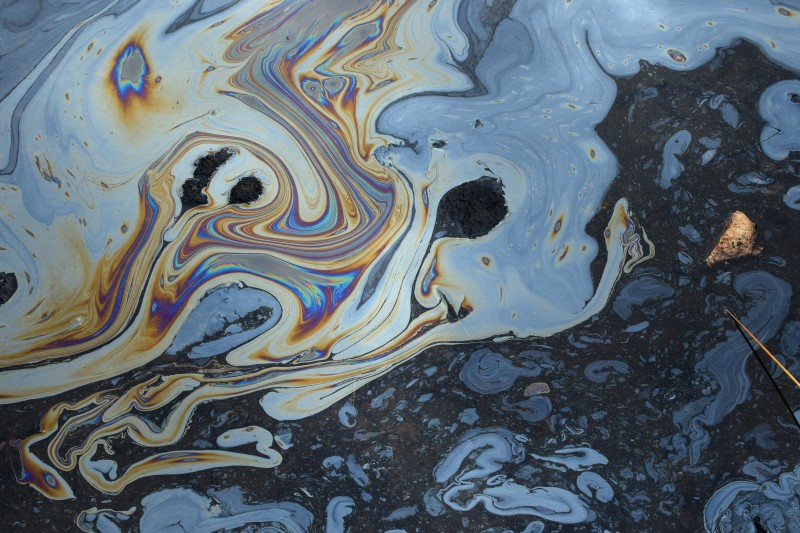

(Reuters) — Days after TC Energy Corp.'s Keystone pipeline shut following a 14,000-barrel spill into a creek in Kansas, traders are questioning whether there is enough oil in storage in key areas if the pipeline remains closed for a number of weeks.

There is still no official timeline for a restart of the line, which will need approval from regulators.

Here is the latest data on storage inventories, and other factors affecting crude cash prices in Canada and the United States:

Western Canadian Inventories

As of the week ending Dec. 2, or the week before the spill, Canadian inventories were just below 29 million barrels, according to energy consultancy Wood Mackenzie, with about 16 million barrels of spare capacity available.

On Tuesday, the latest data for the week ending Dec. 9 showed inventories rose 1.4 million barrels to around 30.4 million, according to a trader. Wood Mackenzie, which sends its inventory data to clients a day or two ahead of making it widely available, declined to confirm those numbers.

Following a previous Keystone leak in 2019, which triggered a 13-day shutdown, inventories climbed by 13.6 million barrels over five weeks. The spare capacity on hand this time suggests Canadian storage hubs have ample space for any barrels stranded in Alberta.

Canadian crude prices remain broadly steady. The discount on Western Canada Select (WCS) heavy crude for delivery in December fell to $33.50 a barrel below the U.S. crude benchmark the day the leak was reported, before recovering. WCS for January delivery last traded at a discount of $28.20 a barrel, only slightly wider than before the spill.

"It looks like nothing has really changed in Canada, but Canada still has enough storage space," the trader said.

U.S. Gulf Inventories

Before the Dec. 7 spill, crude oil stocks at the Gulf Coast were at their lowest in more than eight months, at about 226.5 million barrels, according to the U.S. Energy Information Administration's data for the week to Dec. 2.

Weekly Gulf Coast gross input into refineries stood at 9.4 million barrels per day.

However, analysts were not worried about inventory.

"The Gulf Coast is reasonably well supplied. I don't think that there is any sort of significant panic in terms of lack of heavy (crude) in the Gulf Coast, particularly given that we could pull more Colombian as well Latin American barrels into the Gulf," said Michael Tran, an analyst at RBC Capital Markets.

Prices of U.S. sour crude oil grades strengthened slightly on Monday, as refiners sought alternatives to Canadian barrels.

Cushing Storage Hub

Inventories at the key U.S. crude storage hub in Cushing, Oklahoma, totaled 28.3 million, according to Wood Mackenzie data for the week ending Dec. 9.

That puts inventories at about a third of capacity and less than 4.5 million barrels above the operational floor, based on operational capacity and historical low utilization.

West Texas Intermediate crude futures CLc1have jumped over 6% this week as traders are starting to grow concerned that an ongoing shutdown will cause a drop in inventories at Cushing, also the delivery point for the benchmark. [O/R]

Weekly industry inventory figures from the American Petroleum Institute are scheduled to be released at 4:30 p.m. EST (2130 GMT) on Tuesday, followed by U.S. Energy Department data on Wednesday.

Numerous refineries in the U.S. Midwest usually pull barrels from the storage hub, but cash crude prices at Cushing WTC- has not moved much because traders expect part of Keystone to reopen soon.

The leak occurred just south of a key junction in Steele City, Nebraska, where Keystone splits into two legs. The leg that flows to Patoka, Illinois, could be reopened as it was not affected, said Dylan White, an analyst at Wood Mackenzie.

So far, TC has not commented on a partial restart of the Patoka leg.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments