February 2010 Vol. 237 No. 2

Features

Pipeline & Gas Journals 2010 International Pipeline Construction Report

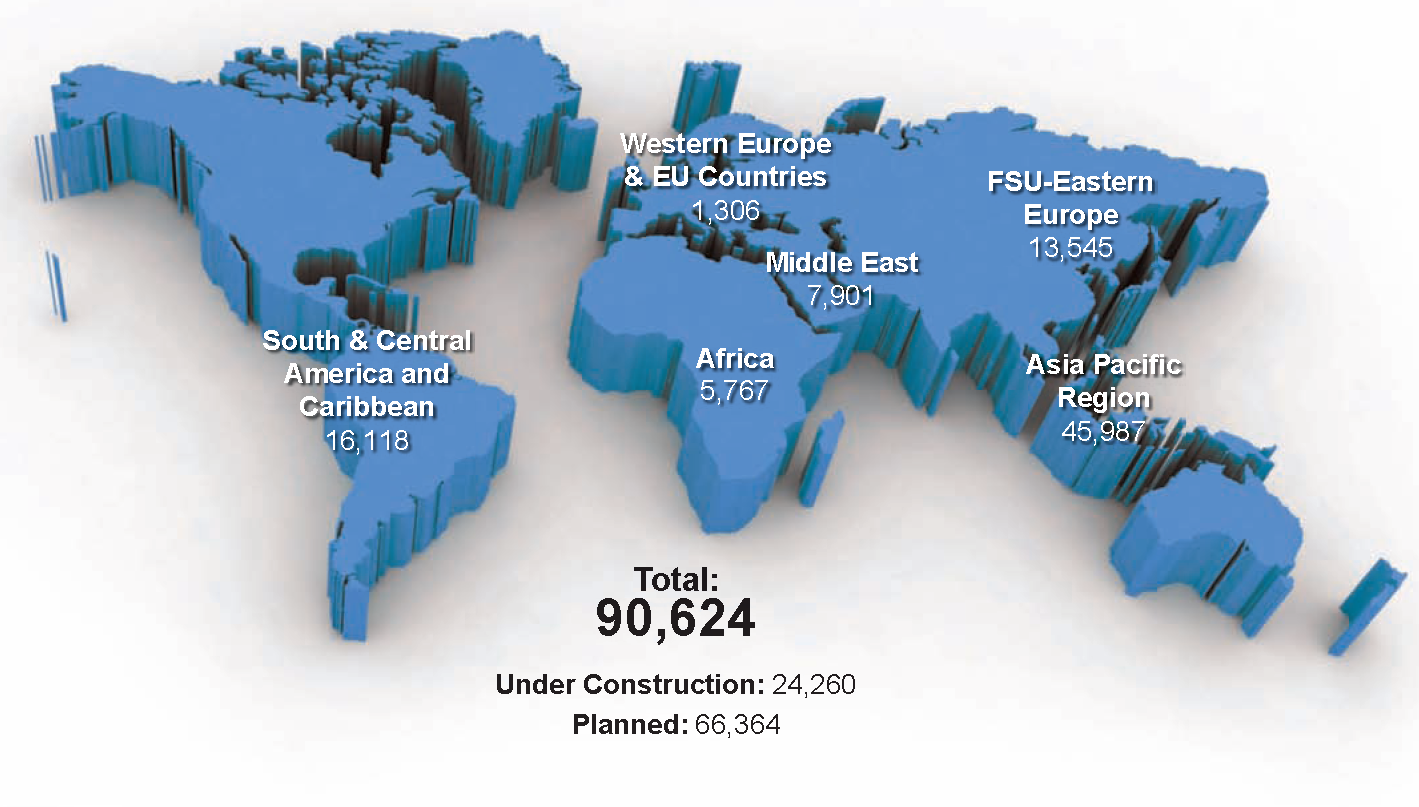

P&GJ’s latest international survey indicates a much higher number of pipelines in the engineering and design phase vs. actual construction. This year’s figures show the international sector accounts for 90,624 miles of pipelines under construction and planned.

Of these, 24,260 miles represent pipelines in various stages of construction, while 66,364 miles account for planned projects.

Current figures show the number of pipeline under construction increased 6,391 miles over the past year, from 17,941 miles to 24,260. Conversely, over the same period, the number of planned pipelines decreased slightly, from 67,135 to 66,364 miles.

The increase in pipelines under construction is not particularly surprising, as most nations are expected to see energy consumption grow at rates anticipated prior to the recent economic downturn.

Construction Overview

P&GJ’s report highlights some of the major pipeline projects planned and under construction in the international sector at this time. Following is a breakdown identifying international areas by levels of new and planned pipeline miles in the six basic geopolitical groups used in this article (see accompanying map): Asia pacific Region. 45,987 miles; Caribbean, South and Central America, 15,869 miles; Former Soviet Union and Eastern Europe, 13,545 miles; Middle East, 7,901 miles ; Africa, 6,016 miles; and Western Europe and European Union Countries, 1,165 miles. More information is provided in P&GJ’s sister publication Pipeline News.

Asia-Pacific

Countries in the Asia Pacific region are engaged in a massive effort to control rising energy use while promoting rapid economic growth. Nevertheless, the region is on its way to becoming the world’s most significant oil and gas consumers with demand projected to grow 90% by 2030. Therefore it is not surprising that this area accounts for the most new and planned pipeline projects at this time, totaling 45,967 miles. Of these, 28,038 miles represent projects in the engineering and planning phase, while 17,949 miles account for pipelines in various stages of construction.

In addition to the new and planned pipelines in the region, pipelines are also being completed. On December 14, 2009, a four-nation project saw the first transnational gas pipeline to go into service in China.

At the inauguration ceremony of the Central Asia-China Gas Pipeline, held in the gas plant on the right bank of the Amu Darya River in Turkmenistan, Chinese President Hu Jintao, Turkmen President Gurbanguly Berdymukhamedov, Kazakh President Nursultan Nazarbayev and Uzbek President Islam Karimov turned on the flow of natural gas together.

The pipeline starts at the Turkmenistan-Uzbek border city Gedaim and runs through central Uzbekistan and southern Kazakhstan before reaching Horgos in China’s Xinjiang Uygur Autonomous region. The pipeline has dual lines in parallel, each running for 1,140 miles. Construction of the Central Asia-China Gas Pipeline commenced in July, 2008 and Line “A” became operational in December 2009. Line “B” is expected to be operational by the end of September, 2010. A delivery capacity of 30 Bcm/a will be reached by the end of 2011.

As to projects under construction, after placing the first West-East Pipeline in service, the approximately 1,678-mile western section of China National Petroleum Company’s second West – East gas pipeline, which runs from Xinjiang to Shaanxi province, has become operational.

With a total length of 5,410 miles, the $US23.3 billion Second West – East pipeline will connect Xinjiang in China’s northwest to the southern province of Guangdong. The trunkline is being designed with a gas capacity of 30 Bcm/a. Construction commenced in late 2008 and is expected to be completed by 2011.

According to CNPC, a third West-to-East Pipeline is in the planning phase that will run from Xinjiang region in northwest China to Guangdong province in the south. The preliminary designed transmission capacity is also 30 Bcm/a. While the third West – East pipeline is scheduled to become operational in 2012 a fourth is reportedly being considered.

CNPC has also received exclusive rights to build and operate the 480-mile China – Myanmar crude oil pipeline, securing political assurance for the project from the military-ruled Myanmar government. The pipeline will transport oil from the Middle East and Africa to China and gas from Southeast Asia to Chinese users.

One project in China aimed at easing feedstock shortages in the production of fuel oil is PetroChina’s Rizhao – Dongming pipeline project. As proposed, the 287-mile pipeline will carry heavy crude from the Lanshan port of Rizhao, Shandong, to the Dongming Petrochemical refinery in Heze, China. The first phase has a designed transmission capacity of 10 MMt/a and is expected to begin operation by the end of 2010. A second phase calls for expanding capacity to 20 MMt/a. Once completed, the area’s independent refineries will receive 10 MMt/a of crude from the Middle East, easing a feedstock shortage in the production of fuel oil.

China is also poised to become the one of the largest non-OECD gas producers, as production has declined in recent years in Indonesia and the increases in China’s production have outpaced those from the region’s other major producers, Malaysia, Pakistan, and India.

Elsewhere in the region, a consortium led by Punj Lloyd has been awarded the largest pipeline project in Malaysia valued at US$500 million. The contract for the Sabah Sarawak Gas Pipeline was awarded by Petronas Carigali Sdn Bdh, a subsidiary company of Petronas, the state oil and gas major in Malaysia.

The 318-mile pipeline will connect the proposed Sabah oil and gas terminal in Kimanis, Sabah to the Petronas LNG complex in Bintulu, Saraak. The gas line will run approximately 56 miles in Sabah state and 262 miles in Sarawak state.

The project is expected to take 36 months to complete and is scheduled to begin service in March 2011.

In India, the Russian contractor Stroytransgaz is working to complete construction of the Dadri – Bawana – Nangal Gas Pipeline for Gail (India) Ltd. The 380-mile pipeline will supply gas to the Bawana power project in Delhi, National Fertilizer Ltd.’s fertilizer plants in Nangal, Bhatinda and Panipat, and a power plant in Doraha among other customers. It will connect into the Hazira – Vijaipur – Jagdishpur pipeline.

First commercial operation is scheduled for October 2010.

Gail is also moving forward on its 697-mile Kochi – Mangalore – Bangalore pipeline to transport gas from Petronet LNG’s Kochi terminal through Coimbatore to Bangalore. This pipeline project consists of a 162-mile offshore segment from Kochi to Kayamkulam with a designed capacity of 1.4 MMcm/d and a 535-mile onshore portion designed for a capacity of 11 MMcm/d. Commissioning is scheduled by the year-end.

Elsewhere in the region, under a joint venture between Russia’s Zarubezhneft and the General Petroleum and Gas Company of Vietnam, PetroVietnam, work is moving forward to construct the Can Tho natural gas pipeline in the south of Vietnam. The 247-mile, US$1 billion pipeline will carry gas from offshore fields in southwest Vietnam to power plants in the province of Can Tho. The pipeline will have a capacity of 16–18 MMcm/d of natural gas.

Australia

Much of the growth in Australia’s natural gas production is expected to support planned or proposed LNG export projects, although it is possible that some projects and the related production increases could be delayed.

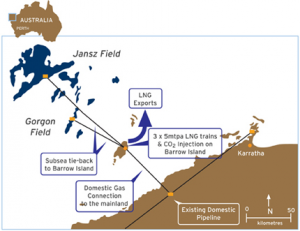

Nevertheless, several major LNG projects are in the planning phase and under way. Among these is the Grogan Project, one of world’s largest natural-gas projects. The project is being developed by the Australian subsidiaries of three leading international energy companies: Chevron, ExxonMobil and Shell. Chevron is operator of the project with a 50% interest, and ExxonMobil and Shell each hold 25%.

Chevron has received environmental approval to build a three-train LNG processing plant capable of producing 15 MMt/a. Barrow Island, the proposed site, is located about 30 miles offshore. Plans call for the proposed gas processing facilities on Barrow Island to include an LNG plant, condensate handling facilities, carbon dioxide injection facilities and associated utilities. A gas pipeline will also be built from Barrow Island to a tie-in with the Dampier-to-Bunbury natural gas pipeline.

The $43 billion (Aus) development has a resource life of more than 40 Tc/f of gas and an estimated economic life of at least 40 years.

The initial gas shipment is expected to take place in 2014.

Another LNG project still in the planning phase involves Australia Pacific LNG (APLNG) joint venture partners Origin Energy and ConocoPhillips who awarded the McConnell Dowell and Consolidated Contractors joint venture the contract to build a 280-mile gas transmission pipeline for the APLNG Project to be located in Gladstone, Australia.

The scope of the works includes the design, engineering and construction of the pipeline to transport coal seam gas (CSG) from the Surat and Bowen basins to a proposed LNG processing site at Laird Point on Curtis Island, Gladstone.

Assuming a final investment decision for the project later this year, construction on the pipeline will start in late 2011 with completion by the end of 2013.

Also, front end engineering and the design phase (FEED) for the greenfield onshore LNG and Wheatstone gas project in the Pilbara region of Western Australia is moving forward.

The FEED contracts for the upstream (offshore) portion of the project were awarded to two companies. Intecsea Pty Ltd. will design the subsea gas gathering facilities and pipeline and Technip Oceania Pty Ltd. will design the production platform. The upstream scope includes subsea gas gathering for the Wheatstone and Lago fields, an offshore production platform and a 125-mile pipeline linking the platform to the downstream gas plant located at Ashburton North, about 7.5 miles away.

The downstream (onshore) FEED contract for the Wheatstone LNG and domestic gas plant and export facilities at Ashburton North was awarded to Bechtel Oil Gas and Chemicals Inc.

Offshore Western Australia also accounts for several major projects, including Apache Energy’s Devil Creek development. SapuraAcergy was awarded a $US170 million pipelay and wellhead construction contract for the project that calls for the installation of offshore pipeline component, comprising approximately 56 miles of 16-inch rigid pipeline, including a shallow water beach approach, subsea tie-in and provide stabilization works. The company will also construct a wellhead platform comprising a 1,700 ton four-leg jacket and a 450 ton topside processing module.

The Devil Creek gas plant will have the capacity to supply 500 bpd of condensate and 22 TJ/d of sales gas to the domestic market, boosting Western Australian gas supply capacity by more than 20%.

Work also continues in Bass Strait, where the billion dollar Kipper Gas project is being pursued by the Kipper Unit Joint Venture – Esso Australia Resources Pty Ltd (operator, 32.5%), BHP Billiton Petroleum (Bass Strait) Pty Ltd (32.5%) and Santos Limited (35%).

The Kipper field is being developed by the installation of a number of subsea wells, piped back to existing infrastructure at Longford. First gas is expected in 2011.

Also in the region, Nacap Australia is scheduled to begin work by mid-year on the QSN3 pipeline project for Epic Energy. The scope of the project incorporates the looping construction of approximately 585-miles of 18-inch diameter gas pipeline from Wallumbilla in South East Queensland to Moomba in South Australia.

Papua New Guinea

LNG action is also heating up in Papua New Guinea where Esso Highlands Ltd., as operator, has awarded a number of contracts for pipeline construction and other works on its $15 bllion Papua New Guinea (PNG) LNG project, following a final investment decision on the project.

Construction of the offshore pipeline will be undertaken by Italian-based Saipem. The scope of work includes the engineering, transportation and installation of a 253-mile, 34 inch diameter subsea gas pipeline connecting the Omati River landfall point on the southern coast of PNG to the onshore point near Port Moresby, where the LNG plant will be located. The contract also includes the shore approach excavation and backfilling at Port Moresby and the trenching and backfilling of a 47-mile section of the pipeline at the Omati River landfall.

The onshore pipeline and affiliated infrastructure will be built by the French company Spiecapag. The onshore section will connect the offshore pipeline and the LNG facility site, a distance of approximately 185 miles.

Japanese engineering and construction firms Chiyoda and JGC won EPC contracts for the LNG plant. The plant will involve two trains, each with capacity of 3.3 MMt/a, as well as facilities for inlet processing, treating, liquefaction, storage and loading, while a CB&I and Clugh JV won the EPC contract for the gas conditoning plant.. The JV will also be involved in the installation of nearby wellheads, piping and infrastructure associated with the plant.

The PNG LNG joint venture partners include Esso Highlands Limited (as Operator) 41.5%, Oil Search 34.0%, Santos 17.7%, Nippon Oil 5.4%, Mineral Resources Development Company 1.2 %, and Petromin PNG Holdings Limited 0.2%.

Western Europe & EU

While this region continues to show low level pipeline construction activity, currently accounting for only this could soon change. More than 50% of the EU’s energy comes from countries outside the union – and the percentage is growing. Making setting up a southern gas corridor of pipeline networks to bring gas from the Caspian Sea region via Turkey a high priority, along with proeucts such as the Nord Stream to link Germany and its neighbors to new gas sources in northern Russia.

Subsea 7 Inc. has been awarded a contract by BP Norway for engineering, procurement and installation and commission of the Valhall Flank Gas Lift Pipelines and wellhead platform riser caisson projects in the Norwegian section of the North Sea. The scope of work involves engineering, procurement and fabrication of subsea and platform components, installation of 2 x 8-inch pipelines (1 x 3.7-mile pipeline + 1 x 4.3 mile pipeline) and 1 new caisson (Nom 30-inch) on the wellhead platform and subsea tie-in spools at the Valhall Flank South and Valhall Flank North platform locations.

The offshore operations are due to take place in two campaigns commencing in the summer 2010.

In the UK North Sea, E.ON Ruhrgas has awarded Technip a $43.5 million lumpsum contract for the development of the Babbage gas field. The project scope includes: project management; design, fabrication, and installation of a 17-miles of gas export rigid pipeline; a 40-metric ton manifold, and three flexible tie-in jumpers; pipeline protection materials installation; trenching and backfilling operations; and pre-commissioning, tie-ins, and testing.

FSU-Eastern Europe

Transneft has commissioned the remaining portion of the first stage of its East Siberia – Pacific Ocean (ESPO) oil pipeline. The first stage of the line runs 2,757 km from Taishet, Irskutsk Region, via Yakutia to Skovorodino in the Amur Region. A 1,100 km section of the first stage was brought online in October 2008.

The second stage of the ESPO will run 2,100 km from Skovoridino to the Pacific coast. It is anticipated that the second stage of the ESPO will be brought online in 2014–15.

The entire ESPO pipeline will extend more than 4,857 km.

Russia’s state-owned Transneft also recently completed construction on a 64 km spur line running from the ESPO pipeline to the Chinese border. The branch is due to start supplying China with oil in January 2011.

Russia’s Gazprom has started construction on the 1,100-mile gas pipeline network, which will connect the gas fields around the island of Sakhalin to Vladivostok on the coast of the Pacific Ocean. Construction of the Sakhalin-Khabarovsk-Vladivostok pipeline started in the Khabarovsk region in June 2009. The entire project, which carries an $11 billion price tag, is expected to be completed in 2012.

Gazprom reports construction on the Gryazovets-Vyborg natural gas pipeline construction is progressing according to the schedule. The line will transport gas to the Nord Stream pipeline where construction is scheduled to commence in early 2010. To date, 370 miles of miles of the Gryazovets-Vyborg pipeline has been completed. Owners say completion is scheduled in December 2010.

KBR has been awarded a contract by Verkhnechonskneftegas (VCNG) to provide front-end engineering and design (FEED) services for the VC FFD Project located in the Eastern Siberia region of Russia. KBR will provide FEED services for a single new build, 140,000 bpd oil facility, which will be tied back via a new 53-mile pipeline, to the existing East Siberian Pacific Ocean (ESPO) pipeline. The field development will involve 645 wells distributed over 75 well pads. Work on the project is already under way, however, no timeline for completion has been announced.

MRK- Engineering of Moscow is constructing a gas pipeline from the Central Karakum Desert to the Yilanli gas compressor station in Turkmenistan for Turkmengaz. The pipeline will run from the Central Karakum gas deposit to the Yilanli compressor station in the Dashoguz Province, connecting gas fields in Turkmenistan’s desert region with the nation’s network and the Central Asia – Russia gas pipeline, which will transport gas from the Caspian Sea, Turkmenistan and Kazakhstan into Russia’s gas network.

Stroytransgaz is constructing a 115-mile, 55-inch diameter gas pipeline in Turkmenistan for Turkmengaz. The pipeline begins at the Malai field and runs to the gas metering point near the village of Bagtyyarlyk on the Uzbekistan border where it connects to the Central Asia – Russia pipeline. The route runs through the Karakum desert. Operation is expected to commence in 2010.

In northern Russia, Stroytransgaz is constructing the 685-mile Bovanenkovo-Ukhta gas trunkline for Gazprom. TMK recently shipped the first large-diameter longitudinal welded pipe with internal and external anticorrosion coatings for the project. The project represents a portion Gazprom’s field development plans in the Yamal-Nenets autonomous district of Siberia. Plans call for an annual production of 15 Bcm from the field when it begins production in 2011.

As to near-term construction, Nord Stream AG has received permits from the Russian, German, Sweden and Finland to construct the sections of the Nord Stream Pipeline that pass through the four respective country’s territories.

Nord Stream, an $11 billion pipeline, will consist of two parallel pipelines which will transport natural gas from Russia to EU countries. The first pipeline is expected be operational by 2011, and will have a capacity of approximately 27.5 Bcm/a. The second pipeline will go online during the second phase of the project, with full capacity expected to reach 55 Bcm/a.

The Nord Stream joint venture – consists of Gazprom, BASF/Wintershall Holding AG, E.ON Ruhrgas AG and NV Nederlandse Gasunie.

Plans are also under way by the Caspian Pipeline Consortium (CPC) to expand the capacity of the 982-mile CPC Pipeline, which runs from western Kazakhstan to the Black Sea coast in Russia, to 67 MMt/a of oil. The project is expected to commence as early as next year with completion in 2014.

CPC participants include Transneft, CPC Company, KazMunayGaz, Chevron Caspian Pipeline Consortium Company, Lukarco, Mobil Caspian Pipeline Company, Rosneft-Shell Caspian Ventures, BG Overseas Holding, Eni International, Kazakhstan Pipeline Ventures and Oryx Caspian Pipeline.

The start of oil exports via the 2,900-mile East Siberian Pacific Oil (ESPO) pipeline that reportedly started late last year is seen as a major step toward moving oil from Russia to Europe. The initial phase of the pipeline, which runs from Taishet in East Siberia to Skovorodino in the Amur region of Russia’s Far East, near the border with China, has a capacity of 600,000 bpd.

From Skovorodino, 300,000 bpd will be transported by rail to a new export terminal at Kozmino on the Pacific coast, and eventually another 300,000 bpd will be delivered to China, following completion of the Skovorodino to Daqing pipeline to be completed by CNPC later his year, and an additional 40-mile segment to be constructed by Transneft.

The second phase of the pipeline will involve the construction of a 1,210 mile segment from Skovorodino to the Pacific Ocean terminal at Kozmino that is slated for completion in 2014.

Capacity is set to increase to 1 MMbp/d by 2012 in the second stage of the project, and potentially to as much as 1.6 MMbp/d at a later date.

Also, an agreement of co-operation has been signed by Gazprom Management Committee Chair Alexey Miller and Vologda Oblast Governor Vyacheslav Pozgalev in regard to several pipeline projects to be constructed within the region.

Under the agreement, the Vologda Oblast Government will assist Gazprom in coordinating a wide range of work required for the execution of Gazprom’s projects in the Vologda region, including portions of the: 1,300 km Ukhta – Torzhok gas trunkline system; 2,200 km Northern Tyumen Region – Torzhok gas pipeline; 917 km Gryazovets – Vyborg gas pipeline; and the 650 km Pochinki – Gryazovets gas pipeline.

Meanwhile, shipments of large diameter pipe for the construction of the Pochinki – Gryazovets Pipeline are now under way. TMK was scheduled to ship 40,000 tons of Volzhsky spiral welded, 56- inch diameter pipe to Gazprom between December 2009 and January 2010.

TMK is scheduled to ship 20,000 tons of 56-inch inch longitudinal welded pipe and 56 inch spiral welded pipe to be used by Gazprom in the construction of the Gryazovets – Vyborg Pipeline, which is the Russian onshore section of the Nord Stream Pipeline. Construction of gas trunkline is reportedly on schedule, with 370 miles of the of the 570-mile pipeline now complete. Plans call for the pipeline to be commissioned in stages starting in 2011, and the nominal capacity of 55 Bcm/d of gas to be achieved by late 2012.

The company will supply 107,000 tons of large-diameter pipe for the project. Shipments are scheduled from January to October 2010.

Two other major natural gas projects also are under way in Russia: one to develop the resources around Sakhalin Island on the country’s east coast and another to develop the Shtokman field, off its western Arctic coast. The Sakhalin-1 project began supplying modest amounts of natural gas to domestic consumers in 2007. Production from the second development phase began in 2009 with export of LNG. The Shtokman natural gas and condensate field in the Barents Sea is officially scheduled to begin producing 840 Bcf of natural gas in 2013 (shipped via pipeline), with additional supplies for LNG anticipated beginning in 2014. That schedule may, however, prove to be overly ambitious.

Middle East

Construction work to expand the second Sheiba – Abqaiq oil pipeline (SHBAB-2) at Saudi Arabia’s Sheiba oil field Is nearing completion. The 135-mile pipeline will connect a new plant, which separates gas and oil at Sheiba, to an existing pipeline that carries crude oil to a processing facility at Abqaiq.

The existing 400-mile SHBAB-1 pipeline transports crude to Abqaiq from the other three gas and oil separation plants located in Sheiba.

Saudi Aramco awarded the contract to construct the SHBAB-2 pipeline to Russia’s Stroytransgaz in 2007.

Austria’s OMV is seeking bids from international companies to build a $US60 million oil pipeline in Yemen. The proposed 60 km pipeline would commence at the Habban Oil Field in central west Yemen and travel to export facilities in the country’s south.

The construction of the pipeline is part of OMV’s plan to boost production at Habban from 11,000 bbl/d of oil to 32,000 bbl/d of oil by the end of 2010.

Nico International has secured an EPC contract from the Fujairah Refinery Company Ltd (FRCL), jointly owned by Vitol Group and the Government of Fujairah for work on the Oil Terminal 2 Connection Project, located in the Port of Fujairah, near the eastern seaboard of the United Arab Emirates.

The project includes construction of pipelines interconnecting the Port of Fujairah facilities for Oil Terminal 2 and tie-ins with Oil Terminal 1.

The scope of work to be carried out by Nico includes design, supply, fabrication, installation, testing and pre-commissioning of pipelines and a pigging facility, along with allied electrical and instrumentation works.

The project is expected to be completed by year-end 2010.

McDermott International, Inc. (NYSE:MDR) (“McDermott”) announced today that its subsidiary, J. Ray McDermott, S.A. (“J. Ray”), has been awarded the Karan Offshore Platforms and Subsea Pipelines project by Saudi Aramco. The project involves work inside Saudi Arabia and outside the Kingdom. Once complete, the facility will have a production capacity of 1,800 MMcf/d of raw sour Khuff gas.

The project comprises four wellhead complexes each of which has a platform topside with gas, chemical injection, and controls facilities as well as a bridge connected auxiliary platform, associated flare bridges and stacks. The four wellhead complexes are clustered around a tie-in platform with similar facilities. The project also includes intrafield pipelines as well as a 110 kilometer trunkline to the shore and all subsea power distribution cables.

The fabrication scope includes topsides and jackets weighing a total of 27,000 metric tons and will utilize J. Ray’s new cladding facility in Jebel Ali, which, with its state-of-the-art computerized vertical and horizontal cladding systems, is capable of welding high integrity corrosion resistant alloys. J. Ray will also perform all of the offshore installation work.

Iraqi officials have announced a master plan to construct new infrastructure to boost the country’s oil export capacity, after the award last year for 10 large contracts to international oil companies. Plans call for the construction of new offshore pipelines to replace ones that connect Basra and Khor al-Amaya terminals with crude deposits in Basra. A network of new oil pipelines is also planned in southern and northern Iraq and two floating oil terminals are reportedly under construction at the main Basra oil terminal in southern Iraq and work on two others scheduled to start soon. Altogether, they should handle 2 MMbop/d. Basra and the nearby smaller Khor al-Amaya port currently handle up to 1.6 MMbop/d.

Foster Wheeler won a contract last year from the Iraqi government for the basic engineering of new oil export facilities to supplement the existing Basra terminal. The new offshore facilities would include new single point mooring tanker loading buoys, together with oil pumping, metering and pipelines, to achieve an export capacity of 4.5 MMbp/d.

Iraq hopes these contracts will increase its crude production to 11 MMbp/d by 2013.

Plans also include a new pipeline to go with the existing northern export pipelines that links Kirkuk oil fields with the Ceyhan terminal in Turkey

South & Central America And The Caribbean

The sizeable number of potential pipeline projects continues to grow throughout this region while few are being implemented. This year is no different; of the 16,118 miles of new and planned pipelines fewer than 6,000 miles of construction is actually taking place at this time.

Brazil’s Petrobras is one of the few in the region with an aggressive pipeline construction program under way that accounts for 870 miles new construction slated for completetion later this year. Natural gas pipelines scheduled to be completed this year, including the projected in-service dates are:

- Pilar-Ipojuca, 117 miles, 24-inch diameter, Sept. 2010;

- Cacimbas-Catu, 584 miles, 28-inch diameter, March 2010;

- Gastau, 60 miles, 28-inch diameter, Oct. 2010;

- Gaspal II, 55 miles, 14-inch diameter, April 2010; and

- Gasan II, 55 miles, 140-inch diameter, April 2010.

Petrobras is also placing new pipelines in service. In November 2009, the Urucu-Coari-Manaus gas pipeline was completed that is part of the Growth Acceleration Program (GAP). The 410-mile-long trunkline connects Urucu to Manaus, and has seven branches that will supply the cities of Coari, Codajás, Anori, Anamã, Caapiranga, Manacapuru, and Iranduba.

The gas pipeline means a significant change to the state’s energy matrix, as it allows for the substitution of diesel fuel and fuel oil for natural gas, particularly to generate electricity.

The pipeline’s initial transportation capacity is 4.1 MMcf/d. With the installation of two intermediary compression stations between Urucu and Coari, this capacity will rise to 5.5 MMcf/d, the total contracted capacity, in September 2010.

Also, the Peruvian company Kuntur Transportadora de Gas is scheduled to start construction in the first quarter to build and operate the $1.35 billion South Andean Pipeline that will transport gas 675 miles across the highlands from Camisea in Cusco region to Ilo port in Moquegua.

The pipeline, which will be fed from the Camisea natural gas field, will serve the Andean cities of Cusco, Puno, Arequipa, Moquegua and Tacna for the benefit of more than 1.7 million residents.

Brazil’s construction firm Odebrecht joined Kuntur’s project and signed an agreement last year to build the pipeline.

First commercial operation is expected at the end of 2012.

The project is an international joint venture whose partners include the Andean Development Corporation (CAF), the U.S. Overseas Private Investment Corporation (OPIC), the Netherlands Development Finance Company (FMO), and the German Investment and Development Company (DEG).

The region also accounts for a project in Argentina where the Allseas Group and Royal Boskalis Westminster NV are charged with constructing a key natural gas pipeline that will connect two areas near the Straits of Magellan. The project is designed to link Cabo Espiritu Santo in Tierra del Fuego Province and Cabo Virgenes in Santa Cruz Province via a 23-mile, 24-inch pipeline. The pipeline, with a transport capacity of 24 MMcm/d, will help tr

Comments