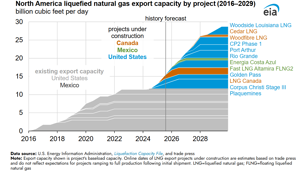

North American LNG Export Capacity Set to More Than Double by 2029

North America’s LNG export capacity is projected to more than double by 2029 to 28.7 Bcf/d, led by U.S. Gulf Coast terminals and new Canadian and Mexican projects now under construction, according to the EIA.

(P&GJ) — The U.S. Energy Information Administration (EIA) projects North America’s liquefied natural gas (LNG) export capacity could more than double by 2029, driven by major U.S., Canadian, and Mexican terminal expansions now under construction.

According to EIA data and trade reports, total North American LNG capacity is expected to rise from 11.4 Bcf/d in early 2024 to 28.7 Bcf/d by 2029 — with the United States accounting for nearly 14 Bcf/d of that growth. The region’s expansion represents more than 50% of anticipated global capacity additions through the end of the decade.

United States: Gulf Coast Expansion Leads Growth

U.S. additions are concentrated along the Gulf Coast, already the world’s largest LNG export hub. Several large-scale projects — including Port Arthur LNG Phase 1, Rio Grande LNG, Woodside Louisiana LNG, Golden Pass LNG, and CP2 Phase 1 — have reached final investment decisions and are under construction. Combined, they will add more than 10 Bcf/d of new capacity.

Plaquemines LNG and Corpus Christi Stage 3 began shipping cargoes earlier in 2025 but have not yet reached commercial operations. Pipeline infrastructure remains a key constraint, as new projects are needed to deliver gas from producing basins to coastal terminals.

Canada and Mexico Add West Coast and Floating Capacity

In Canada, LNG Canada shipped its first cargo in mid-2025, marking a milestone for the nation’s first LNG export facility. The project’s two trains will produce up to 1.84 Bcf/d, with a second phase planned to double capacity after 2029. Additional projects under construction include Woodfibre LNG (0.3 Bcf/d) and Cedar LNG (0.4 Bcf/d), both sourcing feedgas from the Montney Formation.

Mexico is also entering the LNG export market, with Fast LNG Altamira and Energía Costa Azul adding a combined 0.6 Bcf/d of capacity. Both facilities will export U.S.-sourced natural gas, marking a growing cross-border integration between the U.S. and Mexican midstream sectors.