December 2023, Vol. 250, No. 12

Features

Congo LNG Project Boosts Drive for Viable Gas Economy

By Shem Oirere, P&GJ Correspondent, Africa

(P&GJ) — The Republic of Congo is among the African countries making progress in harnessing natural gas for export as LNG, as well as meeting the energy demands of an increasing population — now estimated at 6 million — and expanding its installed electricity capacity of 600 MW by 2018.

The country, also referred to as Congo-Brazzaville, has estimated proven natural gas reserves of about 10 Tcf as of 2021 and is pursuing a three-prong energy strategy, targeting achieving sustainability in natural gas production, processing and LNG exporting, as well as minimizing flaring and deploying substantial amounts of the resource — generating much-needed electricity, as only 5% of the rural population is connected to the power grid.

The attempt by Congo to transform itself into a natural gas-driven economy is also partly driven by the country’s desire to diversify its energy mix by reducing its dependence on rain-fed hydropower generation, thus boosting its national energy security.

The Italian energy group, Eni, through its subsidiary Eni Congo S.A, has so far guaranteed at least 70% of Congo’s gas-based electricity production through the Centrale Electrique du Congo (CEC), which is a gas turbine power plant owned jointly by government of Congo and Eni, with 80% and 20% stakes, respectively.

Feedstock for the power plant is sourced from Eni's M’Boundi gas field. Currently, Congo’s power sector is characterized by an absence of reliable power grids and adequate electrical distribution, which has constrained investment and development “as potential investors typically provide their own power generation to operate effectively,” according to the U.S. International Trade Administration.

Eni — which is the second-largest oil operator in Congo Republic after France’s Total — is leading in the transformation of Congo into an LNG exporter, especially to European markets, and an energy secure country in sub-Saharan Africa, with the commercialization of gas fields in the offshore Marine XII concession.

Eni has a 65% operating interest in the block — estimated to have a sea depth of 65-295 feet (20-90 meters) — under a production sharing agreement that runs until 2039.

Already, there are five discovered gas fields, containing 1.3 Bboe oil of proved and probable (2P) reserves, with the two fields of Nene and Litchendjili — launched in 2015 — currently producing an estimated 28,000 bbl of oil and gas condensate per day, and 60 MMcfd (1.7 MMcmd) of marketable gas, according to Russia’s Lukoil, which holds a 25% stake in the concession.

Lukoil paid $800 million for the non-operating interest to New Age African Global Energy Ltd., which divested from the block in 2019.

State-owned firm Société Nationale des Pétroles du Congo has a 10% stake in the concession.

At the Nene gas field, a new platform was completed in 2019 and connected with the existing production infrastructure via a 10.5-mile (17-km) underwater pipeline network.

Previously, New Age had approved the development of a floating liquefaction project, with a capacity of about 48 Bcf (1.36 Bcm), to commercialize natural gas resources located in the 220.5-square-mile (571-square-kilometer) Marine XII block, on the continental shelf of Congo.

In April 2023, Eni launched the $5 billion Congo LNG project, the country’s first natural gas liquefaction project with an estimated LNG production capacity of 4.5 billion cubic meters annually from 2025.

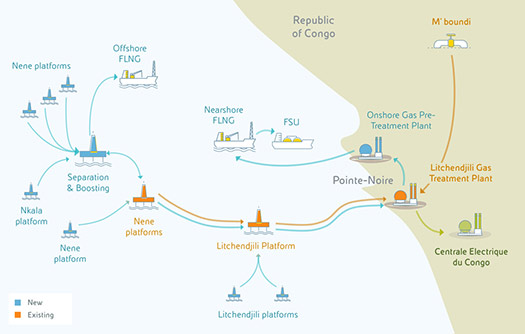

Under the project, Eni will install two floating natural gas liquefaction plants (FLNG) at the Nenè and Litchendjili fields — both already in production — and at three other fields that are yet to be developed.

In early August 2023, Eni announced it had signed a contract with Saipem for the conversion of its Scarabeo 5 semisubmersible drilling unit into a floating production unit (FPU) — a semisubmersible production platform that receives the production fluids from wellheads riser platforms, then separates the gas from liquids and boosts the gas to feed the nearby floating LNG (FLNG) unit.

Saipem said the contract entails engineering, procurement, construction, transportation and commissioning of the FPU, to be installed off the coast of Congo, located northwest of the Djeno Terminal, in a depth of about 1,235 feet (35 meters). The commissioning of offshore works and the start-up of the FPU is scheduled for the fourth quarter of 2025.

Subsequently, Saipem picked Yantai CIMC Raffles Ocean Technology Group — an offshore engineering, procurement and construction company — for the job of converting the semi-drilling rig to an FPU.

CIMC Raffles said the conversion of the vessel — a fourth-generation semi-submersible drilling platform, with maximum operating water depth of 2,000 meters and a maximum drilling depth of 29,528 feet (9,000 meters) — is the first such order for the company since it came into existence in 2022.

Yantai CIMC Raffles Ocean Technology Group is a joint venture of CIMC Raffles Ocean Engineering (Singapore) Pte Ltd., Shenzhen Southern CIMC Container Manufacturing Co., Ltd. and Yantai Guofeng Group.

The main conversion work includes dismantling the drilling system, repairing and refurnishing of the marine system, implementing brand new topside process modules and converting the vessel into a proper offshore oil and gas floating production unit.

Previously, during the first week of August 2022, Eni announced the acquisition of Export LNG Ltd, the owner of the Tango FLNG floating liquefaction facility, from Exmar group for boost natural gas development project in the Marine XII block in a faster, “cost-effective, flexible and reliable manner.”

Eni said the Tango FLNG, built in 2017, has a treatment capacity of 106 MMcfd (3 MMcmd) and an LNG production capacity of about 0.6 mtpa.

“The acquisition of this facility allows the development of a fast-track model capable of seizing the opportunities of the LNG market,” said Eni.

Gas processing at the Tango FLNG in Congo was initially slated to begin in the second half of 2023, “following the completion of mooring and connection works necessary to tie with the Marine XII network and infrastructure.”

Meanwhile, Eni has signed a contract with China’s Wison Heavy Industry, an affiliate of Wison Offshore & Marine, for the construction and installation of a second FLNG unit with capacity of 2.4 mtpa of LNG in Congo. Completion of this installation would push the overall LNG production capacity of Marine XII to 3 mtpa in 2025.

Wison says the FLNG will be moored using a submerged swivel Yoke system, in a water depth of about 1,413 cubic feet (40 meters), in the Nene Marine Field area, about 31 feet (50 km) offshore Pointe Noire — Congo’s second-largest city after Brazzaville. The vessel will have capacity to store over 16.35 MMcf (80,000 cubic meters) of LNG and 1.58 MMcf (45,000 cubic meters) of LPG.

Previously, in January, Eni awarded a 10-year contract to U.S.-based energy services provider, Expro Group Holdings N.V., to design, construct, operate and maintain a fast-track onshore LNG pre-treatment facility, in support of the offshore Marine XII project.

Expro — which expects to earn at least $300 million in revenue from the contract — said the pre-treatment plant will be built near to the Litchendjili gas plant that currently supplies gas to CEC and “will enable the production of LNG to significantly increase from the West Africa area.”

The objective of this facility by Expro is to process 80 MMcfd (2.26 MMcmd), to allow incremental gas production for low carbon electricity generation, and it will link to Eni’s offshore FLNG operations, as well as support “both the local energy market and increased global demands for LNG to support secure energy supplies.”

Fast-tracking the Congo LNG project would be a major boost for efforts to reverse Africa’s falling share of global LNG exports.

A recent report by the African Union, said timely implementation of proposed LNG projects in Africa will be critical for the continent “as competing markets such as Qatar and the US look to ramp up LNG exports to meet global demand.”

Furthermore, the International Gas Union said that while generally, Africa has been exporting slightly less than 5 million terajoules of LNG annually, for the past 10 years — apart from during the Arab spring — its share of global LNG exports has fallen from just over 25% in 2008 to about 12% in 2023.

Comments