December 2023, Vol. 250, No. 12

Features

Looking Back at the Biggest Pipeline Stories of 2023

By Pipeline & Gas Journal Staff

(P&GJ) – In this final issue of P&GJ for 2023, the staff – with more than a little help from our readers – takes a look back at the sometimes chaotic year in midstream that was 2023.

As was the case during the previous 12 months, this year brought its own share of anxiety, as we in the energy industry worked to adjust to the ongoing global demand for natural gas, changes to regulations and growing trend toward mega-mergers and acquisitions.

Our compiled list of Top 10 stories was based largely on our website readership numbers throughout the year, along with staff suggestions.

- Trans Mountain Expansion to Nearly Triple Current Capacity (April)

In April, news came that once the Trans Mountain Pipeline Expansion was completed (in what was expected at the time to be 2024), it would almost triple its current capacity to 890,000 bpd.

The expansion project – acquired by the government of Prime Minister Justin Trudeau for $3.3 billion (C$4.5 billion) in 2018 – was heralded as a way to lessen the reliance of oil-sands producers on U.S. refiners, who currently require them to accept lower rates for their petroleum.

“The simple truth is that Canada’s oil will fetch a better price if we give ourselves the option of shipping more of it via Trans Mountain’s Pacific tidewater terminal in Burrard Inlet,” the company said at the time. “Canada will earn more on every barrel of oil that’s piped west, compared to those sold to our existing customers in the United States Midwest market, a differential that exists regardless of the price of oil.”

According to the project overview, the expansion will include 609 miles (980 km) of new pipeline — 120 miles (193 km) of which will be reactivated pipeline — 12 new pump stations, and 19 new tanks to be added to the existing storage terminals in Burnaby, Sumas and Edmonton.

Update: Trans Mountain had said in January that the expansion effort would be mechanically completed in the third quarter. However, issues with micro-tunneling techniques and the possible need to alter 0.8 miles (1.3 km) of the route could set that timetable back at least 10 months, the Canadian Energy Regulator’s office said in late October.

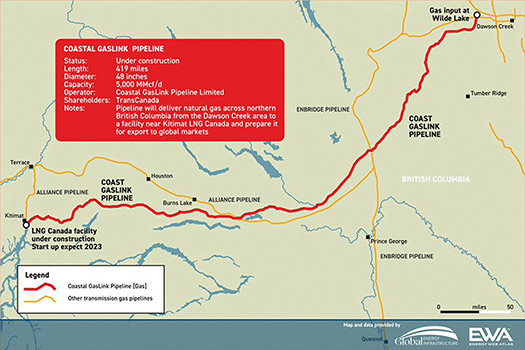

- 416-Mile Coastal GasLink Pipeline Project 98% Complete (October)

TC Energy provided some happy midstream news in October, when the company’s September construction update pointed out that the Coastal GasLink pipeline project was 98% complete.

The 416-mile (670-km) pipeline, which had been dogged by delays and rising costs, was announced in 2018. When completed, the 48-inch pipeline will transport natural gas to the Shell PLC-led LNG Canada facility on the west coast of British Columbia, Canada’s first LNG export terminal.

The Coastal GasLink will be capable of moving 2.1 Bcfd (59 MMcmd) of natural gas with the potential for delivery of up to 5 Bcfd (142 MMcmd).

Update: TC Energy announced on Oct. 30, it had finished installing pipe on its Coastal GasLink pipeline project. As the company said in a news release, “That means that all … of [the] pipe has been welded, coated, lowered into the trench, rigorously tested and backfilled.”

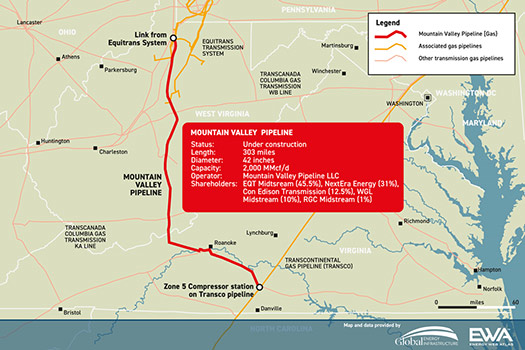

- MVP Gets a Key Approval to Restart Construction (March)

The Mountain Valley Pipeline might not have gotten the biggest of headlines in 2023, but it most likely garnered the most headlines.

Starting in March, the much-delayed project between West Virginia and Virginia gained Supreme Court approval to complete the 42-inch, 303-mile pipeline; then, the project meandered its way through months of permits gained and lost through court decisions.

By October, the project had redefined its timeline for completing the project, now aiming for a startup in the first quarter of 2024, with a total cost estimated at $7.2 billion — excluding allowance for funds used during construction.

This new completion date was influenced by several factors — not the least of which was the slower-than-anticipated ramp-up of the contractor workforce. Many crews have been hesitant to participate in the project, due to past legal construction stoppages.

- Poland Detects Leak in Russia’s Druzhba Oil Pipeline (October)

Nerves were on edge as Polish pipeline operator PERN halted flow through a section of the Druzhba pipeline — which carries oil from Russia to Europe — after detecting a leak in central Poland.

While there was no indication of third-party involvement, the leak followed a series of attacks, on pipelines carrying Russian oil and gas, since the beginning of Ukraine war.

“It is the main line that transports crude oil from sea deliveries to the west. Repair work on the oil pipeline is currently underway. The expected time for pumping to resume is Tuesday morning.”

Germany, which receives supplies through the pipeline, stopped buying Russian oil in January, but German media have reported that oil from Kazakhstan, which shares a northern border was Russia, was being imported through the line.

Update: PERN described the size of the leak as “not huge” and said the damage had been repaired.

- FERC Approves 1,377-Mile West Coast Pipeline Expansion (October)

Despite strong opposition from activists and high-ranking officials in West Coast states, federal regulators approved a significant expansion of a natural gas pipeline in the Pacific Northwest.

Owner TC Energy argued successfully to the Federal Energy Regulatory Commission that expansion is essential to meet rising consumer demands.

The GTN Xpress is designed to bolster the capacity of the Gas Transmission Northwest pipeline — which spans across Idaho, Washington and Oregon — by enabling the transportation of 150 MMcfd (4.2 MMcmd) of natural gas.

The 1,377-mile (2,216-km) pipeline originates at the Canadian border, traverses a portion of Idaho and extends into the states of Washington and Oregon, before connecting with a pipeline bound for California.

The expansion would entail upgrading three existing compressor stations — one each in Oregon, Washington and Idaho — along the Gas Transmission Northwest (GTN) system.

In a joint letter sent to the federal agency the day before the vote, Democratic U.S. Senators Ron Wyden and Jeff Merkley of Oregon, along with Patty Murray and Maria Cantwell of Washington, described the project as “incompatible with our climate laws.”

TC Energy expects to complete all of the project’s components in 2024.

- Williams to Complete 2 Pipeline Projects on Time in 2024 (June)

U.S. energy company Williams closed out the year on track to complete natural gas pipeline projects in New Jersey and Louisiana on schedule during 2024.

CEO Alan Armstrong said the first phase of the 830 MMcfd Regional Energy Access expansion in New Jersey, Pennsylvania and Maryland would provide about half the project’s gas to customers by the fourth quarter.

The preliminary design of the project consists of additional compression and selected new loop segments, along the existing Transco corridor. The expansion project distinguishes itself from other greenfield pipeline proposals by emphasizing the use of existing infrastructure, he said.

Williams is also on track to complete the Louisiana Energy Gateway (LEG) project in Louisiana and Texas, in the fourth quarter of 2024. The project provides producers in the Haynesville shale in Arkansas, Louisiana and Texas more access to the growing LNG export plants on the U.S. Gulf Coast.

“We’ve been working toward buying our own ... LNG capacity, which we will then turn and parcel out to our producing customers,” Armstrong said.

Armstrong said many of Williams’ gas producer customers want to participate in global markets in Europe where gas (at the time) was selling for $8 per MMBtu vs. about $2 at the U.S. Henry Hub benchmark in Louisiana.

- Cheniere Plans for New Pipeline to Feed LNG Expansion (July)

Cheniere Energy said it may build a new pipeline to link its Louisiana expansion project to other pipelines in major shale-gas producing regions, in an effort to diversify its risk.

The company’s Sabine Pass facility, which has expanded since production began in 2016, still lacks access to enough natural gas — beyond current supplies — to support its planned Stage 5 Expansion Project capacity, adjacent to the existing SPL project in Cameron Parish, Louisiana.

“We will likely build a pipeline to where we can access other pipelines,” Corey Grindal, Cheniere’s chief operating officer, told journalists at the time. “That will get us Haynesville (shale gas), any additional Marcellus (gas) that will come down, mid-continent, Permian as well as Eagle Ford as it continues to be developed.”

Cheniere had revamped a portion of its pipeline infrastructure to send gas to the Sabine Pass, but those pipelines began taking on additional demand and became unavailable.

Cheniere said it already spends $800 million a year in pipeline transit fees, to transport 7.5 Bcfd of natural gas from 26 different pipelines to its LNG plants in Texas and Louisiana.

The new project is being designed to produce up to 20 mtpa of LNG, but it is not yet funded.

- Rare Shipments of Forties Crude Head to East Coast Refiners (April)

Among the fallout from lost Russian oil flow, U.S. and Canadian refiners resorted to using North Sea “Forties” crude oil for the first time in seven years.

Almost 2.6 million barrels of the crude had arrived on U.S. East Coast in the first two months of the year, based on U.S. Department data, with some of the oil then sent by pipeline to Canada.

Forties crudes are light and low-sulfur crudes that are blended with other grades. Prior to the ban on Russian products, about 50% of all crude from Russian ports arriving in the U.S. was routed to East Coast refineries, Reuters reported, based on what customs data showed.

In February, the tanker Sea Turtle carried 770,000 bbl of Forties and Forties blend crudes in Maine, headed for Suncor Energy. It was the first such shipment to the U.S. since October 2015.

A second vessel in March discharged 585,000 barrels of Forties crude in Maine for Suncor, and on Wednesday, the tanker Navig8 Perseverance unloaded 630,000 barrels in Delaware City, for PBF Energy.

- U.S. Intelligence: Pro-Ukrainian Group Sabotaged Nord Stream (March)

U.S. intelligence officials, upon reviewing new information, suggested that a pro-Ukrainian group — most likely comprised of Russian or Ukrainian nationals — perpetrated the attack on the Nord Stream energy pipelines in 2022.

While not drawing any firm conclusions, the intelligence sources said no evidence that Ukrainian President Volodymyr Zelenskiy or others in the Ukrainian government were involved in the explosions and resulting leaks in the Baltic Sea, the New York Times reported.

“We do believe, and the president has said this, that it is an act of sabotage,” White House spokesman John Kirby told reporters at the time. “But we need to let these investigations conclude, and only then should we be looking at what follow-on actions might or may not be appropriate,” Kirby said.

The United States and NATO called the Sept. 26, 2022, attacks “an act of sabotage,” while Moscow blamed Ukraine and the West. Little evidence has been presented by either side.

Update: The Swedish prosecutor investigating the Nord Stream attack told The Guardian in June that the “clear main scenario” pointed to a state-sponsored group, which cast doubts over theories that an independent group was responsible. However, he said a non-state-backed plot was still theoretically possible, though “a large portion the actors” investigated had been ruled out.

- Alaska LNG Project Clears Challenge to 800-Mile Pipeline (May)

A U.S. appeals court denied an environmental group’s lawsuit challenging federal approvals for construction of a $39 billion project to ship natural gas from Alaska’s North Slope across the state.

An 800-mile pipeline is part of the proposed project, and, if placed in service, would be the longest pipeline to become operational since Phillip 66’s success with the 850-mile (1,3680-km) Gray Oak gas pipeline in 2020.

In making their ruling, the three-judge panel said, in part, that the possible effects of noise and shipping traffic on native beluga whales — along with how construction might impact wetlands — had been adequately considered by the federal agency, despite the protests of environmental groups.

The court also said the agency’s method of analyzing greenhouse gas emissions from the project, by looking at data from state and nationwide emissions, was sufficient. The decision added that FERC was “under no obligation” to rely on the “social cost of carbon metric” put forward by the plaintiffs.

The state-run Alaska Gasline Development Corp.'s Alaska LNG project would transport natural gas along a pipeline that bisects the state from north to south. Supporters say it could help the United States compete with Russia, by adding shipments of natural gas from the Arctic to Asia.

However, environmental groups claimed the project would “wreak havoc” on the environment and native wildlife.

Update: Construction on the 800-mile pipeline and related infrastructure has not started, and there has been no public announcement of investors. One sticking point would be that the project would not be able to produce gas until at least 2030.

Breakout:

Top Midstream Transactions of the Year

- Magellan Midstream Approves $18.8 Billion Sale to ONEOK (September)

- Energy Transfer to Buy Crestwood in $7.1 Billion Pipeline Deal (August)

- TC Energy Sells $3.9 Billion Stake in CGT Pipelines (July)

- Phillips 66 to Buy Pipeline Operator DCP Midstream for $3.8 Billion (January)

- Energy Transfer to Acquire Lotus Midstream for $1.5 Billion (March)

Top Non-Midstream News (Top Among Readers):

- OMV Petrom Makes Largest Crude Oil Discovery in Decades (June)

- Oil Rises as US Gasoline Supplies Tighten, Saudi Says: ‘Watch Out’ (May)

- U.S. to Sell 26 Million Barrels of Oil Reserves as Mandated by Congress (February)

- Exporting LNG: Support Infrastructure Grows with Transition (January)

- Record Oil-Reserve Sales May Have Benefited US Storage Caverns (April)

Comments