November 2023, Vol. 250, No. 11

Features

Europe Studies Mega-Projects for Piping CO2 Offshore

By Andreas Walstad, P&GJ European Correspondent

(P&GJ) — Belgian TSO Fluxys and Norway’s state oil and gas company Equinor are working on plans for a 620-mile (1,000-km) pipeline that could export CO2 from industrial clusters in Zeebrugge, Belgium to storage sites offshore Norway. An extension to industrial sites in the port of Dunkirk, France is also under consideration.

The offshore pipeline is planned to have a transport capacity of 20-40 mtpa of CO2, meeting an emerging need for carbon capture and storage (CCS) from European industrial players. A final investment decision could be taken in 2025, if everything goes to plan, and this would pave the way for project completion by 2030.

Equinor previously said the total investment cost is expected to be about $3.17 billion (3 billion euros). A spokesperson for Equinor, Magnus Frantzen Eidsvold, told P&GJ that the project hinges on financial support from the relevant authorities “one way or another” during the first phases.

“The commercial and economic framework is a central part of the ongoing work,” he said. “This represents potentially new value chains to which a market must be created in parallel to the establishment of significant new infrastructure.”

Equinor is considering the Smeaheia area in the North Sea as a potential storage site for CO2. Smeaheia is located east of the giant Troll gas field off the west coast of Norway. The CO2 storage potential at Smeaheia is 20 mtpa, with an injection rate of 5 mtpa planned for the first phase, starting in 2028.

EU Targets

The EU has set a target of 55% CO2 reductions by 2030, compared with 1990 levels, and targets for 2040 are expected to be set next year or soon thereafter. Although renewable energy will be the driving force in meeting those targets, it seems unlikely that Europe will get to net-zero by 2050 without CO2 storage solutions.

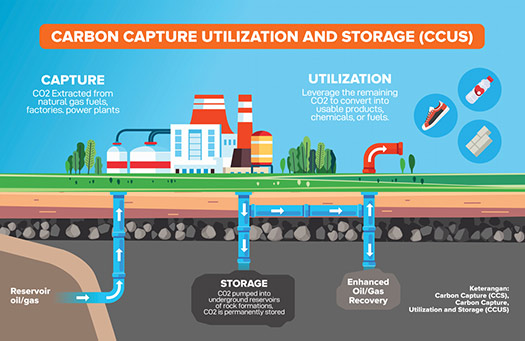

Hard-to-abate sectors, where electrification falls short — including energy intensive industries such as steel and cement production — will rely on carbon capture, transport and storage in order to decarbonize. To this end, the European Commission has, under its Net Zero Industry Act, proposed a CO2 injection target of 50 mtpa by 2050.

Owing to its dense population and industrialized economy, Belgium’s emissions per capita are among the most intensive in Europe, ranked seventh in terms of CO2 per capita out of the 27 EU nations, according to a recent report by McKinsey. About 40% of CO2 emissions in Belgium comes from the industrial sector, according to Fluxys and the TSO; hence, it seems that carbon capture solutions will be key to facilitating the energy transition.

But Belgium — and potentially France — is not the only country looking at the CO2 storage potential offshore Norway. In fact, Equinor and Wintershall Dea are planning to build a 900 km pipeline for CO2 exports from industrial sites in northern Germany to storage facilities offshore Norway. The estimated pipeline capacity is 20–40 mtpa, and the pipeline could be up and running by 2037, if everything goes according to plan.

The plan is to capture CO2 from industrial plants near the cities of Cologne, Hamburg and Kassel and transport it to the port of Wilhelmshaven, via pipelines, and then further on to offshore storage sites in Norway. To this end, Wintershall Dea has recently been awarded two CO2 storage licenses by the Norwegian authorities.

The Luna license is located 120 km west of Bergen and is estimated to hold a CO2 storage injection capacity of up to 5 mtpa. The second, Wintershall Havstjerne, is located 84 miles (135 km) southwest of Stavanger, and the estimated storage capacity here is around 7 mtpa of CO2 per year.

Technological Challenges

Nevertheless, the CO2 pipeline projects are in the early stages of development, and the technical challenges are significant. Jørg Aarnes, global lead for Hydrogen and CCS, Energy Systems at DNV, told P&GJ that an important decision developers must take is whether to transport the CO2 in gaseous or dense phase.

“Even though dense phase may be considered the most attractive option from a pipeline capex perspective, local regulations or safety risk assessments may favor gaseous phase, for onshore CO2 gathering networks in densely populated areas, or for existing lines that do not meet the design pressure needed for dense phase transport,” he said.

Aarnes notes that several decades of industry experience exists for onshore CO2 pipelines, but this is mainly for enhanced oil recovery (EOR) in more sparsely populated areas in the U.S. with limited interference by and potential for exposing third parties. The industry experience is rather limited for offshore pipelines, he said.

As for the planned pipelines between North West Europe and Norway, Aarnes notes that the CO2 will come from various industrial sources and will be captured by different techniques, leading to variations in CO2 composition and impurity elements. This will pose other challenges to the safe operation of these lines, compared to existing pipelines in U.S., which need to be understood and covered by the existing standards and regulations.

“As an example, industry experience shows that the corrosion rates, and possibly the impact on fracture control evaluations, are strongly affected by the type of impurities, combination of impurities and concentration of impurities in CO2 coming from various industrial sources, compared to CO2 coming from processed natural gas,” Aarnes said.

Hydrogen Pipeline

With CO2 potentially flowing from North West Europe to Norway via pipelines, there is also a possibility than renewable (green) and low-carbon (blue) hydrogen will flow in the opposite direction.

Earlier this year, German utility RWE and Equinor signed a memorandum of understanding for transporting hydrogen produced in Norway, via a new pipeline, to Germany. Under the plan, Equinor will build production facilities in Norway to produce low carbon hydrogen from natural gas with CCS.

Equinor targets 2 gigawatt of blue hydrogen production capacity in Norway by 2030 and up to 10 gigawatts by 2038. More than 95% of the CO2 will be captured and stored and permanently under the seabed offshore Norway, according to the Norwegian company.

The two companies also plan to jointly build offshore wind farms that will enable production of renewable hydrogen, which can be piped from Norway to Germany. As for security of demand, Equinor and RWE will also jointly invest in new CCGT’s power plants in Germany — with 3 GW of capacity in total planned for 2030. The goal is that these power plants will be initially fueled by a blend of natural gas and hydrogen, and then they will gradually use 100% hydrogen from the mid-2030s. The hydrogen produced in Norway will also reach industrial customers in Germany, according to plans.

Although these projects look ambitious, they boast political support, as underscored by the joint statement on energy cooperation signed by the governments of Germany and Norway in March this year. The statement said the aim is to realize large-scale hydrogen exports from Norway to Germany as soon as possible. A feasibility study, mapping out the scenarios for hydrogen exports from Norway to Germany, is now near completion, Pål Rasmussen, relationship manager at Norwegian pipeline operator Gassco, told P&GJ.

“Gassco has completed the main work on the feasibility study on the Norwegian side, and the report will soon be finalized from our side,” he said. “We worked closely with the Ministry of Petroleum and Energy, which is our client, to ensure that the content covers all parts of the value chains in a satisfactory manner.”

Gassco is working with DENA, the German Energy Agency, and the German authorities in the final phase to produce a joint report, which, the company said, will cover all requirements for both countries’ further processing.

“When this work is finalized, Gassco and DENA will hand over the report to authorities in Norway and Germany, who will handle the publication of the report's contents,” Rasmussen added.

Past Lessons

For Germany, which targets a 65% reduction in greenhouse gas (GHG) emissions by 2030, compared with 1990 levels, and climate neutrality by 2045, it seems like deploying hydrogen and CCS at large scale will be necessary, in order to carry out the energy transition.

But carbon capture projects, generally speaking, have a track record of long delays, cost overruns and technical setbacks. The CCS project at the Mongstad oil refinery in Norway is an example of this; it was ultimately shelved in 2013, after the Norwegian government had spent $1 billion on the development over several years.

Moreover, the International Energy Agency (IEA) said in its revised Net Zero Report, released in September, that it had scaled back expectations concerning carbon capture and hydrogen.

So far, the IEA said, the history of CCUS has largely been one of unmet expectations.

“Progress has been slow and deployment relatively flat for years. The current level of annual CO2 capture of 45 Mt [metric tons] represents only 0.1% of total annual energy sector emissions,” according to the IEA.

Based on the current project pipeline, CO2 storage capacity could reach over 420 mtpa of CO2 by 2030. However, only about 20 commercial capture projects under development had reached final investment decision by June 2023, the IEA noted. The agency also said cost declines in the CCS sector had been relatively modest over the years.

In Europe, there are some noteworthy projects underway, however. One of them is the Longship project in Norway, which is backed by Equinor, Shell and TotalEnergies. The first phase of the development will see CO2 captured from industrial sites in the Oslo area transported in liquid form by ship, to an onshore terminal on the Norwegian west coast, then via pipeline for permanent storage 2,600 meters under the seabed in the North Sea. Phase one of the project will be operational next year, with a CO2 injection capacity of up to 1.5 mtpa of CO2.

The second phase of the project will see the injection capacity expanded, and the idea is to bring in industrial emitters from across Europe. Danish energy company Orsted has already booked capacity at Longship for 430,000 mtpa of biogenic CO2 to be transported and stored for a period of 10 years, starting in 2026. Longship is expected to cost $2.35 billion (NOK 25.1 billion), to which the Norwegian government will contribute $1.55 billion (NOK 16.8 billion).

Other European projects are also looking at using ships to transport captured CO2 to storage sites. For example, the NoordKaap project — a joint venture between CapeOmega and Neptune Energy — comprises plans to ship CO2 from industrial sites in Europe for offshore storage in the Dutch and Norwegian North Sea from 2028.

As for ships versus pipeline benefits, Aarnes said the main advantage of using pipelines to transport CO2 is lower costs for large volumes and moderate distance transport. The main disadvantages are high upfront capex and less flexibility.

“If the distance between the source and the destination is relatively short or moderate, it is normally more cost-effective and efficient to use pipelines,” Aarnes said. “If there is a need for a continuous injection of CO2 to the storage site, pipelines provide a reliable transportation method.”

Comments