October 2023, Vol. 250, No. 10

Features

Analysis: US Northeast Looks at Winter Threat Once Again

By Michael Reed, Editor-in-Chief

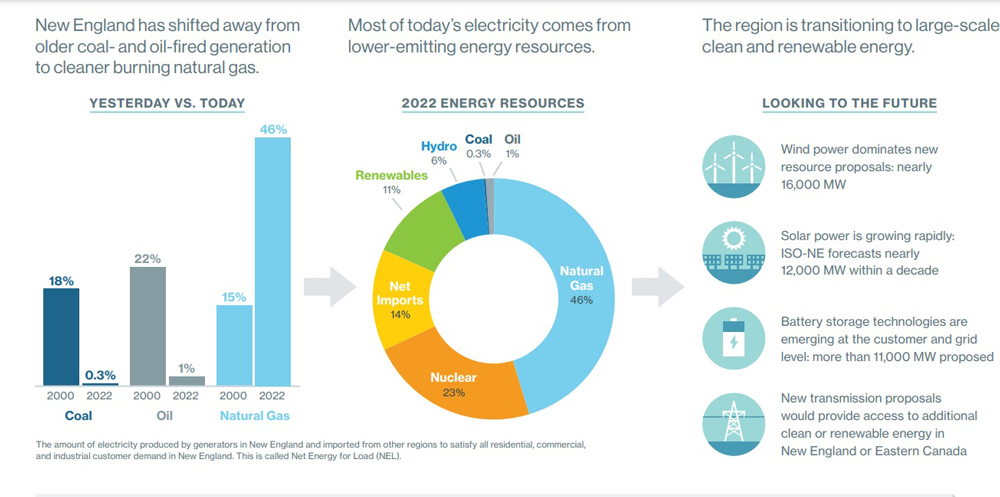

(P&GJ) – Driven in large part by the New England states’ policies seeking to reduce carbon emissions, the shift toward renewable resources to power the electric grid has been underway for years in the region.

And eventually renewables are expected to meet the bulk of energy demand in the region with natural gas filling in the gaps.

However, this theoretical shift to renewables, thus far, has not been accompanied by adequate new infrastructure to support some of the more ambitious projections, according to many analysts. Unfortunately, “proposed” or even “under construction” projects are not the same as “in service” projects.

As retirements of older, more traditional generation with onsite fuel continue on schedule, many planned large-scale renewable projects have been delayed or canceled altogether in recent years.

The inability to expand natural gas pipeline capacity has heightened concerns of grid reliability, particularly in the New England states in recent years.

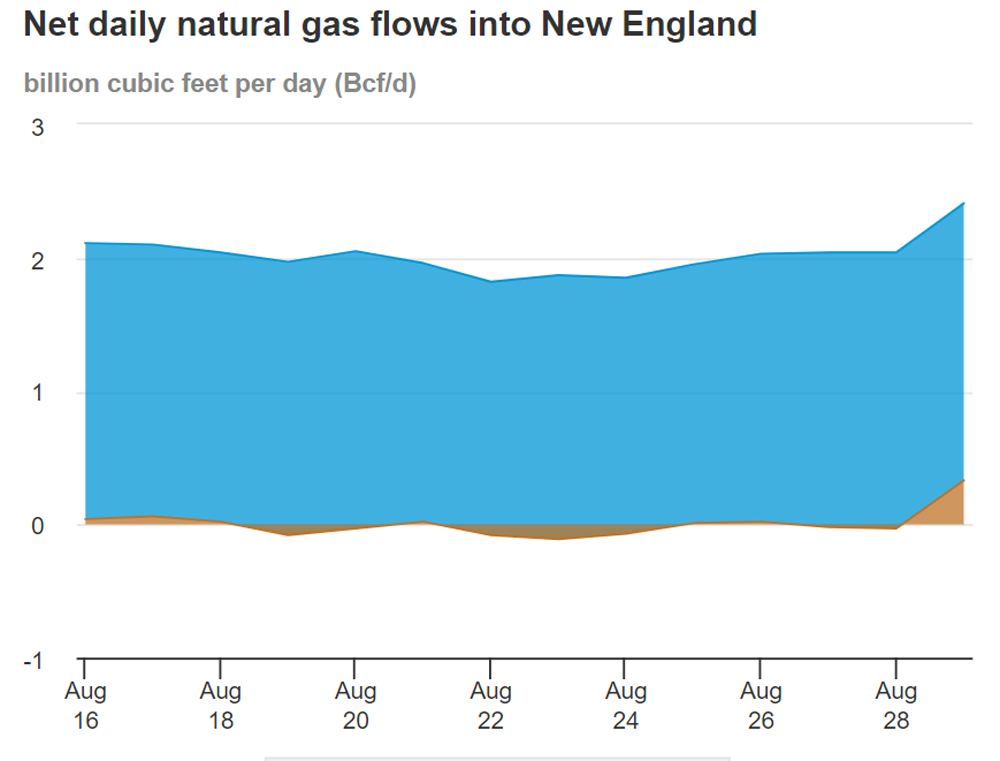

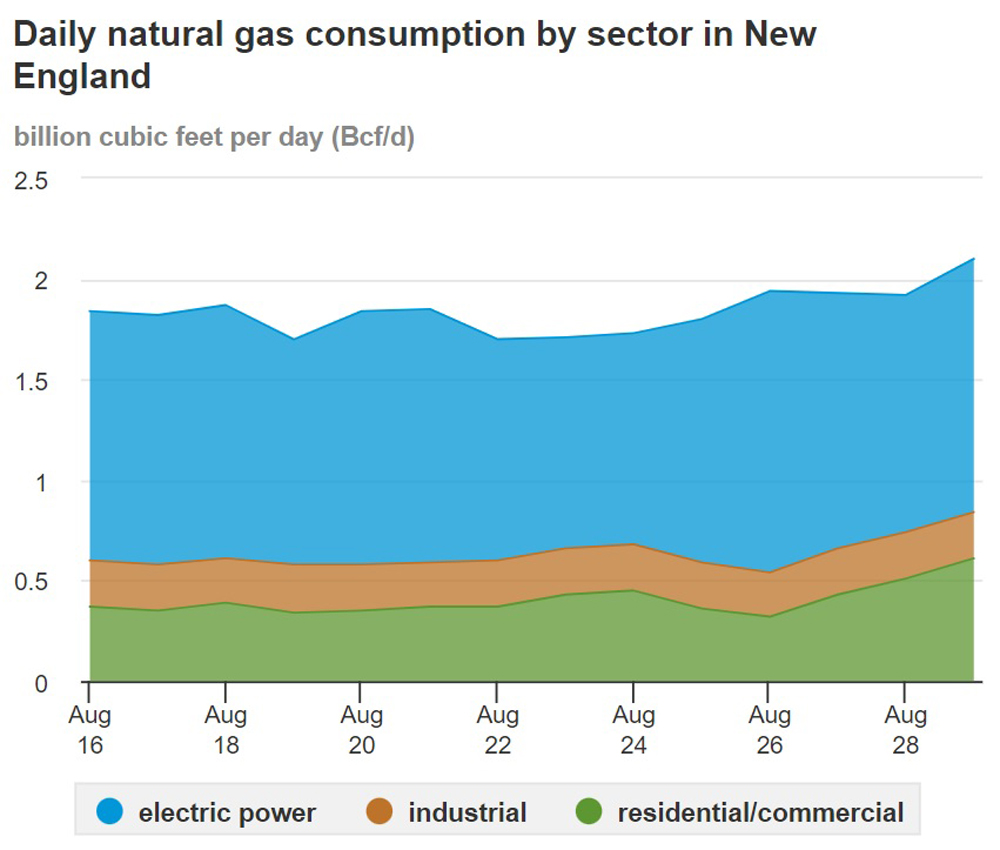

Ironically, the Northeast power grid is the most natural gas-dependent of all U.S. regions, while the nearby Appalachian Basin is setting record highs for gas production. But pipeline construction and expansion projects, bedeviled by regulatory challenges and legal activism, have failed to keep up, and takeaway capacity continues to lag behind production.

Pipelines reliably deliver on their firm contractual commitments despite bottlenecks, records show, but there is not sufficient natural gas pipeline and storage infrastructure serving New England to provide firm transportation to natural gas-fired power generators that have not already contracted for it.

Additionally, there is not any incentive on the part of natural gas-fired power generation companies to purchase firm transportation, even if it were available.

“The current power market structure fails to provide generators with certainty around when they will be needed or the opportunity to recover the fixed costs associated with entering into advance, longer-term arrangements for their fuel supply and pipeline transportation,” Pat Jagtiani, executive vice president of Natural Gas Supply Association (NGSA) told P&GJ almost a year ago. Since then, little has changed.

“We believe regulatory reform should take place to encourage more sustainable supply practices that allow gas generators to prearrange for fuel supplies through contracting with pipelines, suppliers, third-party markets and LNG providers,” Jagtiani said.

Backing up that claim, P&GJ has found 4.75 Bcf/d (135 MMcm/d) in cumulative natural gas takeaway capacity out of the Marcellus and Utica shale formations has been canceled since 2017, much of which would have been destined for Northeast states.

Among the most recent of those project cancellations was the 1.11-Bcf/d (31 MMcm/d) Penn East Pipeline, which fought a barrage of legal and regulatory challenges throughout its construction as project costs to soar. It followed the cancellation of three other projects – the Constitution, Diamond East and Atlantic Coast – which would have added 3.65 Bcf/d (103 MMcm/d) of cumulative capacity.

Another 2.4 Bcf/d (68 MMcm/d) of cumulative capacity out of the Marcellus has been delayed or put on hold, including the Northeast Supply Enhancement (NESE), Northern Access and Mountain Valley projects.

Unfortunately, New England’s energy problems don’t end with power generation. In recent years, some natural gas local distribution companies (LDCs) have imposed moratoriums on new residential and commercial gas services due to infrastructure limitations. This is in spite of the massive reserves located in the nearby Appalachian Basin.

Winter Challenge

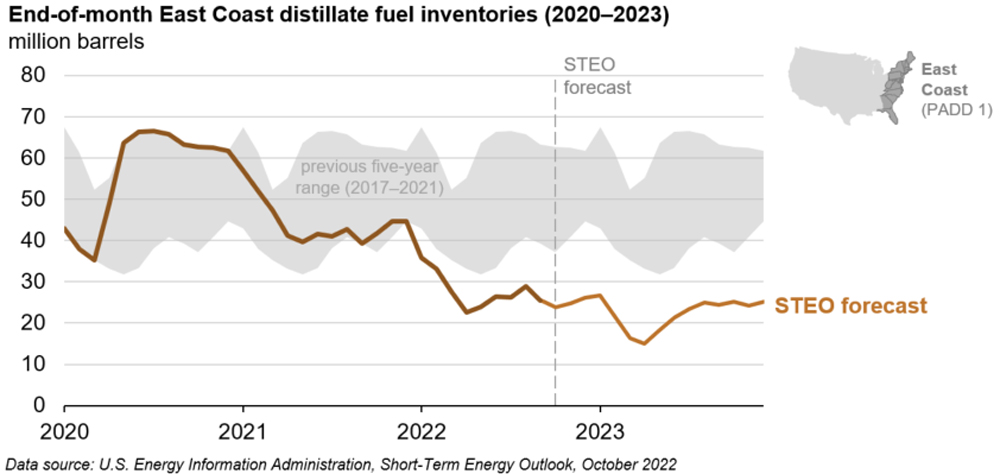

Natural gas pipeline constraints have forced New England to rely heavily on stored fuels and primarily imported LNG for electricity generation during its often-brutal winter months.

This leaves the region exposed to the potential for shortages due to pricing fluctuations and European and Asian nations’ opting to lock in LNG supplies via long-term contracts ever since the war in Ukraine began.

To its credit, the ISO-NE, an independent, not-for-profit corporation responsible for keeping electricity flowing across the six New England states, has raised concerns about the effect of fuel supply constraints on electricity supplies during periods of extreme cold.

Also, early this year, The American Petroleum Institute (API) and its CEO, Mike Sommers, released a new report urging policymakers to take a more realistic approach and ensure that American natural gas and oil are prioritized as long-term strategic assets.

Among the recommendations was a pipeline infrastructure package that could add 4.6 Bcf/d of natural gas throughout the Northeast.

“We know the solution is here,” Sommers said. “Government policy must reflect our resource abundance, our ability to build, and our willingness to get better every step of the way.”

The Everett Factor

One critical factor in the New England energy scenario, certainly by 2024, will be the fate of Constellation’s Everett LNG facility, which is the only location in the region equipped to accept LNG from big tankers and turn it into methane gas.

That methane can, in turn, be used to fuel power plants and heat homes. This has been critical for New England because existing pipelines sometimes cannot accommodate date during the winter peak.

The main power plant receiving methane from Everett is the Mystic Generating Station, which has taken about 80% of that supply, with the rest going to underground pipelines, used at other power plants or for home heating.

In the summer of 2024, the Mystic will close, and it is possible Everett may shut down as well.

Currently, there is a debate about whether New England needs to keep Everett, which is located in the Boston Harbor, online.

Based on a presentation from ISO-NE given at a June forum convened by FERC in Portland, severe weather without the facility would result in “mostly mitigated” shortfalls with increased fuel inventory.

However, assuming a lower fuel-oil inventory of about 100 million gallons, energy shortfalls would range from about 30,000-67,000 MWh distributed over 9 to 13 days.

“ISO does not have the expertise to assess the impacts of Everett’s retirement on the operational capability of the regional natural gas pipeline system, the report said, adding that it was depending on gas pipeline operators and LDCs to “identify and gas system operational concerns.”

ISO said it has shared its concerns about the retirement of existing infrastructure, including Everett, prior to new infrastructure being in-service, commenting that it “would be prudent” to retain its limited gas infrastructure in the mid-term.

In June, more than half of discussion at the New England Winter Gas-Electric Forum centered on the potential retirement of the Everett LNG facility climate goals.

Comments