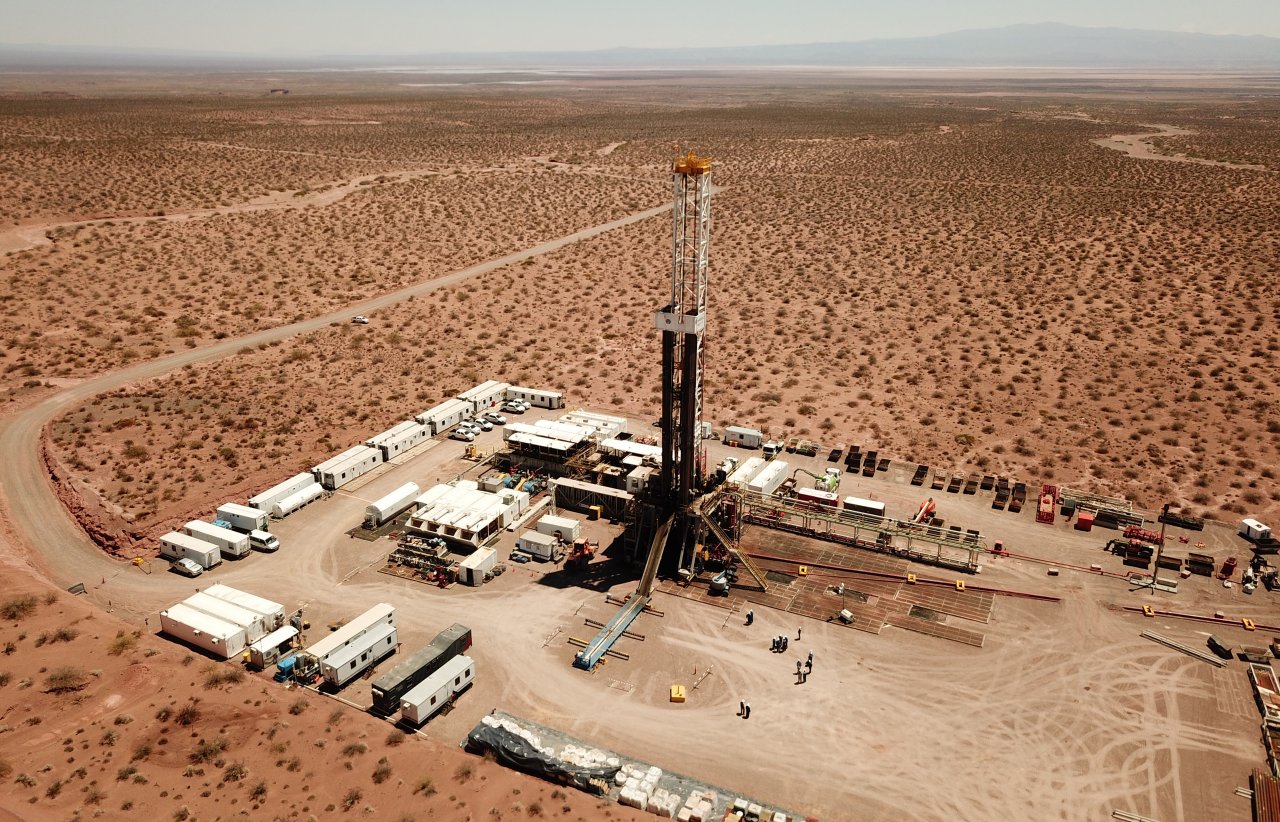

Argentina's Shale Oil Drives Rebound

BUENOS AIRES (Reuters) — Argentina's 'Dead Cow' is roaring back to life.

Oil output from the Vaca Muerta region in Patagonia, which holds the fourth-largest shale oil reserves in the world, stalled during the coronavirus pandemic but hit a record high in December as producers revved up wells with an eye on rebounding prices and a new export market.

The revival of the formation that has been compared with the U.S. Permian Basin signals how it is growing more competitive globally, helped by government policies protecting oil producers, an export tax holiday and reviving global prices.

Producers are focusing on exports with the oil taken up to 900 kilometres (560 miles) to the port of Puerto Rosales by pipeline which can flow 157,000 bpd, with plans to expand this to 220,000 bpd this year and eventually to 415,000 bpd.

The reserves’ revival could bring a timely injection of much needed dollars for the country's Peronist government, which has grappled with a sharp decline in foreign reserves due to the coronavirus pandemic and a currency crisis hammering the peso.

"In the last quarter (of 2020) prices began to rise," Emilio Apud, Argentina former energy secretary, told Reuters, adding that supportive policies for oil and a gas price freeze pushed producers towards unconventional oil. "Producers stopped producing gas and switched to oil."

That saw oil production in Vaca Muerta hit a record 124,000 bpd in December.

Vaca Muerta, given its unusual name literally meaning the "dead cow" by a U.S. geologist in 1931, has taken nearly a century since then to really get going, with its first export cargoes of LNG in 2019 and oil just last year.

Previous, and ambitious, government plans have though targeted over 1 million barrels of unconventional oil per day from the Neuquen region by 2030.

The region's oil production slumped to around 90,000 bpd after the pandemic struck in 2020, before rebounding, while gas production has continued to decline.

Producers, including state energy giant YPF and oil majors Chevron Corp and Royal Dutch Shell Plc, Mexico-based Vista Oil & Gas and Malaysia' state-owned Petronas, were in a decent place to step up as global prices started to rebound.

The creation of a local "criollo barrel" oil price had shielded producers earlier in 2020 and the temporary removal of export tariffs opened up overseas sales.

"In the midst of the crisis, (exports) was a huge opportunity we had," said an executive from an international oil firm in the country, adding Argentina had exported some 7.1 million barrels last year.

Buyers included Brazil, the United States, Chile and the Bahamas, the executive said.

"Vaca Muerta crude oil was unknown to the world's refineries... The pandemic allowed us to take advantage of this sector and develop new markets," he added.

Argentine government data shows the country registered a small energy trade surplus in 2020, the first time in a decade.

GASSING UP?

The world's second-biggest shale gas formation, meanwhile, has remained subdued with almost no wells operating in Vaca Muerta, though industry insiders said there were signs that this could start to bounce back helped by a government five-year gas plan announced late last year.

The government is also eyeing a billion-dollar gas pipeline from Vaca Muerta to Brazil.

"We can already see the impact on the activity of (local firms) Tecpetrol and Pluspetrol, both dedicated to gas in Vaca Muerta," said Luciano Fucello, manager at NCS Multistage, a technology and services company.

He added that YPF, which spearheads much of the development in the region, had also started to ramp up its installation of equipment.

Local consultancy Ecolatina said that of the 51 wells drilled in December, only three were for gas, but said that should have started to shift from the start of 2021.

The revival of Vaca Muerta is a potential boon for the government, which needs export dollars to revive depleted foreign currency reserves, though experts cautioned a tough economy and capital controls created barriers.

Daniel Dreizzen, former secretary of energy planning and now an analyst, said the country needed to guarantee free movement of foreign currency and good financing conditions for firms to really attract investment into Vaca Muerta.

"Production in Vaca Muerta will continue to rise but the macroeconomic conditions are not in place for a flood of investments to come," he said.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments