Chesapeake Energy's Production Falls 15% and Profit Declines Amid Slumping Gas Prices

(Reuters) — U.S. natural gas firm Chesapeake Energy posted a sharp drop in third-quarter profit on Tuesday, hurt by lower prices and production.

U.S. natural gas prices have fallen about 60% in the third quarter, compared with a year earlier, as production continued to rise and concerns eased over energy security following Russia's invasion of Ukraine in Europe.

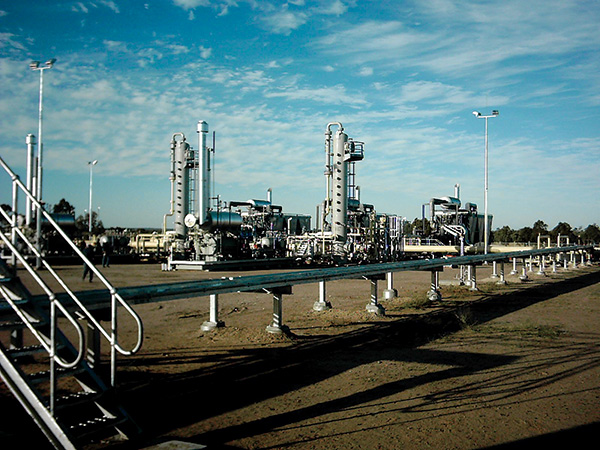

Chesapeake's total production fell about 15% compared with a year earlier to 3,495 million cubic feet equivalent (MMcfe) per day, as it completed its exit from the Eagle Ford basin earlier this year following pressure from activist investment firm Kimmeridge Energy Management to shift toward solely producing natural gas.

However, Chesapeake lifted its forecast of 2023 gas production in the range of 3,425 to 3,525 MMcfe per day from the earlier forecast of 3,400 to 3,500 MMcfe, boosted by higher volumes in Haynesville basin.

The Energy Information Administration (EIA) has also projected dry gas production will rise to 102.69 billion cubic feet per day (Bcf/d) this year from a record 98.13 Bcf/d in 2022.

Chesapeake reported a profit of $70 million, or 49 cents per share, for the quarter ended Sept. 30, compared with $883 million, or $6.12 per share, a year earlier.

The company also announced an agreement with energy trader Vitol, under which Chesapeake would supply up to 1 million tonnes of liquefied natural gas (LNG) per annum for 15 years.

Once the agreement is executed, the companies would jointly select the liquefaction facility in the U.S. to produce the contracted LNG.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments