EPA: Biden's Climate Act to Cut US Emissions by 2030 by 35-43%

(Reuters) — The U.S. economy is on track to spew between 35% and 43% less carbon dioxide by 2030 from 2005 levels as a consequence of the Inflation Reduction Act (IRA), a U.S. government report released on Tuesday showed.

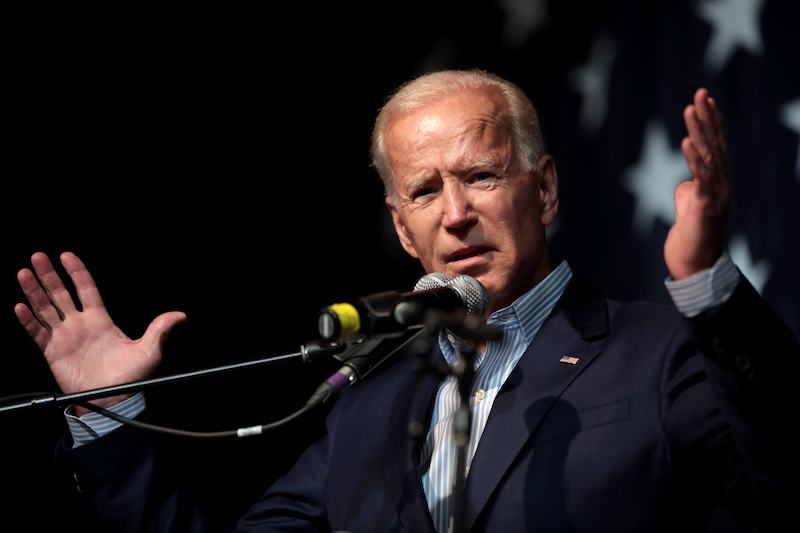

President Joe Biden's IRA, which took effect in August 2022, provides billions of dollars in tax credits to help consumers buy electric vehicles and companies produce renewable energy.

The Environmental Protection Agency (EPA) report analyzed the impacts an estimated $391 billion of support under the IRA for climate and clean energy programs and incentives through 2031.

U.S. annual carbon dioxide emissions should decline to a median of 3,300 metric tons in 2035, below the 4,100 MT projected without the IRA - equivalent to shutting 214 coal-fired power plants - and down from 6,130 MT in 2005, the report said.

The report showed that the EPA "has supercharged climate action in the United States," said John Podesta, a senior White House adviser on clean energy.

It projected CO2 emissions from electricity production in 2030 declining by 49% to 83% from 2005 levels, largely driven by greater use of solar and wind output.

By 2035, electricity CO2 emissions on average will be half of what they would be in the 'No IRA' scenario, the models showed.

The modeling does not include the impact of a contested plan announced by the EPA in July to slash U.S. power plant emissions through large-scale use of carbon capture and green hydrogen.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments