Gas Pipeline Expansion Trends Shift: Intrastate Capacity Surpasses Interstate in 2023

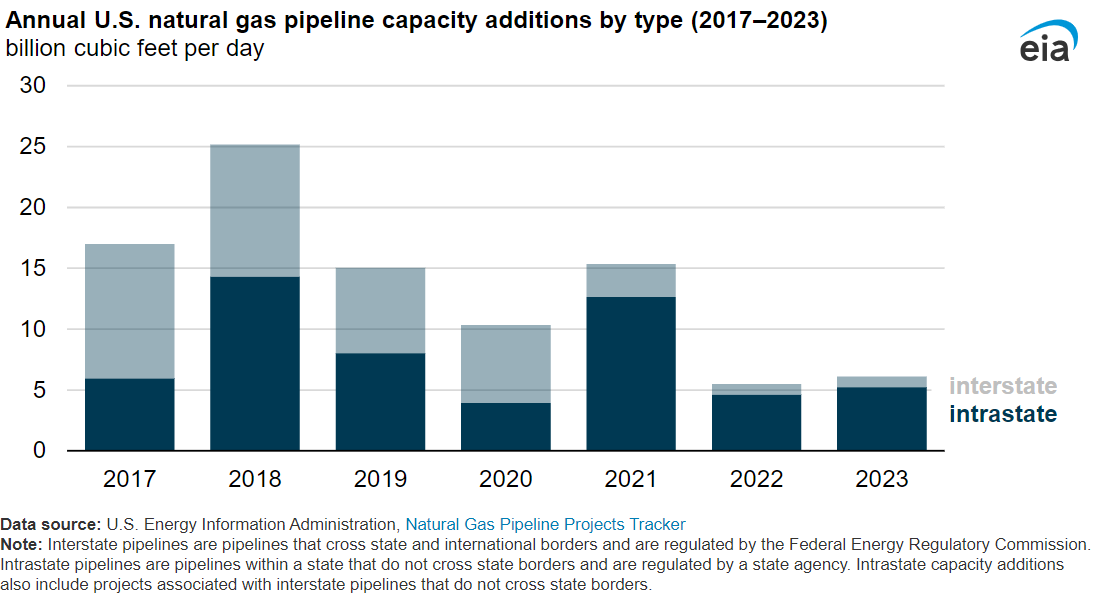

(P&GJ) — In a significant shift, natural gas intrastate pipeline capacity outpaced interstate additions in the United States in 2023, according to data from the U.S. Energy Information Administration’s (EIA) Natural Gas Pipeline Projects Tracker.

Unlike interstate pipelines, which cross state and international borders and fall under Federal Energy Regulatory Commission (FERC) regulations, intrastate pipelines operate within a single state and are regulated by state agencies.

Last year saw the addition of 5.2 billion cubic feet per day (Bcf/d) of intrastate pipeline capacity, with the majority concentrated in Texas and Louisiana. These expansions primarily aimed to meet the growing demand for natural gas in U.S. Gulf Coast markets, including those driven by liquefied natural gas (LNG) exports.

Key intrastate projects included expansions by major players like Enterprise Products Partners, Kinder Morgan, DTE Midstream, and Howard Energy Partners, targeting regions such as the Haynesville producing area and the Eagle Ford region.

Meanwhile, interstate pipeline capacity additions in 2023 amounted to 0.9 Bcf/d, marking a slight decrease compared to the previous year, as they have declined since 2018. New capacity on pipelines crossing state lines accounted for 14% of total new capacity in 2023, a notable drop from the 65% seen in 2017.

Projects such as TC Energy's North Baja Xpress and Alberta Xpress expansions, Tennessee Gas Pipeline Company's East 300 Upgrade, and WBI Energy Transmission's Grasslands South Expansion contributed to this interstate capacity growth.

These developments highlight the evolving dynamics within the natural gas transportation sector, with intrastate projects taking the lead in addressing regional demand while interstate expansions continue to play a vital role in interconnecting major producing and consuming regions across the country.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments