Pipeline and Infrastructure Projects Advance Across U.S., Argentina, and U.K.

Williams Subsidiary Proposes Utah Infrastructure Expansion Project

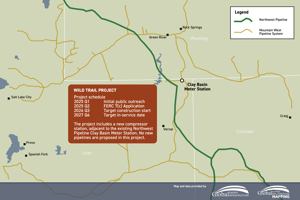

Northwest Pipeline LLC, a wholly owned subsidiary of The Williams Companies Inc., has filed an application with the Federal Energy Regulatory Commission (FERC) seeking authorization to build and operate the Wild Trail Project, a natural gas infrastructure expansion centered around a new compressor station in Daggett County, Utah.

The project includes the construction of the Daggett Compressor Station, a greenfield facility that will feature a Solar Taurus 70 turbine rated at approximately 11,110 ISO horsepower (7,710 site-rated horsepower).

The facility will provide up to 57,955 dekatherms per day (Dth/d) of incremental northbound firm transportation capacity from the White River Hub in Colorado to Kern River Gas Transmission at the Muddy Creek interconnect in Wyoming.

In addition to the new northbound service, the project also offers 25,000 Dth/d of existing southbound firm service from the Wild Horse Receipt Point to El Paso Natural Gas at Ignacio, Colorado.

Sequent Energy Management LLC, a marketing affiliate of Northwest Pipeline, has executed a 15-year binding precedent agreement for 100% of both the northbound and southbound capacities. The project is scheduled for an in-service date of Nov. 1, 2027, with an estimated capital cost of $77.3 million.

Northwest has requested FERC approval by May 1, to remain on track for the construction timeline.

CB&I to Build Crude Storage Tanks for Vaca Muerta Terminal

CB&I has been awarded a contract by VMOS S.A. to build storage tanks for Argentina’s Vaca Muerta Sur oil export terminal in Punta Colorada, Río Negro Province.

The contract covers engineering, procurement, fabrication, and construction (EPC) of storage capacity totaling 630,000 cubic meters (4 million barrels). The storage tanks will support the planned Vaca Muerta crude oil pipeline system, aimed at boosting Argentina’s oil exports to global markets.

The 437-kilometer (272-mile) Vaca Muerta Sur pipeline will transport oil from Argentina’s shale formation to the coastal export terminal. The project is led by VMOS, a midstream joint venture backed by state-owned YPF along with Pan American Energy, Vista Energy, and Pampa Energía.

CB&I participated in the project from the front-end engineering and design (FEED) phase through EPC execution, optimizing the design to reduce costs and accelerate the timeline.

“We are excited to be VMOS’s storage solutions partner for this critical export infrastructure project in Argentina,” said CB&I CEO Mark Butts.

Construction is set to begin in the second quarter of 2025, with completion targeted for the fourth quarter of 2026. CB&I classifies the project as a “significant contract,” valued between $100 million and $250 million.

BKV to Develop East Texas CCS Project Without New Pipeline

BKV signed a new agreement with a major midstream energy company to develop a carbon capture and sequestration (CCS) project at an operating natural gas processing plant in East Texas.

According to the company, this is an expansion of a previously announced collaboration to develop another CCS project in South Texas.

The new East Texas facility is expected to begin operations early in 2027. Under the terms of the deal, roughly 70,000 mtpa of carbon dioxide will be captured from the plant and delivered to BKV for compression, transport, and permanent storage via a co-located Class II injection well. The use of an on-site injection well avoids the need for constructing a high-pressure pipeline.

“This project demonstrates our technical and operating expertise in developing and scaling carbon capture, utilization, and sequestration projects,” said BKV CEO Chris Kalnin.

BKV will retain ownership of the East Texas CCS project, though the company noted it may transfer the asset to its newly launched CCS joint venture with Copenhagen Infrastructure Partners.

Sumitomo Backs UK CO₂ Pipeline Project to Move 3 mpta

Sumitomo Corporation is investing in a carbon dioxide transport pipeline that will support the Peak Cluster carbon capture and storage (CCS) project in the United Kingdom, the company announced through its subsidiary Summit Energy Evolution Limited (SEEL).

The pipeline will transport up to 3 mtpa of CO₂ from four cement and lime plants near the UK’s Peak District. These plants account for 40% of the country’s domestic cement and lime production, making them a significant contributor to the UK’s industrial emissions.

“This project will contribute to decarbonizing one of the U.K.’s hardest-to-abate sectors,” the company stated, adding that the buried, onshore pipeline will form part of a full CCS value chain. Captured CO₂ will be sent to the coast and stored under the seabed in the East Irish Sea’s Morecambe Net Zero (MNZ) project, led by Spirit Energy.

The total planned investment for the project is $70.12 million (£59.6 million), which will fund front-end engineering and design (FEED) and regulatory studies ahead of a Final Investment Decision (FID) expected by 2028. The UK’s National Wealth Fund is also making a new equity investment in Peak Cluster Limited (PCL), alongside SEEL and project originator Progressive Energy.

“Cement and lime are two of the hardest industrial sectors to decarbonize due to the high levels of process emissions which cannot be mitigated through a transition to low carbon fuels,” the release noted.

Sumitomo says the initiative builds on its broader carbon storage business strategy, including two UK offshore storage licenses secured in 2023. The company views CO₂ transport as a pre-commercial space with significant technical and operational complexity and says it will leverage its global CCS experience and pipeline supply business to expand into markets across the Americas and Asia-Pacific.

Permian Pipeline Being Converted for Interstate Gas Service

Producers Midstream II is moving forward with plans to convert an existing natural gas pipeline in Texas from intrastate to interstate service, according to a recent report from East Daley Analytics.

The company held a binding open season from June 30 to July 14 for its Palo Duro Pipeline project, which would transport natural gas northbound from the Permian Basin to Midcontinent markets. The pipeline would operate under Federal Energy Regulatory Commission (FERC) oversight once reclassified.

Producers Midstream plans to convert an existing 275-mile, 16-inch pipeline running from Nolan County to Wheeler County, Texas. The system would connect with the company’s existing residue header infrastructure in Wheeler County, linking to major interstate pipelines including Northern Natural Gas, Southern Star, ANR, NGPL, Panhandle Eastern, Enable Gas Transmission, and Transwestern, as well as regional intrastate networks.

The project targets growing demand from data centers, petrochemical facilities, power generation, and other industrial sectors. According to East Daley Analytics, the pipeline will have a design capacity of 80 MMcf/d and will be supported by one compressor station and up to 12 meter stations. If fully dedicated to data center use, the project could support between 125–150 MW of total load.

No new pipeline construction is planned for the conversion. Instead, the company intends to use existing infrastructure and lease capacity on its header system to connect the Waha hub with the Anadarko Basin.

Mississippi-to-Alabama Gas Pipeline Moves into FERC Review

Kinder Morgan’s Tennessee Gas Pipeline Company, L.L.C. (TGP) has filed a formal application with federal regulators to build the Mississippi Crossing Project (MSX), a $1.7 billion natural gas pipeline expansion designed to deliver 2.1 billion cubic feet per day (Bcf/d) of firm transportation capacity across Mississippi and Alabama.

The project includes 208 miles of new pipe — the centerpiece being a 199-mile, 42- and 36-inch mainline stretching from Greenville, Mississippi, to Butler, Alabama. Additional infrastructure includes three new compressor stations, multiple interconnects, and four metering facilities.

TGP submitted its Certificate of Public Convenience and Necessity application to the Federal Energy Regulatory Commission (FERC) on June 30, officially moving the project into the federal review phase. The filing followed the May 31 submission of all required environmental resource reports, which included consultations with regulatory agencies and other stakeholders.

The project is backed by strong market demand, with more than 90% of its capacity under long-term precedent agreements. Customers include major Southeast utilities and power generators such as Southern Company Services, Dominion Energy South Carolina, Tennessee Valley Authority, and the Municipal Gas Authority of Georgia. TGP affiliate Southern Natural Gas Company has secured 1.17 Bcf/d of capacity to serve downstream users.

TGP is requesting FERC approval by July 1, 2026, with construction scheduled to begin in January 2027 and the pipeline expected to enter service by November 2028.

An independent market analysis submitted with the application projects that natural gas demand in Mississippi and Alabama will grow by 8% by 2030, driven by coal retirements, increased electricity generation, and industrial activity. Current infrastructure in the region is operating near peak capacity.

– Pipeline & Gas Journal